Are Retail Investors Done? Biggest Liquidation Since 2020 As Retail Is Now ‘Selling The Rally’

When it comes to the stock purchasing (and selling) habits of institutional and retail investors, even as the former had aggressively unwound their exposure throughout 2022 with both gross and net leverage at multi-year lows, retail investors showed remarkable stoicism, patience and resiliency. But all that changed in recent weeks, and according to JPMorgan’s Peng Cheng, retail traders have now capitulated, not only selling stocks for the second week in a row, but in a stark reversal from their momentum-chasing ways, retail investors sold both the Monday and Tuesday rallies.

Specifically, in the past week they net sold – $1.1B (1.9-SD below 12M average), and more notably they sold the rally on both Monday (SPX +2.59%) and Tuesday (+3.06%). Curiously, they remain buyers in ETFs (+$1.4B) and net bought S&P 500 (+0.7z leverage adjusted) but sold Russell 2000 ETFs (- 2.0z).

Retail traders net sold -$2.4B of single stocks. Large cap tech names including AAPL (-$470MM), META (-$134MM), and GOOG (-$128MM), in particular, suffered from heavy selling.

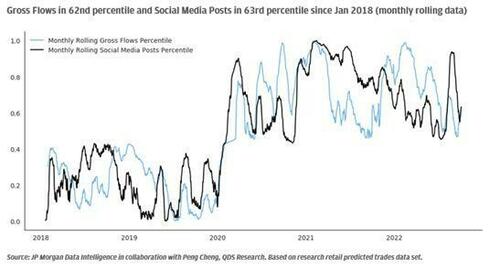

As both retail and gross flows and social media posts show, we are well beyond peak retail enthusiasm and we can now conclude that the distribution phase where institutions sell to retail – which defined markets for much of the past two years – is truly over.

Even more notable is that as the chart below shows, the last two weeks represented the worst selling in single stocks since March 2020 (on the other hand, inflows into ETFs, although showing signs of slowdown, remained positive).

Some more details broken down by industry group and thematic:

Large-cap: At the industry group level, volumes were slightly higher, driven by Autos and Consumer Services, partially offset by Tech Hardware. Looking at Large-cap single-stock, retail pared down exposure again this past week (-$2.0B) across most industry groups. We again observed some of the strongest retail selling across Technology, especially Tech Hardware (e.g. AAPL, CSCO). This was partially offset by buying within Autos (e.g. TSLA, RIVN, QS).

Thematic: Retail investors again shed exposure this past week across themes, though Green / EV Infrastructure (JPAMIGRN) and Long Rising Oil Beneficiaries (JPAMNRGY) were marginal bright spots. We observed heavier selling across Domestic (JPAMDOME) and Covid-19 Domestic Recovery (JPAMCRDB). On the wage side, we also saw Retail cut exposure to US Wage Growth Sensitive Basket (JPAMWAGG)

Bearish sentiment was also evident in the options market. According to JPM, retail traders sold -$1.0B of delta and bought $520MM of gamma this past week. They supplied -$1.3B of delta on SPX/SPY, QQQ, and IWM, mostly via put option buying.

Finally, just to make things “interesting”, here is the latest confirmation that anyone trying to make even a little sense of the market is destined for catastrophic failure: as noted above, JPM said that “retail investors sold the rally on both Monday and Tuesday.”

Well, one look at VandaTrack’s latest weekly research shows that “retail investors have been chasing the last two days rebound by buying US$ 860 mn worth of US securities on Monday and US$ 960 mn on Tuesday. A considerable amount given that they are usually contrarian and reduce their purchases during rallies. We expect this trend to continue and foresee a slowdown in inflows if the rebound will fade; however, we could see a ramp up in purchases if the rally gains traction.”

And while retail investors may have bought… or sold… stock in during the latest meltup, depending on whose “research” one reads, one thing is clear: the recent sell-off in retail favorites such as AAPL and TSLA has had a large impact on retail portfolios’ performance and as of yesterday, the average retail portfolio’s relative drawdown is again close to -32% and has started to underperform the S&P 500 again.

As Vanda notes, “additional losses will be both financially and psychologically hard to handle for the average retail trader”, and the greater the eventual drawdown, the less likely retail will be to rush into the next dip and buy it.

Tyler Durden

Thu, 10/06/2022 – 15:39