Sell low, buy high – max pain market remains king

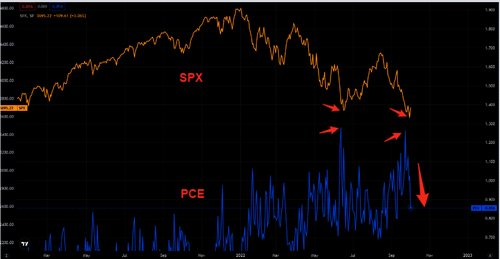

Say hello to put puke

Nothing really new, but the crowd continues to load up on protection at local market lows, just in time when vols are very rich. Now comes the painful part where people realize “protection only costs money bro…”

Source: Tradingview

They call it range trading for a reason

SPX is back inside the big range post the latest squeeze. Range trading is a special beast to trade, and most suck at buying when it “feels” the world is ending, and selling when it “feels” the only was is higher.

Source: Refinitiv

The mate factor

Early yesterday we wrote: “…last time the GBP traded here, the SPX was 300 points higher…and they used to move in tandem.” The SPX added some 100 points since then, but the GBP extended the move as well. The gap remains very wide…

Source: Refinitiv

The net long ain’t that long

…especially not if you compare it to where SPX is trading in relation to the 200 day moving average.

Source: DB

Volatility control funds have puked equities

Is everybody trading this market as if they were running short gamma books?

Source: DB

Hedgies have been adding to shorts

MS Shows that hedge funds have been adding to index shorts rather aggressively over the past two weeks. Let’s see if today’s squeeze reverses this trend…

Source: MS

Positioning

”Positioning is very consensually bearish across the HF community (L/S ratio 5y lows, Gross leverage 95th 5y%ile), CTAs are short $52bn of global stocks, close to historical max but still sellers (-$36bn on flat tape), GS positioning indicator reached -1.5 entering buy signal territory, put call ratio at 2y highs also signaling a local bottom driven by technicals and flow dynamics could be near.” (GS trading desk)

Hedgies running low leverage

Latest net leverage marked another low. We are now at levels seen in April 2009 according to MS. The beta adjusted version is even lower. P/l pain is a master of education

Source: MS

Reflexivity

Reflexivity a topic for many at the moment. The SPX has been down -12.5% in a month 25 times in the past 25 years, which was followed by a 6.5% retracement in the following week on average – adding credence to the squeeze arguments in the short term (GS trading desk).

What happened, now “everyone” wants to increase equity exposure?

Massive jump in the JPM cross-asset survey. Question: Are you more likely to increase or decrease equity exposure over the coming days/weeks?

Source: JPM cross-asset

See TME’s daily newsletter email above. For the 24/7 market intelligence feed and thematic trading emails, sign up for ZH premium here.

themarketear

Tue, 10/04/2022 – 07:04