D.E. Shaw Hiking Some Hedge Fund Fees To As High As 3.5%-And-40%

As market volatility increases, one would naturally expect hedge funds (many of which are underperforming) to be lowering their fees in an effort to entice new business (and retain their legacy clients).

But D.E. Shaw is doing the exact opposite. The pioneer in quantitative trading is a page out of Adidas’ “we’re luxury now and are going to price ourselves as such” strategy, the hedge is planning to raise some of its fees to as high as 40%, according to new reporting by Bloomberg this week.

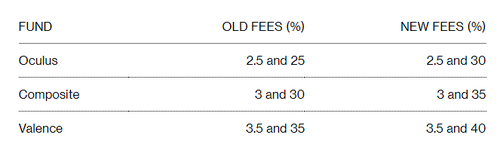

The company has about $60 billion under management and is raising performance fees for its Oculus, Composite and Valence funds starting in July. Respectively, those fees will go to 30%, 35% and 40% of profits, the report says, while managed asset fees remain the same.

The three funds have bucked the trend, putting up double digit returns last year and so far in 2022, the report says. The largest fund, the Composite fund, is up 20.5% this year following its strategy of making “quantitative and human-driven bets across assets and geographies”.

Oculus has a “sizeable” macro allocation and Valance focuses more on equities.

The three funds collectively manage about $40 billion of the firms total assets. They are capacity constrained and will remain closed to new cash, the report says.

This fee increase marks the second since 2019, Bloomberg reports. The price hike is being touted as a way for the firm to pay for technology, data infrastructure and compensation in an industry that has seen increase competition for talent over the last several years.

D.E. Shaw is also in the midst of raising its first ever PE fund, seeking $500 million.

Tyler Durden

Tue, 10/04/2022 – 15:21