Turkey’s Erdogan Mocks Britain’s Currency “Blow Up” As Lira Collapse Continues

Turkish President Erdogan’s battle against the central bankers’ holy scripture continued today as in the face of soaring inflation (over 80%), he told central bank decision-makers to continue lowering rates at its next meeting in October.

“My biggest battle is against interest. My biggest enemy is interest. We lowered the interest rate to 12%. Is that enough? It is not enough. This needs to come down further,” Erdogan said during an event, according to a Reuters translation.

“We have discussed, are discussing this with our central bank. I suggested the need for this to come down further in upcoming monetary policy committee meetings,” he added.

He told CNN Turk on Wednesday night, adding that he expects the country’s key rate, currently 12%, to hit single digits by the end of this year.

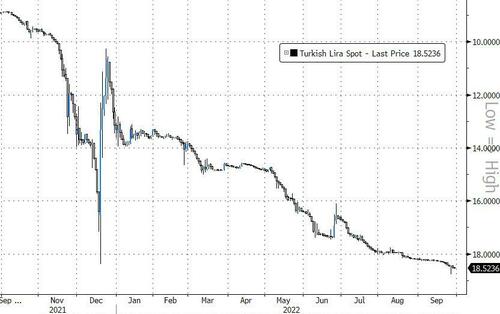

How’s that plan working out for you?

But, in what appeared to be an effort to deflect from his own countries collapse under his ‘odd’ economic perspective, Erdogan also took a swing at the U.K., saying that the British pound has “blown up.”

As The Fed raises its interest rate and the dollar grows stronger, Turkey’s many dollar-denominated debts, and the energy it imports in dollars, will only become more painful to pay for.

“With external financing conditions tightening, the risks remain firmly skewed to sharp and disorderly falls in the lira,” Liam Peach, a senior emerging markets economist, wrote in a note after Turkey’s last rate cut on Sept. 22.

“The macro backdrop in Turkey remains poor. Real interest rates are deeply negative, the current account deficit is widening and short-term external debts remain large,” he wrote.

“It may not take a significant tightening of global financial conditions for investor risk sentiment towards Turkey to sour and add more downward pressure on the lira.”

“Oh the irony, Erdogan giving Truss advice on the economy,” Timothy Ash, an emerging markets strategist at BlueBay Asset Management, said in a not to CNBC.

“Turkey has 80% inflation and I guess the worst performing currency over the past decade. Lol. How low the U.K. has sunk.”

While on a year-to-date basis the two currencies relative weakness against the dollar is not miles apart (TRY -28%, GBP -18%)…

Since 1980, the Turkish Lira has lost 99.99% of its value against the greenback versus Sterling’s decline of around 50% in those 40 years…

Source: Bloomberg

Pot meet kettle?

Tyler Durden

Sat, 10/01/2022 – 07:35