Bond Portfolios In Var Shock Get BOE Help, But There’s Plenty More Action To Come

By Ven Ram, Bloomberg markets live reporter and commentator

The Bank of England did what it had to. But there’s plenty more action to come.

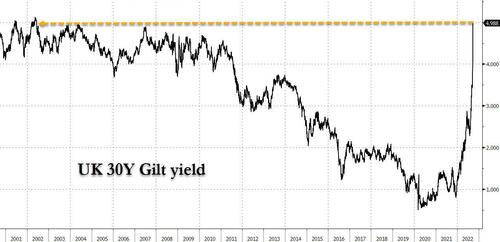

Yields spiraling out of control is bad enough, but when they skyrocket some 150 basis points in the space of just a week, that represents a value-at-risk shock of epic proportions. It hurts particularly if it happens at the long end, where pension funds and insurers are active. Of course, immunizing a bond portfolio is just par for the course for liability-driven investors, but when rate volatility is what it is these days, it can at best cushion the variance in the realized rate of return — not insulate your portfolio completely from the maelstorm.

Of course, the BOE’s purchases of bonds mean that fiscal and monetary policy, taken together, haven’t been this incongruous in a long, long time — a quantitative conundrum if you like. In any case, the backstop raises several questions. Among them:

Are we past the worst?

To the extent that the BOE’s bond purchases obviate the need for liability-driven investors to post additional collateral — a step that would force many of them to sell other parts of their portfolio and entrench a vicious market circle — the move certainly does the job of an doctor at an A&E. But what happens after Oct. 14, when the purchases are supposed to end? A whole lot depends on how Downing Street will respond between now and then. Will the chancellor, for instance, roll back some of the measures and heed the advice of the International Monetary Fund?

What does this mean for rate hikes?

Investors fully expect the BOE — already way behind the curve — to see the obvious and raise rates before its scheduled meeting. November 3 is just an arbitrary policy date, and there is hardly anything sacrosanct about it. Central banks need to change interest rates when they need to, not when the calendar says it’s time. Front-end yields are some 200 basis points higher than the policy rate, which sets a minimum hurdle for the BOE to clear.

It’s important to remember that the BOE’s backstop just papers over the cracks, but doesn’t undo any of the damage from a) a massive inflation problem that wasn’t addressed adequately before the present crisis brewed; and b) the still-considerable increase in yields since before the episode.

What happens to the pound now?

We aren’t done with the declines — considerable as they have been this year — in sterling. The pound is likely to hurtle toward parity as noted here in the coming months so long as the Fed keeps going, exposing inflation-adjusted yield differentials against other economies.

Against that backdrop, expect the pound to weaken against not just the dollar, but also against the euro. The euro is already trading about 1% higher against sterling in my model, a sign of speculation building in the cross.

Tyler Durden

Thu, 09/29/2022 – 07:31