JPMorgan: “At This Stage The Question Is Do We Still See A Bounce In Equities”

JPMorgan’s notoriously, and increasingly comic, permabullish outlook has been the topic of many articles both on this website – and elsewhere- and as of this morning, even JPM’s own in house market analyst, Andrew Tyler, appeared gently mock the bank which come rain, shine of nuclear holocaust will still be telling cockroaches to buy the dip. In his morning market intelligence note (available to pro subs), the JPM trader writes that “at this stage, the question being if we will still see a bounce in equities?” His answer? Well, this is JPMorgan after all, so take a wild guess…

For those who enjoy JPM’s unshakable ability to keep selling stocks to naive clients no matter how big the mushroom cloud outside the window, below we excerpt from Tyler’s full note:

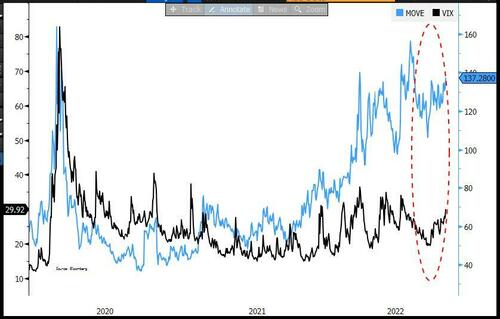

SPX lost 10.15% in the past two weeks, while 10yr yields added 36.9bp to now at 3.689%. Last week, the stock markets were mainly driven by the move in bonds market; MOVE Index added 2.81% and with rates vol spiked and bond selloff globally, equities were under pressure.

The selloff in global bonds was triggered by a flurry of central bank activity plus the UK moving to add fiscal stimulus.

At this stage, the question being if we will still see a bounce in equities? Positioning Intelligence tells us that after the selling pressure over the past few weeks, there are more signs that we might be closer to “at least a short term bounce”. In addition, in our note on August 27th, we discussed the seasonality factors: this century, September has been the worst month for performance, averaging a negative 1.16% return, while Q4 has been the best performing quarter, averaging +3.73% this century.

If we do see a bounce, the rally may be led by short-covering in Tech and Cyclicals, with more Equity Supply coming as we approach 4000 in SPX. On the other hand, if the bonds market continues its selloff and rates vol spike again, we may see Defensives outperform while Cyclicals get punished (see the JPPQCYDE vs. 2s10s chart below).

In our opinion, we still see energy the best long: with Brent at $86 now, Natasha reiterated her 4Q22 estimation of $100 Brent oil price amid volatility returns to the market. She sees demand bouncing 1.5mbd yoy amid gas to oil switching and higher demand from China (her note is here). Besides that, Russian exports and the hurricane season remains wildcards for supply constraints.

GLOBAL RECESSION RISKS: Last week, we saw a hawkish tilt across the Fed, BoE and ECB. Our Economics team now raised their forecasts of YE22 policy rate for the Fed (4.25%), BoE (3.5%) and ECB (2%). In US, Feroli still sees a soft landing to be the baseline case through the end of 2023 and views the Fed pause early next year. He forecasts the unemployment rate moving up to 4.3% by 4Q23 and lowered 2023 GDP forecast from 1.2% to now 0.9%. However, globally, the Economics team is seeing higher risk of recessions. Given more front-loaded actions and higher likelihood of central banks to engineer a recession, the team now sees global recession risks to be ~30% of supply-shock next six months and ~42% of CB induced 23/24 recession.

Q3 EARNINGS & VALUATION: Q3 Earnings will kick off on Oct. 12 with PEP reporting pre-mkt. 21% of the co’s in SPX will report by Oct. 22, 67% by Oct. 29 and 84% by Nov. 5 (see the earnings calendar below). For we week of Oct. 10, we will receive 3Q earnings from 28% of the Financials sector (by mkt cap). Thematically, cost-induced margin shrinking, and FX impacts will be the key focuses, as well as company-specific outlooks for Banks and Consumers. In terms of valuation, Dubravko has FY22 EPS estimate of $225 (vs. $223.46 consensus) and FY23 EPS estimate of $240 (vs. $243.21 consensus). We also updated the chart for the scenario of 10-15% drop in EPS estimates (see the black box below).

More in the full note available to pro subscribers.

Tyler Durden

Mon, 09/26/2022 – 13:40