Gartman Says Time To Go “Little Bit Long” Of Stocks

After the Gartman Letter was pulled off the market due to far too much mockery by various third parties, and is now reserved for handful of “friends and family”, it has become virtually impossible to fade Dennis Gartman, arguably the best counter indicator in market history simply because his updates are few and far between. Today, however, was different because the retired publisher of The Gartman Letter spoke to Bloomberg Radio, sharing his latest outlook.

And in a notable reversal, the pundit who back on January 5 turned bearish, said that after the relentless waves of selling triggered by the Fed and other central banks which are hell bent on sparking a global recession, Gartman says he’s moderating his bearish view, and is turning “a little bit long.”

“We’ve gotten too many people who are bearish,” said Gartman, who now chairs the Endowment Investment Committee at something called the University of Akron.

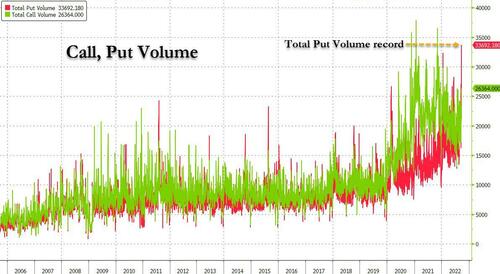

Referring to the record put volumes observed last Friday (see “Friday Was The Highest Put Option Volume Session In History“), he said this was “historically unprecedented,” and it’s a signal to go “a little bit long,” by his account.

“At least a bounce is required for the next week or two or three, after the oversold conditions we got Friday afternoon,” Gartman said, although clearly there will be no bounce today.

Incidentally, Gartman is not wrong in expecting a bounce with everyone massively hedged to the downside, although the relentless ascent in the dollar – which will need some dovish commentary from the Fed to stop steamrolling all currencies – is monkeyhammering risk assets. Another of Wall Street’s most vocal bears, Morgan Stanley’s Michael Wilson said the greenback’s recent rally is creating an untenable situation for stocks.

Overnight, the British pound flash crashed to an all-time low against the greenback after Chancellor Kwasi Kwarteng promised “more to come” on tax cuts, raising fears of even further inflation and debt in the midst of a cost of living crisis in the UK.

Gartman thinks that may be overdone as well: “I understand the argument that tax cuts can be inflationary, but I think that tax cuts have proven in the past to be disinflationary, to be supportive of economic growth,” Gartman says, cryptically concluding that “we’ll see.”

Gartman’s full interview can be found on Bloomberg.

Tyler Durden

Mon, 09/26/2022 – 14:00