One Trader Is Betting On A ‘Financial Crisis’ By The Middle Of 2024

As recently as May 2020 – amid silence from Powell after his ‘save the world’ moves in March – the Fed Funds futures market started to price in the possibility of negative rates by November 2000.

This echoed summer of 2016 when traders started to bet on the possibility of negative rates by 2017 as post-Brexit chaos sparked a slew of bets that The Fed would pause its rate-hike cycle and revert back to cuts.

Now, one day after Jay Powell vociferously pushed the anti-inflation-fighting stance of The Fed – promising to hike rates higher and hold them longer than the market expected… no matter what – something interesting just happened in the rates options market.

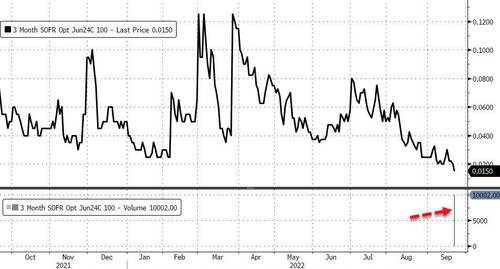

As Bloomberg’s Ed Bolingbroke reports, traders in the SOFR options markets have started to position for The Fed to shift to the zero lower bound by the middle of 2024.

One trader said 7,500 Jun24 SOFR 99.50/100.00 1×2 call spread were bought and we noted that open interest in both strikes is currently zero, so this position is new risk targeting a Fed Funds rate of 0%.

This would be a dramatic difference from the current (OIS) market-implied level of 3.70% by the middle of 2024 and even more from The Fed’s Median DotPlot projection of 4.625% by the end of 2023 and 3.875% by the end of 2024…

Some traders have described these positions as the cheapest ‘recession hedges’ around.

However, for The Fed to go from its projected rate level of around 4.625% – or even more conservatively, from the current level of 3.25% – to ZIRP, we would imagine a little more of a catastrophic event than a ‘recession’ (that would be a drop on the scale of the 2008 Lehman crisis response).

Tyler Durden

Fri, 09/23/2022 – 06:55