Neurotic Markets Swing Ahead Of Fed Decision, Eyeing Ukraine War Escalation

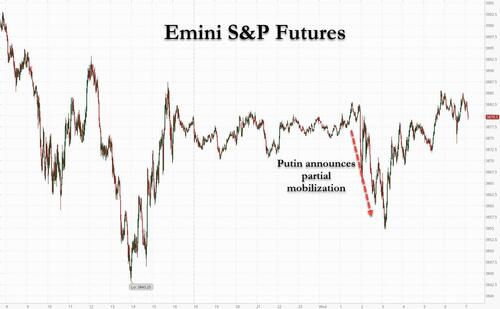

With traders nervously doing nothing ahead of today’s FOMC meeting, where Powell will announce a 75bps rate hike but all attention will be on whether the 2023 median dot (which as we previewed will unleash havoc if it comes above 4.5% which is where market expectations top out for this hiking cycle), today market got an extra jolt of volatility just before the European open when shortly after 2am ET Vladimir Putin delivered his postponed message to announce a “partial mobilization” over the Ukraine war. The news slammed stocks, yields, and the euro while sending oil and commodities sharply higher. And while the initial spike lower has reversed and futures are modestly in the green now, there is zero liquidity right now and the smallest sell program could topples risk assets.

As of 7:15am ET, US futures pointed to a recovery from Tuesday’s tumble on anxiety policy makers are hoping to spark a recession in their zeal to subdue price pressures. S&P futures were up 0.2% after trading down 0.6% earlier, with Nasdaq futures 0.1% in the green. 10Y yields dipped 3bps to 3.54% even though the USD was higher and bitcoin fluctuated between losses and gains.

In premarket trading, the MIC won again with US defense stocks rising amid after Russian President Vladimir Putin declared a “partial mobilization” with the Kremlin also moving to annex occupied regions of Ukraine. Northrop Grumman +1.9%, Lockheed Martin +2.8% and Raytheon +2.5%. Oil and gas shares also rose in US premarket trading, benefiting from a surge in crude prices after Putin ordered a partial mobilization to hold on to disputed territories in Ukraine. Exxon +1.2%, Devon Energy +2%, Marathon Oil +1.8%, Occidental Petroleum +1.9%, Schlumberger +1.5%. Other notable premarket movers:

Stitch Fix (SFIX US) shares are down 10% in premarket trading after the personal styling company issued a weaker-than-expected 4Q update and disappointed analysts with its FY23 outlook. At least two analysts cut their PT on the stock

Keep an eye on Oxford Industries (OXM US) as Citi upgrades it to neutral in note, citing the apparel company’s continued momentum and “attractive” acquisition of the Johnny Was brand

Watch Coty (COTY US) as the company raised its outlook for the current quarter because of stronger-than-expected sales of more expensive fragrances and personal-care products, showing demand for higher-end items remains robust despite rising living costs

The escalation of the Russian war is likely to reverberate across markets, deepening the energy and food crisis, according to Ales Koutny, portfolio manager at Janus Henderson Investors. Putin’s land grab and military escalation comes after a Ukrainian counteroffensive in the last few weeks dealt his troops their worst defeats since the early months of the conflict, retaking more than 10% of the territory that Russia held.

“This will continue to put risk assets under pressure, with sentiment playing a significant part for both equities and credit,” Koutny said. “We believe the USD will continue to benefit as the US is isolated from a geographic perspective and more resilient due to the make-up of its economy.”

Turning to today’s main event, Powell is widely expected to boost rates by 75 basis points for the third time in a row, according to the vast majority of analysts surveyed by Bloomberg. Only two project a 100 basis points move.

“There’s been so much speculation about the Fed’s next step that finally having a decision should provide some much needed relief for investors,” said Danni Hewson, an analyst at AJ Bell Plc. “If it sticks to script and delivers another 75 basis point hike markets are likely to rally somewhat, partly because the specter of a full percentage point rise didn’t come to pass.”

European equities also swung higher after posting early losses in the run-up to the Fed meeting; the Stoxx 50 was little changed. FTSE MIB outperforms peers, adding 0.8%, DAX lags, dropping 0.1%. UK stocks climbed and the pound slid after the British government unveiled a £40 billion bailout to help companies with their energy bills this winter amid soaring prices that threaten to put many out of business. Travel, autos and tech are the worst-performing sectors. European defense stocks and energy stocks gain after President Vladimir Putin declared a “partial mobilization” and vowed to use all means necessary to defend Russian territory as the Kremlin moved to annex parts of Ukraine that it’s occupied, threatening to escalate the conflict further. Rheinmetall rises as much as +11%, Thales +6.1%. Energy stocks outperform as oil rallies, with Shell up as much as +3.3% TotalEnergies +3.0%. Here are some other notable premarket movers:

UK homebuilders gain, bucking a broader market decline, following a Times of London report saying Prime Minister Liz Truss will outline a plan to cut stamp duty during Friday’s mini budget

Persimmon gains 6.2%, Bellway +4.3%, Barratt Developments +4.9%

Fortum shares rise as much as 20%, the biggest jump ever, after Germany said it will buy all of the Finnish company’s stock in Uniper at a better-than-expected price of EU1.70 a share. Meanwhile, Uniper slides as much as 39% on the news, its biggest drop ever.

Vodafone shares gain as much as 2.4% after French billionaire Xavier Niel’s 2.5% stake in the telecom company adds to the pressure for the telecom giant to accelerate its M&A push, according to New Street Research

Renault shares drop as much as 4.0% after Bernstein says it remains cautious about the carmaker’s earnings prospects for 2023 following the stock’s recovery from the Russia crisis earlier this year

Autoliv drops as much as 4.7% in Stockholm, to the lowest since mid July, following SEB downgrade in Sept. 20 note citing a “more uncertain” outlook for 2023

Games Workshop shares fall as much as 16%, the most since Jan. 11, after the maker of the Warhammer series of games said pretax profit in the three-month period to Aug. 28 slid to ~£39m from £45m a year earlier

Earlier in the session, Asian stocks declined ahead of an expected interest-rate hike by the Federal Reserve and as Russia’s escalation of war sapped investors’ appetite for risk. The MSCI Asia Pacific Index fell as much as 1.5%, driven by losses in technology shares. The benchmark held the loss as Russia said it was mobilizing more troops for its war against Ukraine. Hong Kong’s Hang Seng Index led declines among regional measures, with notable drops also in Japan, South Korea, Australia and the Philippines. The main gauge of Hong Kong-listed Chinese firms sank into a technical bear market. With a third 75-basis-point rate hike by the Federal Open Market Committee widely expected, some investors have moved to price in an even larger increase. Fed Chair Jerome Powell’s comments on efforts to fight inflation will be closely parsed for clues on the future rate path.

“Asian markets are still uncertain about size of rate hikes in upcoming FOMC meetings including today’s meeting,” said Banny Lam, head of research at CEB International Investment Corp. “Also, recent depreciation of Asian currencies, especially RMB, enlarges the weakness of equity markets.” The dollar’s strength has pushed a gauge of Asian currencies to a 19-year low, prompting global investors to withdraw funds from the region’s emerging stock markets. Central bank decisions are also due this week from Japan, Taiwan, Indonesia and the Philippines. The Asian Development Bank cut its economic growth forecast for China and also lowered its outlook for developing Asia amid rising interest rates, a prolonged war in Ukraine and Beijing’s Covid-Zero policy.

Japanese equities fell as investors await decisions from central banks including the Federal Reserve and the BOJ. The Topix Index fell 1.4% to 1,920.80 as of market close Tokyo time, while the Nikkei declined 1.4% to 27,313.13. Toyota Motor Corp. contributed the most to the Topix Index decline, decreasing 2.4%. Out of 2,169 stocks in the index, 345 rose and 1,734 fell, while 90 were unchanged. “The focus is on the FRB terminal rate and how far the monetary tightening will go,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Limited. “They have a strong stance of controlling inflation no matter what happens to the economy and it’s questionable whether they can really do that.”

In Australia, the S&P/ASX 200 index fell 1.6% to close at 6,700.20, with miners and banks weighing the most on the benchmark, as investors positioned for a hefty interest rate hike from a hawkish Federal Reserve. All sectors except communication services declined. In New Zealand, the S&P/NZX 50 index fell 0.6% to 11,498.95

In FX, the dollar headed for a fresh record, rising for a second day as the greenback traded steady to higher against all of its Group-of-10 peers. CHF and JPY are the strongest performers in G-10 FX in haven play, SEK and EUR underperform. Sweden’s krona suffered the steepest loss among G-10 peers to trade at around 11 per dollar, and is set for its longest slump since June, one day after the . The euro plunged as much as 0.9% to $0.9885, a two-week low, after Vladimir Putin threatened to step up his war in Ukraine. Bunds and Italian bonds advanced, outperforming Treasuries on haven buying and snapping two-day declining streaks. The pound dropped to a fresh 37-year low against a broadly stronger US dollar. Data showing a rise in UK government borrowing also weighed on sterling.

The offshore yuan fell to the lowest against the greenback since mid 2020, even after the People’s Bank of China set the daily reference rate for the currency stronger-than-expected for a 20th day.

In rates, Treasuries advanced, with yields falling up to 4bps, led by the belly of the curve trailing bigger gains for most European bond markets after Russia’s Putin mobilized more troops for Ukraine invasion and referenced nuclear capabilities. US 10-year yields around 3.55%, richer by ~2bp on the day and trailing comparable bunds by ~1bp in the sector; gilts lag by ~3bp; 2s10s curve is flatter by ~2bp, 5s30s by ~1bp. Euro-area bonds advanced, with the German 10-year yield dropping three basis points to 1.89%. Gilts 10-year yield down 2bps to 3.27%.

In commodities, WTI drifts 2.7% higher to trade near $86.17. Spot gold rises roughly $9 to trade near $1,674/oz.

Crypto markets saw a leg lower following the Putin-induced risk aversion, with Bitcoin still under the $19,000 mark.

In terms of the day ahead, the highlight will be the Fed’s policy decision and Chair Powell’s press conference. We’ll also hear from ECB Vice President de Guindos, and on the data side we’ll get US existing home sales for August.

Market Snapshot

S&P 500 futures little changed at 3,874.75

STOXX Europe 600 up 0.3% to 404.48

MXAP down 1.4% to 148.38

MXAPJ down 1.4% to 485.75

Nikkei down 1.4% to 27,313.13

Topix down 1.4% to 1,920.80

Hang Seng Index down 1.8% to 18,444.62

Shanghai Composite down 0.2% to 3,117.18

Sensex down 0.2% to 59,574.87

Australia S&P/ASX 200 down 1.6% to 6,700.22

Kospi down 0.9% to 2,347.21

German 10Y yield little changed at 1.85%

Euro down 0.7% to $0.9901

Brent Futures up 2.6% to $93.00/bbl

Gold spot up 0.4% to $1,670.80

U.S. Dollar Index up 0.51% to 110.77

Top Overnight News from Bloomberg

The US dollar’s rally is at risk of a reversal if the Federal Reserve sets its interest-rate outlook at a lower level than traders are betting on after market-implied expectations for the so-called dot plot jumped this month

Currency traders are girding for the biggest price swings in months in the build up to this week’s crucial Federal Reserve and Bank of Japan policy decisions

Some investors have a message for anyone looking to bet big before one of the most pivotal Federal Reserve policy meetings of this year: don’t, or risk getting burned

The ECB faces a delicate balancing act as it seeks to address record euro-zone inflation while the economy weakens, according to European Central Bank Vice President Luis de Guindos

The British government unveiled a multibillion-pound bailout to help companies with their energy bills this winter amid soaring prices that threaten to put many out of business

Prime Minister Liz Truss will cut the rates of stamp duty for UK home purchases as the government attempts to stimulate growth, The Times of London reported. Shares of UK homebuilders climbed

China’s current interest rates are “reasonable” and provide room for future policy action, the People’s Bank of China said, adding to expectations it may resume lowering rates in coming months

A right-wing coalition is widely expected to win Italy’s election on Sunday. Such an outcome may raise doubts over the path of reforms that are a condition for the country to receive EU funds to hasten its post-pandemic recovery

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded lower as the region followed suit to the global risk aversion heading into today’s FOMC policy announcement and amid heightened geopolitical concerns surrounding Ukraine as several separatist regions plan to hold a referendum to join Russia, while Russian President Putin is to address the nation in which many expect him to call for a mobilisation. ASX 200 declined with the commodity-related sectors and tech leading the downturn seen across all industries. Nikkei 225 was subdued ahead of central bank announcements including the BoJ which began its 2-day meeting. Hang Seng and Shanghai Comp were also negative with underperformance in Hong Kong amid tech weakness and with sentiment not helped by the US FCC adding more companies to its national security threat list.

Top Asian News

Asian Development Bank cut its Developing Asia growth forecast for 2022 to 4.3% from 5.2% and for 2023 to 4.9% from 5.3%, while it cut its China growth forecast for 2022 to 3.35 from 5.0% and for 2023 to 4.5% from 4.8%.

FCC added China Unicom (762 HK) to its national security threats list.

North Korean leader Kim sent a message to Chinese President Xi and said that ties with China are to reach a new high stage, according to state media.

RBA Deputy Governor Bullock said policy is not restrictive as yet and is looking at opportunities to slow hikes at some point, while she noted concerns about the health of China’s economy, zero-COVID policy and property market.

RBA announced its review of the pandemic bond-buying program (BPP) in which it found that it should only be used in extreme circumstances and said it recorded large mark to market losses on BPP bonds in 2021/22, while it plans to hold BPP bonds to maturity and receive face value to offset accounting losses, according to Reuters.

Stocks in Europe have clambered off worst levels with the region now trading mixed on the eve of the FOMC following initial Russian-induced downside. Overall sectors are now more mixed, and the earlier defensive bias has somewhat dissipated. Stateside, after the dust settled and earlier moves have been trimmed, with US equity futures now trading on either side of the unchanged mark.

Top European News

UK PM Truss is to tell the UN General Assembly that she will lead a new Britain for a new era and will call on democracies to harness the power of cooperation seen since Russia’s invasion of Ukraine “to constrain authoritarianism”, according to Downing Street. Furthermore, PM Truss is to tell the UN that Britain will no longer be dependent on those who seek to weaponise the global economy and will argue that the free world must prioritise economic growth and security, according to Reuters and Sky News. Furthermore, PM Truss is to launch a new defence review and call on Russian reparations, according to FT.

UK PM Truss is to announce plans to cut stamp duty in the mini-budget this week in an effort to drive economic growth, according to The Times.

ECB SSM member McCaul said the ECB is particularly concerned about banks that are heavily exposed to highly vulnerable corporates with a weak debt servicing capacity.

ECB’s de Guindos said FX rate is one of the most important variables that need to be looked at carefully.

FX

USD bid on risk-aversion pre-FOMC, though the DXY has since eased from the fresh YTD high at 110.87.

Amidst this, the EUR slipped below 0.99 and away from hefty OpEx with G10 peers broadly softer amid the above USD move.

However, petro-fx bucks the trend given the pronounced crude rally and has seen the CAD and NOK derive modest upside.

PBoC set USD/CNY mid-point at 6.9536 vs exp. 6.9539 (prev. 6.9468).

BoC’s Beaudry said the bank will continue to do whatever is necessary to restore price stability and maintain confidence it can meet the 2% target, while Beaudry thinks August inflation data is still too high but added that the data shows we are headed in the right direction. Beaudry also stated that to avoid de-anchoring and to bring inflation sustainably back to target, some suggested a substantial slowdown or even a recession be engineered.

Fixed Income

A concerted initial bid for core benchmarks driven by broad risk-aversion, lifting Bund to a unsuccessful test of 142.00 briefly.

Though, as action settles post-Putin and pre-Fed EGBs have backed away from best levels though retain a positive foothold.

Note, it is worth caveating that today’s upside is well within existing parameters for the week – given the pronounced hawkish action on Tuesday.

10 year T-note is hovering on the 114-00 handle within a 114-07+/113-27+ band and awaiting the Fed & Chair Powell.

Commodities

The crude complex has been propped up by the escalation in rhetoric from Russia.

US Private Inventory Data (bbls): Crude +1.0mln (exp. +2.2mln), Cushing +0.5mln, Gasoline +3.2mln (exp. -0.4mln), Distillates +1.5mln (exp. +0.4mln).

Spot gold caught a bid despite the firmer Dollar on the back of post-Putin haven demand.

LME copper has given up its earlier gains as the Dollar gained and sentiment soured.

US Event Calendar

07:00: Sept. MBA Mortgage Applications +3.8%, prior -1.2%

10:00: Aug. Existing Home Sales MoM, est. -2.3%, prior -5.9%

10:00: Aug. Home Resales with Condos, est. 4.7m, prior 4.81m

14:00: Sept. FOMC Rate Decision (Lower Boun, est. 3.00%, prior 2.25%

DB’s Jim Reid concludes the overnight wrap

Markets are often in a holding pattern when we arrive at Fed decision days, with investors waiting for the policy announcement before the big moves take place. But the last 24 hours have been a very different story, with the selloff accelerating thanks to concerns that the Fed and other central banks still have plenty of hawkish medicine left to deliver. See my CoTD here yesterday for the 500bps of hikes from major central banks expected between yesterday and lunchtime tomorrow. As I also showed the ratio of global hikes to cuts now stand at 25:1, this hasn’t got above 5:1 in the 25 years I have comprehensive global data. Email jim-reid.thematicresearch@db.com if you want to be on the daily CoTD list.

Those rate hike jitters were present from early in the session yesterday after Sweden’s Riksbank unexpectedly announced a bumper 100bps hike, which came shortly after a stronger-than-expected print on German producer prices for August. In the meantime, the latest on the Ukraine situation didn’t help sentiment either, as it was announced that referendums would be held later this week in the Russian-occupied regions on whether they should be part of Russia.

By the close of trade, this had led to a very challenging day across the major asset classes, with little respite for investors anywhere. In particular, there were some big moves on the rates side as Treasury yields hit their highest levels in years, with the 10yr Treasury yield up +7.3bps to a post-2011 high of 3.56% after trading as much as +10bps higher, intraday. The 2yr followed a similar pattern, increasing as much as +5.2bps intraday before ending the day +3.1bps higher at 3.97%, not quite breaching the 4% mark in trading, which would have been for the first time since 2007. This morning in Asia, yields on 10yr USTs (-0.59 bps) are fairly stable.

To counter higher bond yields, the Bank of Japan (BOJ) in an unscheduled government bond buying operation this morning, announced that it would purchase 150 billion yen ($1.04 billion) of debt with a remaining life of five to 10 years, and 100 billion yen of securities maturing in 10 to 25 years. The fresh buying would be in addition to the central bank’s already existing daily offer of buying unlimited quantities of 10yr JGBs at 0.25%. However, the response was muted as the Japanese yen was trading flat at about 143.8 against the US dollar, still in the vicinity of a 24-year historical low as we go to print. Debate around the BoJ’s defence off its YCC policy will only intensify as global yields are under pressure. One to watch again.

Yesterday’s bond losses come against the backdrop of the Fed’s decision today at 19:00 London time, where futures are fully pricing in a third consecutive 75bps hike. That’s quite the turnaround since the last meeting in July, when markets initially latched on to a dovish interpretation after Chair Powell said “it likely will become appropriate to slow the pace of increases”, which led to an easing of financial conditions following the meeting and well into August. However, no such slowdown is in sight following last week’s CPI print, which shut down any lingering questions about a slower pace of hikes for the time being. In fact, any doubts over today’s decision are all about whether the Fed might go even faster and hike by 100bps, with futures currently pricing in a 18% chance of such a move. So clearly not dismissing the possibility, although the absence of “well informed” journalist articles preparing the ground for 100bps speaks volumes

Our US economists’ expectations (link here) are in line with market pricing today, and they expect a 75bps move that’ll be followed up with another 75bps hike in November. One thing to keep an eye out for will be the latest Summary of Economic Projections, which they expect will signal more pain in the labour market in order to tame inflationary pressures, with an upgrade to their unemployment forecasts. We’ll also get a first look at the 2025 dot plot, which they think will show the Fed funds rate at 3.4%, so still above their long-run estimate for the nominal fed funds rate, and they think the tone in Chair Powell’s press conference will sound more like the hawkish messaging out of Jackson Hole rather than the dovish signals from July.

Those hawkish expectations meant that risk assets continued to struggle alongside sovereign bonds, with the S&P 500 (-1.13%) very nearly ending up back in bear market territory. It was much the same story in Europe, where the STOXX 600 (-1.09%) lost ground for a 6th consecutive session for the first time since the June slump, and is within 1% of the YTD lows. Germany’s DAX (-1.03%) is now down by more than -20% on a YTD basis again. Interestingly, European equities had initially opened higher on the day, with the STOXX 600 up +0.96% at its peak. However, sentiment turned around the time we heard of the Riksbank’s policy decision, as they unexpectedly hiked by 100bps, rather than the 75bps expected by the consensus, whilst also signalling further rate hikes ahead. In turn, that fuelled speculation that the Fed might also pull off a surprise move, even if that’s still far from the market’s base case.

Staying on Europe, it’s worth noting that the rise in sovereign bond yields there were more dramatic than those seen in the United States. For instance, yields on 10yr bunds (+12.1bps) rose to a post-2014 high of 1.92%, whilst those on BTPs (+10.1bps) hit a post-2013 high of 4.18%. Following the end of European bond trading, ECB President Lagarde noted that inflation was much higher and persistent than anticipated, which has driven the front-loading of ECB rate hikes we’ve seen to date. She reiterated the ECB plans to raise rates over the next few meetings, and will size those hikes on a meeting-by-meeting basis. Like some Fed speakers, she noted the ECB cannot take anchored inflation expectations for granted, but drew contrast to the situation in the United States by spending a lot of her speech outlining why European inflation was not as demand-driven, but a result of supply shocks. I personally would say that’s up for debate with unemployment at the lowest since the Euro came into being and wage growth high.

Gilts were the biggest underperformer ahead of tomorrow’s Bank of England decision, with 10yr yields up +15.4bps to a post-2011 high of 3.29%. In terms of market pricing for that decision tomorrow, overnight index swaps are pricing in 65.2bps worth of hikes, so nearly equidistant between 50bps and 75bps.

Whilst central banks are in focus this week, there was significant news from Ukraine as four Russian-controlled regions will be holding referendums this week on whether they should be a part of Russia. They’re set to happen from September 23-27, and will take place in the regions of Donetsk and Luhansk, as well as in Kherson and Zaporizhzhia. Further, as reported in Bloomberg, the concern is that Russia is moving toward a more full mobilisation, which would only lead to a further entrenchment of the war. All this news doesn’t suggest that the peaceful end of the war is imminent and that the counter offensive successes by Ukraine 10 days ago might have escalated tensions as was feared at the time. We expect to hear public remarks from President Putin later this morning, so more to come on what already promises to be a big macro day for markets.

Asian equity markets are continuing with their downward trend this morning. Among the major indices, the Hang Seng (-1.66%) is the biggest laggard in early trade, reversing the previous session’s recovery. Elsewhere, the Nikkei (-1.37%), Shanghai Composite (-0.58%), the CSI (-0.98%) and the Kospi (-0.95%) are all trading in the red.

US stock futures are fluctuating with contracts on the S&P 500 (+0.09%) and NASDAQ 100 (+0.07%) just above flat but with DAX futures (-0.29%) lower.

In terms of yesterday’s data releases, US housing starts rose by more than expected in August, reaching an annualised rate of 1.575m (vs. 1.45m expected), while the prior month was revised down to 1.404m from 1.446m. Meanwhile, building permits continued to fall, down to an annualised 1.517m (vs. 1.604m expected), which is their lowest level since June 2020. The net impact of the housing data had the Atlanta Fed’s GDPNow model revise down third quarter growth to 0.3% from 0.5% after downgrading residential investment growth to -24.5% from -20.8%. So, we’re a surprise or two away from a third straight quarter of negative headline GDP growth, and yet more equivocation about why the US currently is or is not in a recession.

Otherwise, German producer prices were up by +45.8% in August on a year-on-year basis (vs. +36.8% expected). That said, there was some weaker-than-expected inflation from Canada, where CPI fell to +7.0% year-on-year (vs. +7.3% expected).

In terms of the day ahead, the highlight will be the Fed’s policy decision and Chair Powell’s press conference. We’ll also hear from ECB Vice President de Guindos, and on the data side we’ll get US existing home sales for August.

Tyler Durden

Wed, 09/21/2022 – 07:45