US Building Permits Crash In August, Multi-Family Starts Hit Record High

Following yesterday’s 9th straight monthly decline in US homebuilder sentiment – the longest losing streak since 2014 – this morning’s housing starts and permits data will be watched like a hawk (the former expected to see a small bounce MoM and the latter – more forward-looking – a big tumble MoM).

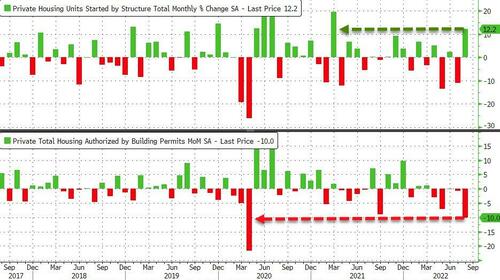

The data was ‘mixed’ to say the least – August Housing Starts exploded 12.2% MoM (+0.3% exp) while August Building Permits crashed 10.0% MoM (-4.8% exp).

Source: Bloomberg

That is the biggest monthly jump in starts since March 2021 and biggest monthly crash in permits since April 2020.

The forward-looking permits print is the lowest SAAR since June 2020…

Source: Bloomberg

Both single- and multi-family permits plunged on the month…

All the gains in starts were driven by multi-family units, which soared 28.6% MoM from 483K in July to 621K, highest on record!

Finally, given the sudden realization among homebuilders, we would not be surprised if building permits (the more forward-looking signal of today’s data points) collapsed in the next few months…

Source: Bloomberg

This is a dilemma for The Fed (who implicitly triggered this of course) as UBS notes, the decline of the US housing market is both disinflationary and inflationary – it lowers demand for building materials and associated durable goods, but people still have to live somewhere. If people are not buying houses, but are determined to move out of their parents’ basements, this means higher rents and more upwards pressure on the fantasy owners’ equivalent rent measure.

So be careful what you wish for Mr.Powell.

Tyler Durden

Tue, 09/20/2022 – 08:41