Sweden Shocks Markets With A Record 100bps Rate Hike, As It Rushes To Hit Its Terminal Rate

Another day, another shock from a raging hawk of a central bank which until just a year ago was one of the world’s biggest doves.

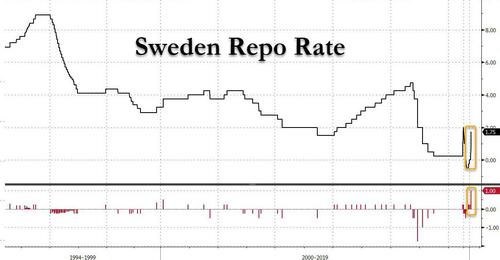

Not that long after the Swedish central bank appeared lock into NIRP for ever, this morning the Swedish central bank surprised markets with a full percentage-point hike (consensus looked for “only” 75bps), the biggest ever under the current monetary-policy regime.

Only two of 19 forecasters polled by Bloomberg expected such a large move with most economists penciling in a 75 basis-point hike while warning that a bigger move was possible.

However, while today’s hike was a record and certainly bigger than expected, the central bank hinted that it is merely rushing to get to the terminal target quicker: the Riksbank raised its policy rate path, with the rate now seen peaking at about 2.53% in 2023 Q3. The Executive Board continues to be concerned over a price-wage spiral and inflation expectations becoming entrenched, with the MPR noting again that the Riksbank needs to make “it clear to price- and wage-setters that the inflation target can continue to be used as a benchmark.

As Viraj Patel notes, the hawkish hike was a bit of a headfake because the central bank has maybe “one more big hike left & then DONE according to their forward rate path. Don’t think there’s much cross-read for other central banks (like Fed)… European central banks were/are playing catch-up”

⚠️ Don’t read too much into the Riksbank’s 100bps hike. They’ve maybe got one more big hike left & then DONE according to their forward rate path. Don’t think there’s much cross-read for other central banks (like Fed)… European central banks were/are playing catch-up $SEK $EUR pic.twitter.com/F9eeZrCHtg

— Viraj Patel (@VPatelFX) September 20, 2022

While the Swedish krona spiked higher in kneejerk reaction to the jumbo rate hike, it quickly erased gains as the market had priced in a more aggressive profile for the rate path, with a peak at around 3.5%.

The Monetary Policy Report showed another sharp upward revision to the inflation forecast (+0.9pp to 5.1% in 2023) and a sharp downward revision to the growth forecast (-1.4pp to -0.7% in 2023). The Executive Board also signaled continued concern about the triggering of a wage-price spiral, and high inflation becoming entrenched in expectations, though the overall message was more dovish with the policy rate forecast only showing moderate further tightening until the end of the year. But given today’s hawkish surprise and the Riksbank’s revealed preference for frontloading hikes, Goldman now expects a further 75bp hike at the November meeting (revised up from 50bp previously), followed by a 50bp and a 25bp hike in 2023. This raises our terminal rate estimate to 3.25% (from 2.50% previously), above Goldman’ estimate of the neutral rate in Sweden of 2%.

And while the Riksbank’s near-term policy rate forecast is somewhat dovish, given the Executive Board’s revealed preference for frontloading hikes and their expectation of a 2.50% terminal rate, Goldman thinks it is more likely than not that the Riksbank will continue to hike aggressively in the near term, albeit at a slightly slower pace. Here is Goldman’ Christian Schnittker:

We see two-sided risks to this call: faster wage growth or a continued rise in inflation expectations could push the Riksbank to hike more aggressively, possibly another 100bp or more 75bp hikes, given the Executive Board’s concern about a wage-price spiral. But a material slowdown in European activity, caused by unfavourable winter weather or new gas supply issues, could lead to a slower hiking pace, as the Riksbank seeks to balance supporting economic activity with countering inflation pressures.

Policy makers acknowledged that the more-aggressive stance will hurt households, but said even more pain would be in store if inflation were to remain at current levels. The central bank now expects an ongoing housing slump to be deeper, with prices falling 18% from a peak earlier this year.

Additionally, the Riksbank said that it will continue to buy bonds until the end of this year, at the pace it outlined in June, in other words, QE continues. However, the bank’s balance sheet will still shrink as bonds mature, and asset purchases come to an end this year.

Tyler Durden

Tue, 09/20/2022 – 06:23