Stellar 20Y Auction Helps Reverse Yield Blow Out

After last month’s terrible 20Y auction, which matched a record big tail of 2.5bps, expectations were not very optimistic for today’ sale of $12 billion in 20Y paper (actually 19-Y 11-month reopening of the ugly August issue) despite the Treasury’s attempt to boost demand by reducing supply. Well, for once consensus was wrong and moments ago Treasury Direct announced pretty strong results in today’ auction:

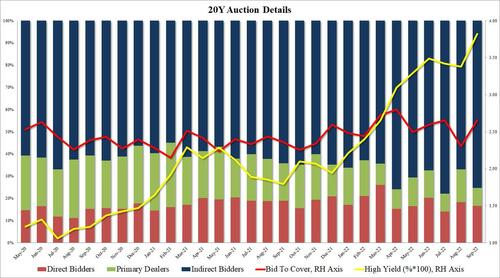

the high yield of 3.820%, which is still a major kink compared to the 3.55% yield on the 30Y, stopped through the When Issued 3.8330% by 1.3bps, a big improvement to last month’s 2.5bps tail.

the bid to cover of 2.65 was also a solid improvement to the 2.30 last month, and was one of the highest on record.

internals were solid too, with Indirects taking down 75.3%, above the six-auction average of 70.5%, and with Directs taking down 16.6%, or just below the recent average, left Dealers holding 8.1%, one of the lowest awards on record (to be expected for a tenor which nobody seems to want).

And visually.

Bottom line, in a day which already saw yields blow out to fresh 11 year wides across the curve, the 20Y auction was unexpectedly a positive catalyst, and helped push yields sharply lower…

… even if in today’ bizarro day, that meant sending stocks back to session lows too.

Tyler Durden

Tue, 09/20/2022 – 13:17