Emerging Markets Start Sending Out Warning Signals Against The Soaring Dollar

A few weeks ago we said that the real Fed pivot will not take place because of some arbitrary (actually not arbitrary at all but entirely political) BLS determination of what inflation or employment is, but when the US dollar soars so high it trips trillions in dollar margin calls and finally breaks something, a something which we speculated would be in the form of “devastation across the rest of the world”, something which China – whose pegged yuan is suffering from crippling pain as a result of the soaring dollar – has realized penning a scathing anti-Fed editorial titled “The strong dollar should not become a sharp blade to cut the world.”

BBG dollar index 1300, back over covid panic highs, and new record as dollar margin call sweeps emerging markets. Pivot will not come from “inflation target is hit” but from devastation across ROW pic.twitter.com/C3h15bko0B

— zerohedge (@zerohedge) September 1, 2022

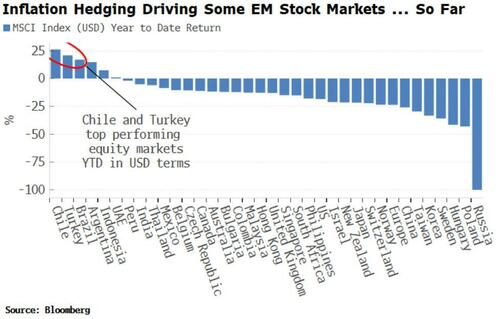

And with the dollar ascent relentless amid growing rumors of an imminent Plaza Accord 2.0, Bloomberg’s Simon White today looks at Turkey and Chile, which “are sending an ominous signal for broader EM equity returns” and may be the first EMs to break as a result of the soaring dollar.

Pointing to EMs with inadequate reserves and large and growing current-account deficits, White says that those EMs are most exposed to a rising dollar and higher US yields, and adds that Turkey and Chile are two of the most vulnerable EMs in this environment “yet they have seen the highest equity returns – even in USD terms – so far this year.”

While this might seem paradoxical, White counters that Chile and especially Turkey have among the highest and fastest rising levels of inflation. And equities are generally seen as an inflation hedge (which as we have repeatedly noted is an erroneous assumption to make, especially in DM markets) – leading to supportive flows. This has certainly been the case in Turkey where President Erdogan has favored rate decreases as the response to inflation now running at over 80%.

And yes, with bond yields stuck around the 10% mark, the 100%-150% returns on offer on the stock market are almost irresistible.

But now both Turkey and Chile’s stock markets are suddenly tumbling. There are reasons specific to each country that might explain this – a rout in Turkish bank stocks, political and social unrest in Chile.

But both countries are facing an increasingly intolerable reversal in capital flows, compounded by rising energy prices and, in Chile’s case, falling copper prices.

White concludes that as two of the very few EM or DM equity markets with a positive YTD return, “their recent travails are a harbinger for other EMs, most notably those highly reliant on foreign financing and a stronger dollar.”

Tyler Durden

Tue, 09/20/2022 – 13:57