Xi’s Meeting With Putin Seen As Major Market Risk

By Ye Xie, Bloomberg markets live reporter and commentator

President Xi Jinping’s planned visit to Central Asia this week will mark his first trip aboard since the pandemic hit more than two years ago. In normal times, it wouldn’t register strongly on a trader’s radar.

But these aren’t normal times, and it comes at a rather delicate moment for China, domestically and internationally. Some analysts are fearful that Xi’s trip, which reportedly includes a meeting with Russian President Vladimir Putin, may pose a major risk for the Chinese market.

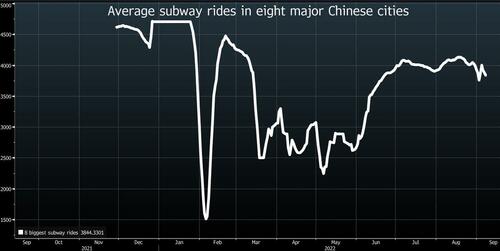

Xi’s trip to Kazakhstan and Uzbekistan was announced just as Beijing doubled down on its Covid restriction before the Party Congress next month. The policy is weighing on the economy and the rhythms of daily life, with the state media reporting that the number of China’s passenger trips expected during the holiday may fall 38% from a year earlier. Is it just a coincidence — or is the party leader’s traveling schedule a signal that normalcy is returning to China, albeit slowly?

More importantly, the trip comes barely a month ahead of the twice-a-decade Party Congress, where Xi is expected to accept an unprecedented third term. Analysts at Clocktower Group, an alternative asset management platform, noted that it’s “extremely rare” for the party leader to travel abroad ahead of the Party Congress. President Xi, for example, stopped making overseas trips three months ahead of the 19th Party Congress in 2017. “President Xi was not expected to leave the country unless it was extremely urgent for him to do so,” the analysts wrote.

What’s the urgency? Uzbekistan is hosting the Shanghai Cooperation Organization summit, which will give Xi a chance to meet Putin in person for the first time since Russia’s invasion of Ukraine in February. It comes at a time when Russia is suffering major setbacks as Ukraine mounts counter attacks to take back lost territory. Clocktower’s analysts wrote:

If the Western high-tech sanctions are pushing Russian industries and military to the brink of collapse, China may be the only white knight that is capable of providing a rescue. As such, an “SOS” from the Kremlin is likely the reason behind the reported Xi-Putin meeting in the coming week.

The meeting will pose a significant risk for Chinese markets. If China decides to help Russia beyond merely buying its commodities, there is considerable risk that the US and Europe will implement secondary sanctions on China. There may also be pressure on Chinese assets from a general investor aversion – likely strengthened by a social media “cancel” campaign against Beijing – to hold them once Beijing recalibrates policy to more concretely support Moscow.

It might be too speculative to guess what might come out it. But keep in mind that at the onset of Russia’s invasion, foreign investors dumped Chinese stocks and bonds because they were worried that China may be embroiled in the second-round sanctions because of Beijing’s ties with Moscow.

So don’t be surprised if what would look like a lackluster trip by Xi winds up moving the market.

Tyler Durden

Mon, 09/12/2022 – 22:40