Extreme ‘Negative Delta’ Position Unwound, Now Comes The CTA-Buying-Panic…

The pendulum is about to swing the other way…

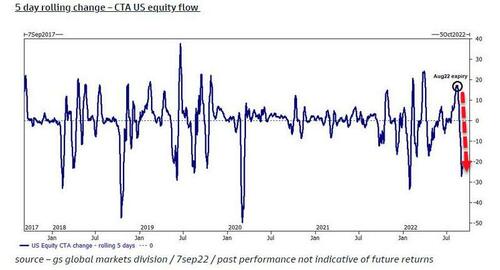

As we detailed early last week, since the Aug expiry, and as we warned two weeks ago in “Now It Gets Ugly: CTAs Turn Short, Have Over $8BN To Sell This Week”, the CTA community flipped from long $25BN of US stocks to short ~$15bn of US equities, selling tens of billions in the process, resulting in one of the largest net selling sprees by CTAs in US equities over the last 5 years!

At the same time, we saw unprecedented levels of options hedging (and thus a build of negative delta)…

Since then, things have gone just a little bit turbo in US equity markets, which have ripped higher on the back of a dramatic and painful short-squeeze…

However, as Nomura’s Charlie McElligott notes this morning, that face-ripper has dramatically and rapidly unwound the ‘negative delta’ pressure…

US Equities Index / ETF Options positioning, which is seeing Puts burned and Calls move ITM, where the “fuel for melt-up” from what had been EXTREME Negative $Delta and Dealer “Short Gamma vs Spot” of just 3.5 days ago has been absolutely eviscerated, with a TON of Positive $Delta ADDED and SPXSPY and QQQ both back “Long Gamma” territory

So, we are free to short?

Not so fast!

As the Nomura stratgeist notes, the rally flows remain extremely ‘mechanical’ in nature and while CTA’s extreme short-positioning has begun to unwind (hence the squeeze higher), we are rapidly approaching a number of ‘buy triggers’ for CTAs – which could well be the ammo for the next leg higher…

And the S&P 500 just broke above its CTA ‘buy’ trigger level…

As Goldman’s Brian Garrett noted last week, “colleagues and clients have recommended the very short term technical set up feels bullish… but this bullishness feels much more tactical than fundamental.”

However, the more the market rallies, the more financial conditions will ‘ease’ and the more likely Fed Chair Powell is to unleash his hawkmen (and women of course) to tamp down market enthusiasm (tighten financial conditions) to achieve his inflation-fighting goals.

So, while riding the upside ‘technically’ and ‘tactically’ makes sense here (with the levels described above), be careful what you wish for and don’t believe the hype that is anything but a squeeze.

Tyler Durden

Mon, 09/12/2022 – 12:05