Futures, Euro, Oil All Jump As Dollar Tumbles

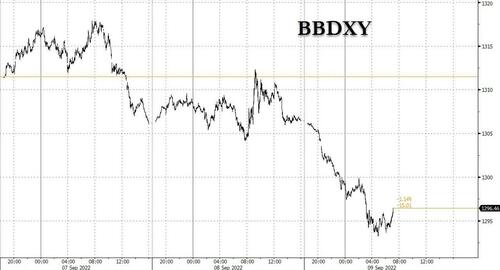

US equity futures, European stocks, and pretty much all risk assets rose on Friday morning as the dollar finally stumbled, dropping by the most in a month to the lowest level in Septemember, after hitting an all time high just two days earlier.

S&P 500 and Nasdaq 100 futures gained more than 0.8% at 730am ET. Europe’s Stoxx 600 Index jumped as miners rallied on optimism over Chinese demand, while banks surged following the European Central Bank’s record rate hike. That’s even as BofA said an “appalling” mood fueled a $11 billion US stock exodus in the week to Sept. 7. The yen headed for its best day in a month as Japanese officials and BOJ governor Kuroda gave the strongest hint yet at possible direct market intervention as a response to weakness in the currency. Oil and cryptos jumped.

In premarket trading, DocuSign jumped 17% in premarket trading, after the e- signature company reported second-quarter results that beat expectations and raised its full-year billings forecast. Digital Media Solutions soared 73% in premarket trading after receiving a non-binding “go private” proposal from Prism Data for $2.50/share in cash, representing ~95% premium to last close. Other notable premarket movers:

Zscaler (ZS US) was up 13% in premarket trading, after the security software company reported fourth-quarter results that beat expectations and gave an outlook that is seen as strong.

Digital World Acquisition (DWAC US), the blank-check firm merging with Trump Media & Technology Group, rises 7.1% premarket, on course for a third day of gains.

The shares have had a volatile week, falling 11% on Tuesday, amid uncertainty over a vote to extend the deadline to complete the Trump deal.

Marathon Digital (MARA US) and Riot Blockchain (RIOT US) lead cryptocurrency-exposed stocks higher in premarket trading as Bitcoin rises the most in more than a month, breaching the closely watched $20,000 level. MARA +10%, RIOT +8%.

RH (RH US) was little-changed in postmarket trading. Analysts were torn on the luxury home furnishings retailer’s results, noting that while the company beat expectations, it lowered its full-year forecast.

Global stocks are on course for their first weekly advance in four, a small measure of respite from the bear-market omens circling markets due to monetary tightening, energy woes and China’s growth slowdown.

“The market has been extraordinarily focused on the actions of the ECB and Fed as they try to bring inflation under control,” said Sebastien Galy, senior macro strategist at Nordea Asset Management. “Eventually this will change and the investment horizon will lengthen considerably. For now though, the market has good reasons not to. Inflation saps consumer confidence and overtightening could send the European and US economies into a recession.”

Speaking at a conference, Powell said “we need to act now, forthrightly, strongly as we have been doing” and added that “my colleagues and I are strongly committed to this project and will keep at it.”

In contrast with the buoyant mood in equity markets Friday, Bank of America Corp. strategists flagged that investors are rushing out of US stocks as the likelihood of an economic downturn increases amid a myriad of risks. US stock funds posted outflows of $10.9 billion in the week to Sept. 7, according to EPFR Global data cited by the bank, with the biggest exodus in 11 weeks led by technology stocks.

In Europe, nat gas prices eased as the region’s energy ministers gathered for a summit to draw up plans to fix an unprecedented crisis that threatens to undermine the broader economy. Expect the news to be a major letdown unless somehow Brussels figured out how to print commodities. The euro touched the highest level in three weeks after the ECB raised rates 75 basis points Thursday. Bets the Federal Reserve will hike by the same margin when it meets later this month increased after chair Jerome Powell reiterated the Fed is determined to curb price pressures.

Elsewhere in Europe, stocks rallied as all sectors trade in the green. Euro Stoxx 50 climbs 1.9%. Miners, banks and autos are the strongest-performing sectors. European miners soared, significantly outperforming the Stoxx Europe 600, as iron-ore and base-metals prices rose on improving sentiment surrounding the Chinese market. Here are some of the biggest European movers today:

Deutsche Telekom shares gain as much as 3.1% after its unit T-Mobile US embarks on a buyback program of as much as $14b of shares, which Goldman Sachs sees as a positive catalyst for the telecom group

Zealand Pharma shares rise as much as 8.7% after Morgan Stanley initiated coverage with overweight rating on near-term catalysts and the biotech’s rich pipeline

Synlab shares rise as much as 7% after Berenberg initiated coverage at buy, saying the shares should benefit as investors start to focus on the potential for the diagnostics firm’s core business

Rubis climbs as much as 8.9%, the most intraday since March, after the French oil and gas distributor reported a jumped in 1H profit helped by growth in its Caribbean operations

TI Fluid Systems shares rise as much as 7.6% after Jefferies upgraded them to buy, saying concerns on the auto parts maker’s outlook are now sufficiently priced in

Gear4Music shares plummet as much as 23% after the online retailer said summer trading was hit by the cost-of-living crisis and unusually hot weather. Peel Hunt sees a challenging winter ahead

Computacenter shares fall as much as 12%, with analysts saying the IT services firm missed profit estimates in 1H amid continued supply constraints and tough comparisons

Immobel shares drop as much as 5.1% after KBC downgraded the real estate developer to accumulate from buy and reduced the PT to a Street-low

Melrose shares drop as much as 6.1% in a second day of declines after the company said it will spin off two units. Analysts said the change in strategy raises questions.

Earlier in the session, Asian equities advanced, poised to wipe out a weekly loss, as China’s consumer inflation came in lower than expected and the dollar rally showed signs of easing. The MSCI Asia Pacific Index advanced as much as 1.7%, with a materials sub-gauge set for its best day since March –climbing almost 3% — amid a rally in metals due to supply concerns. Stock gauges in Hong Kong led gains in the region as developer stocks climbed on speculation of more easing of home-purchase restrictions. Mainland Chinese shares had their best day in almost a month as August data showed an unexpected moderation in prices, giving the country’s central bank room to stay accommodative. Markets in South Korea and Taiwan were closed for holidays. A dollar gauge edged lower, helping to lift sentiment, as comments from Federal Reserve Chair Jerome Powell that hardened expectations of another jumbo rate hike appeared to have been largely priced in.

Asian equities fell to a May 2020 low earlier this week as the dollar’s strength put pressure on capital flows amid rising inflation. Meanwhile, China’s continued lockdowns have weighed on supply chains and investor sentiment, and the country is stepping up defenses ahead of a key Communist Party meeting with further restrictions on internal travel. “Growth, inflation and yields have been driving the markets since the beginning of the year and there is still no consensus,” Sanford C. Bernstein strategists including Rupal Agarwal wrote in a note. A global slowdown or recession has historically worked in favor of defensive styles such as high quality, high yield and low volatility in Asia, they added.

Japanese equities advanced, driven by gains in telecoms and service providers, after a rally in US peers overnight and as the yen gained against the dollar. The Topix rose 0.4% to close 1,965.53, while the Nikkei advanced 0.5% to 28,214.75. Volumes were above the 30-day averages after special quotation settlement for futures and options. The yen strengthened as much as 1.1% against the greenback in afternoon trading. Nippon Telegraph & Telephone Corp. contributed the most to the Topix gain, increasing 0.7%. Out of 2,169 shares in the index, 1,354 rose and 684 fell, while 131 were unchanged

Australian stocks advanced, boosted by banks and miners. The S&P/ASX 200 index increased 0.7% to close at 6,894.20, making a weekly gain of 1%, as banks and mining shares rose. Mineral Resources led lithium shares higher after responding to a media report that the company is considering a spinoff of its lithium mining and processing operations arm, as well as a possible US listing. In New Zealand, the S&P/NZX 50 index rose 0.7% to 11,757.77.

In FX, the Bloomberg Dollar Spot Index fell to its lowest level this month as the greenback weakened against all of its G10 peers, while the pound, euro, yen and yuan all rallied against the greenback. Risk-sensitive currencies advanced most, led by Norway’s krone which rose by as much as 2%. The euro rallied by as much as 1.1% to trade around $1.01 for the first time since mid-August. Italian bonds tumbled, snapping the BTP-bund spread wider as money markets cranked up ECB hike bets after Bloomberg reported policy makers are prepared to tighten another 75bps next month, according to people familiar with the debate. The yen rebounded as traders mulled comments from Bank of Japan Governor Haruhiko Kuroda on the currency’s decline amid a broad dollar selloff. The dollar-yen pair fell 1.3% to around the 142.20 level, after climbing for four straight sessions. Kuroda held a meeting with Prime Minister Fumio Kishida in a sign of the nation’s heightened alert levels. The Australian dollar surged the most in a month as the greenback weakens and a rally in equities boosts risk-sensitive currencies

In rates, US Treasuries trimmed their retreat, with the policy-sensitive two-year yield still near the highest since 2007. Treasury futures push higher over early US session as S&P 500 futures advance, taking yields richer by up to 7bp across intermediates which lead the rally. The Advance followed wider bull-flattening move seen across UK curve as gilts pare a portion of Thursday’s losses. 10-year TSY yields were around 3.26%, richer by 6bp on the day although lagging gilts where yields drop as much as 9bp out to 10s; in Treasuries, intermediate-led gains richen 2s7s30s fly by 5bp. Bunds 10-year yield is down 1.5bps to 1.73%. Peripheral spreads widen to Germany with 10y BTP/Bund adding 2.2bps to 227.3bps.

Oil futures traded at session high, jumping 1.5% to below $85; gold jumped ~$18 to $1,727. Most base metals trade in the green; LME nickel rises 4.4%, outperforming peers. Bitcoin extended gains, rising 6.7% just shy of the $20,000-level, rising the most in more than a month.

Looking to To the day ahead now, and EU energy ministers will be meeting in Brussels to discuss emergency measures to deal with high energy prices. Otherwise, data releases include French industrial production for July and Canada’s employment report for August. Finally, central bank speakers includes ECB President Lagarde, and the Fed’s Evans, Waller and George.

Market Snapshot

S&P 500 futures up 0.8% to 4,035.75

STOXX Europe 600 up 1.4% to 419.91

MXAP up 1.6% to 154.48

MXAPJ up 1.6% to 506.33

Nikkei up 0.5% to 28,214.75

Topix up 0.4% to 1,965.53

Hang Seng Index up 2.7% to 19,362.25

Shanghai Composite up 0.8% to 3,262.05

Sensex up 0.2% to 59,834.09

Australia S&P/ASX 200 up 0.7% to 6,894.18

Kospi up 0.3% to 2,384.28

German 10Y yield little changed at 1.75%

Euro up 1.0% to $1.0100

Gold spot up 1.2% to $1,728.41

U.S. Dollar Index down 1.12% to 108.47

Top Overnight News from Bloomberg

The EU is throwing together a series of radical plans to tame runaway energy prices and keep the lights on across the continent, but governments across the region are going to need to find common ground and fast

The ECB will continue raising interest rates until it reaches its inflation goal, according to Governing Council Member Klaas Knot. Governing Council Member Bostjan Vasle said the ECB will continue the strong normalization of monetary policy with more interest-rate hikes, while Peter Kazimir said euro-zone inflation is “unacceptably high” and sees more hikes in the near future to get inflation under control. Bank of France Governor Francois Villeroy de Galhau said the ECB must be “orderly and determined” with rate increases after hiking by a record 75 basis points

Japanese officials sound increasingly alarmed over the yen’s weakness, and while intervention is not imminent, the market takes notice. The pair’s volatility skew turns bearish the dollar this week at the front-end yet topside trades better bid further out; this suggests that traders see risk of a yen rebound, but unilateral intervention won’t have a lasting effect as long as monetary policy divergence between the Fed and the BOJ remains in place

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks followed suit to the gains on Wall St although the upside was capped after recent global central bank activity including a 75bps rate hike by the ECB and Fed Chair Powell’s hawkish reiterations. ASX 200 was led by the mining-related sectors although advances were limited by weakness in defensives. Nikkei 225 extended on gains above the 28k level but with upside capped amid currency-related jawboning. Hang Seng and Shanghai Comp were also lifted with property and tech stocks spearheading the outperformance in Hong Kong owing to supportive policy-related headlines, while the mainland was somewhat contained in comparison after softer-than-expected inflation data from China and ahead of the long weekend with markets shut on Monday for the Mid-Autumn Festival.

Top Asian News

US is considering an order to screen US investment in tech in China and elsewhere, according to WSJ.

US Treasury Secretary Yellen said President Biden continues to consider tariff relief on Chinese imports and wants to make sure the decision is good for Americans, while she added that it is important to take a tough stance on China due to its economic practices and national security threat, according to Reuters.

US reportedly relaxed Huawei curbs to counter China’s push on tech standards with the Commerce Department issuing a new rule to permit sharing of certain ‘low-level’ technologies and software, according to SCMP.

BoJ Governor Kuroda said he met with PM Kishida to explain domestic and overseas economic developments and markets, but noted there was no specific request from PM Kishida on the economy or markets. Kuroda said hediscussed FX moves with Kishida and noted that rapid FX moves are undesirable and heighten uncertainty, as well as make it difficult for companies to do business, according to Reuters.

Japanese Finance Minister Suzuki said they are to tap JPY 3.5tln in budget reserves to speedily deliver measures against the negative impact of price hikes, while he added that sharp FX moves are undesirable and won’t rule out any options on FX, according to Reuters.

Japanese Chief Cabinet Secretary Matsuno said he is concerned about abrupt FX moves and noted that speculation is a factor behind recent moves, while he added that the strong USD is affecting other currencies, not just the JPY, according to Reuters. Matsuno said watching FX carefully, ready to take necessary steps if current FX moves continue, without ruling out options; recent JPY moves show excessive volatility

European bourses trade firmer across the board following constructive leads from APAC and Wall Street, with the softer-than-expected Chinese inflation data overnight also lifting spirits. European sectors are in the green but portray a clear anti-defensive bias – Utilities, Healthcare, Food & Beverages, Media, and Personal Care reside at the bottom of the bunch. Stateside, US equity futures are also higher across the board, with the tech-laden NQ leading the charge

Top European News

ECB’s Kazimir said discussion on what levels of rate the ECB aims to reach is premature; priority is to continue fiercely with normalisation of monetary policy, via Reuters.

ECB’s Knot said ECB has sent a forceful signal with rate rise; sees big risks of second-round effects, via Bloomberg.

ECB’s Villeroy said half of the current inflation is not linked to energy or agricultural prices; says inflation should be brought back to around 2% by 2024; earlier we act the easier it is to achieve results, via Reuters. Villeroy added that neutral can be estimated in the Euro Area at below or close to 2% according to him, should not speculate on the size of the next rate move – “we did not create a jumbo habit”.

ECB is said to be ramping up scrutiny of banks’ readiness for a gas halt by Russia, according to Bloomberg sources.

FX

DXY suffers from a large fall amid risk appetite, ECB sources yesterday and Japanese verbal intervention, with the index back around 108.50 from a 109.54 peak.

The EUR is probing 1.0100 from a sub-0.9900 midweek trough and pulling away from decent option expiry interest below.

The AUD stands as the outperformer amid renewed risk appetite and the revival of base metals.

Fixed Income

UK Gilts have rebounded to extend well beyond prior session peaks to almost 106.00

Bunds are back around par within extended 143.82-142.46 extremes

US Treasuries are near the top of a 116-07+/115-22 range.

Commodities

WTI and Brent front-month futures have been climbing since the start of the APAC session as a function of the declining Dollar and overall risk appetite in the market.

Spot gold is firmer as the DXY losses further ground, with the yellow metal topping yesterday’s high as it eyes its 50 DMA at USD 1,744.12/oz.

Base metals are bolstered by the softer Chinese inflation metrics – which also lowers the chances of further state intervention.

Indian food secretary said rice production could drop due to droughts; output could drop by 7-8mln tonnes, via Reuters

Black Sea grain deal is being fulfilled badly, according to the Russian Foreign Ministry, its extension will depend on implementation, via Ria.

US Event Calendar

10:00: July Wholesale Trade Sales MoM, est. 0.8%, prior 1.8%

10:00: July Wholesale Inventories MoM, est. 0.8%, prior 0.8%

12:00: 2Q US Household Change in Net Wor, prior -$544b

Central Banks

10:00: Fed’s Evans Discusses Careers in Economics

12:00: Fed’s Waller Discusses Economic Outlook

12:00: Fed’s George Discusses the Economic Outlook

DB’s Jim Reid concludes the overnight wrap

Markets struggled for direction yesterday as it dawned on investors that central banks still aren’t ready to slow down their rate hikes just yet. First, we had the ECB who hiked by 75bps for the first time in their history and signalled that further hikes were still to come. Then we had a Bloomberg report suggesting that ECB officials were prepared to move by the same amount again in October. And finally in the US, Fed Chair Powell delivered remarks that cemented expectations that the Fed are set to hike by 75bps for a third consecutive meeting this month. That combination of hawkish developments meant that sovereign bonds struggled on both sides of the Atlantic, with a fresh surge in real yields that left the 5yr real Treasury yield at a post-2019 high of 0.95%.

Looking at the ECB decision in more detail, the Governing Council decided to take their main rates up by 75bps as expected by the consensus, leaving the deposit rate at 0.75% and the main refinancing rate at 1.25%. A number of details also tilted in a hawkish direction, including their statement that they expected “to raise interest rates further to dampen demand and guard against the risk of a persistent upward shift in inflation expectations.” We even got some detail from Lagarde on what they meant when they said there’d be “several” future hikes, which was that it meant “probably more than two, including this one, but it’s also probably also going to be less than five.” Furthermore, they upgraded their inflation forecasts yet again, now seeing 2023 inflation +5.5% (vs. +3.5% in June), and 2024 inflation at +2.3% (vs. +2.1% in June), so still above their +2.0% target even in a couple of years. They also significantly downgraded growth in 2023, now expecting +0.9% (vs. +2.1% in June), and said that they expected the economy “to stagnate later in the year and in the first quarter of 2023.”

Here at DB, our own European economists have now shifted their view for the next meting in October, and now expect another 75bps hike. They write that the guidance from President Lagarde that rates are “far away” from appropriate levels for getting inflation back to target underscores the ECB’s insensitivity to the growth headwinds and their focus on bringing inflation down. They maintain their 2.5% terminal rate forecast for the deposit rate, but the timing for that has moved forward to March 2023, with that 75bp hike in October being followed by a 50bp move in December, and then 25bp moves in February and March. You can see their full reaction note here.

European sovereign bonds sold off following the decision, with yields on 10yr bunds (+13.8bps), OATs (+11.0bps) and BTPs (+10.8bps) all moving higher. That also followed an announcement that they were temporarily removing the 0% interest rate ceiling on the remuneration of government deposits, which they said would “prevent an abrupt outflow of deposits into the market”. Instead, the ceiling will be at the lower of either the Eurosystem’s deposit facility rate or the euro short-term rate, with the measure intended to remain in effect until 30 April 2023. Later, we then heard in a Bloomberg article that ECB officials were prepared to move by 75bps again in October, with the report further saying that Chief Economist Lane’s presentation “struck a much more hawkish tone than his latest speech”. All in all, investors took away a very hawkish message, with the rate priced in by the December meeting rising +21.2bps on the day to its highest level to date.

Today, attention will remain on Europe since we have the much-awaited meeting of EU energy ministers in Brussels. They’ll be discussing emergency measures to help with high energy prices, and we’re expecting a press conference at 14:30 Brussels time. We’ll have to see what happens, but the tone among policymakers has remained incredibly downbeat, with Belgian Prime Minister De Croo warning that “A few weeks like this and the European economy will just go into a full stop”. In the meantime, natural gas futures recovered +3.40% yesterday, which still leaves them at €221 per megawatt-hour, or more than quadruple their levels from a year ago. For those after more info on the situation, our research colleagues in Frankfurt published their latest gas supply monitor yesterday as well, where they update their scenarios for how fast German gas storages will be depleted, assuming zero gas flows from Russia to Germany. Their model shows that even with a 20% year-on-year reduction in total gas consumption, that would largely deplete the country’s gas storage by the end of the heating season. They also preview what to expect from today’s meeting (link here).

Otherwise yesterday, there were mounting expectations that the Fed would hike by 75bps again at their meeting on September 21, which would mark the third consecutive hike of that magnitude. That followed a further set of remarks from Fed Chair Powell, in which he stuck to his resolute tone on beating inflation, saying that “We need to act now, forthrightly, strong as we have been doing”. The FOMC are entering their blackout period tomorrow, so today is the last day ahead of the meeting we’ll hear from any of them, but Chicago Fed President Evans also said that they “could very well do 75 in September”. Fed funds futures responded accordingly, with +71.6bps worth of hikes now priced in for that meeting, and the rate priced in for December went up +4.3bps to 3.82%, which is the most hawkish market pricing to date.

The effects of the Fed’s hikes are being increasingly seen in the real economy, and yesterday we got data from Freddie Mac showing that the average 30-year mortgage rate hit a post-2008 high of 5.89%. However, there was a further round of decent data on the labour market, as the weekly initial jobless claims for the week ending September 3 fell to 2322k (vs. 235k expected). That’s their 4th consecutive weekly fall and brings them to their lowest level since May, so it’s becoming harder and harder to dismiss the better-than-expected data as just a blip. There have been some other tailwinds recently too, and daily data from the American Automobile Association is now showing that gasoline prices are down by just over a quarter from their peak in June, having fallen from $5.02/gallon back then to $3.75/gallon on Wednesday.

When it came to Treasuries, the hawkish rhetoric and more robust economic data helped yields rise further yesterday, with the 10yr yield up +5.4bps to 3.32%, although there’s been a partial pullback in Asia this morning, with yields down -2.3bps. The rise was driven by higher real yields, with those at shorter maturities hitting their highest levels since before the Covid-19 pandemic. For equities however, the day was marked by significant swings between gains and losses, before the S&P 500 eventually ended the day up +0.66%. It was a similar story in Europe too, where the STOXX 600 eventually ended the day up +0.50%. Looking forward, US stock futures are pointing to further gains today and contracts on the S&P 500 (+0.38%) and the NASDAQ 100 (+0.59%) have both risen.

Here in the UK, Prime Minister Truss outlined the government’s plan on consumer energy bills, with a new Energy Price Guarantee that will mean a typical UK household only pays up to an average of £2,500 a year on energy. This applies to all households, and once you take into account the existing £400 discount this winter, it means that average costs over the coming year will be roughly around where the current energy price cap stands, rather than going up to a new cap of £3,549 as had been previously planned. Against that backdrop, we also saw 10yr gilt yields (+11.3bps) rise to a new post-2011 high yesterday, although yesterday’s move was broadly in line with what we saw elsewhere in Europe following the ECB decision.

Overnight in Asia, equities are advancing this morning as they follow up the rise on Wall Street yesterday. The Hang Seng (+2.24%) is leading gains followed by the CSI (+1.26%), the Shanghai Composite (+0.84%) and the Nikkei (+0.55%). Elsewhere, markets in South Korea are closed for a holiday. Risk appetite was supported by Chinese inflation data that showed a slowing in the rate of both consumer and producer price growth, which offers the authorities more space to support the economy without sparking further inflation. Consumer prices were up by +2.5% in August (vs. +2.8% expected), while producer prices were up +2.3% (vs. +3.2% expected), and both readings were down on the previous month. Finally, the Japanese Yen has strengthened for the first time this week after BoJ Governor Kuroda commented that “The rapid weakening of the yen is undesirable”, gaining +0.94% against the US Dollar.

To the day ahead now, and EU energy ministers will be meeting in Brussels to discuss emergency measures to deal with high energy prices. Otherwise, data releases include French industrial production for July and Canada’s employment report for August. Finally, central bank speakers includes ECB President Lagarde, and the Fed’s Evans, Waller and George.

Tyler Durden

Fri, 09/09/2022 – 07:56