Bad News Is Great: Stocks Hit Session Highs After Beige Book Downgrades Growth, Sees “Softening” Demand, Moderating Price Growth

Normally, today’s Beige Book would be bad news – if modestly for Democrats and the Biden administration – as it confirmed what everyone knows, namely that the US economy is stagnating at beast, and slowing in reality. However, with bad news now widely viewed as great by a market starved for anything that will accelerate the coming recession – as it means the Fed’s tightening campaign will be cut prematurely short – the fact that according to the Fed, economic activity was downgrade to “Stagnating” – or “unchanged” – since July’s “modest expansion”, with five Districts reporting slight to modest growth in activity and five others reporting slight to modest softening, with home sales falling in all twelve Districts and residential construction remained constrained as “residential loan demand was weak amid elevated mortgage interest rates”, was clearly just the bullish news markets wanted.

But while the slowdown in the economy was good, the outright “moderation in price levels” in nine of 12 districts, while the “outlook for future economic growth remained generally weak, with contacts noting expectations for further softening of demand over the next six to twelve months” was positively great, and just the catalyst that spoos needed to blast off to session highs.

Elsewhere, manufacturing was mixed, as supply chain bottlenecks continuing to constrain activity in some locations, while labor markets remained tight but showed some signs of softening amidst improved worker availability (suggesting the next JOLTS report will be a doozy), with moderation in wage expectations. Still, employers planned to provide end-of-year pay raises to their workers, although expectations for the pace of wage growth varied across industries and Districts.

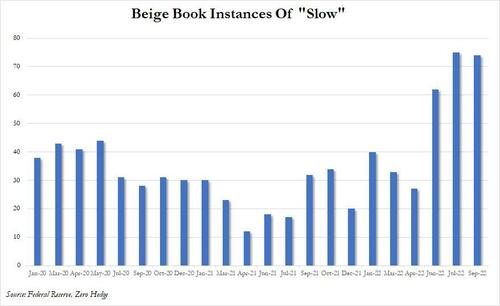

Some more details from today’s Beige Book, which among other things, used some version of “slow” no less than 74 times and just shy of the highest for the cycle, with just July’s 75 higher.

Overall economic activity

Overall economic activity was unchanged, on balance, since early July, with five Districts reporting slight to modest growth in activity and five others reporting slight to modest softening.

Most Districts reported steady consumer spending as households continued to trade down and to shift spending away from discretionary goods and toward food and other essential items.

Auto sales remained muted across most Districts, reflecting limited inventories and elevated prices. Hospitality and tourism contacts highlighted overall solid leisure travel activity with some reporting an uptick in business and group travel.

Manufacturing activity grew in several Districts, although there were some reports of declining output as supply chain disruptions and labor shortages continued to hamper production.

Despite some reports of strong leasing activity, residential real estate conditions weakened noticeably as home sales fell in all twelve Districts and residential construction remained constrained by input shortages.

Commercial real estate activity softened, particularly demand for office space.

Loan demand was mixed; while financial institutions reported generally strong demand for credit cards and commercial and industrial loans, residential loan demand was weak amid elevated mortgage interest rates.

Nonfinancial services firms experienced stable to slightly higher demand. Demand for transportation services was mixed and reports on agriculture conditions across reporting Districts varied.

While demand for energy products was robust, production remained constrained by supply chain bottlenecks for critical components.

The outlook for future economic growth remained generally weak, with contacts noting expectations for further softening of demand over the next six to twelve months.

Labor Markets

Employment rose at a modest to moderate pace in most Districts.

Overall labor market conditions remained tight, although nearly all Districts highlighted some improvement in labor availability, particularly among manufacturing, construction, and financial services contacts.

Moreover, employers noted improved worker retention, on balance.

Wages grew across all Districts, although reports of a slower pace of increase and moderating salary expectations were widespread.

Employers in several Districts reported giving midyear and off-cycle raises to offset higher living costs, and many noted that offering bonuses, flexible work arrangements, and comprehensive benefits were deemed necessary to attract and retain workers.

Looking ahead, employers planned to provide end-of-year pay raises to their workers, but expectations for the pace of wage growth varied across industries and Districts.

Prices

Price levels remained highly elevated, but nine Districts reported some degree of moderation in their rate of increase.

Substantial price increases were reported across all Districts, particularly for food, rent, utilities, and hospitality services.

While manufacturing and construction input costs remained elevated, lower fuel prices and cooling overall demand alleviated cost pressures, especially freight shipping rates.

Several Districts reported some tapering in prices for steel, lumber, and copper.

Most contacts expected price pressures to persist at least through the end of the year.

Tyler Durden

Wed, 09/07/2022 – 15:06