Nomura Warns ‘Squeeze’ Risk Returns As CTAs’ Shorts “Now Essentially Established”

The ‘100 Trillion Dollar Question’ that the world is mulling right now is whether “bad (data) is bad (for markets)” because the Fed and ECB have their hands still tied – i.e. this morning’s ADP miss as a “tell” into NFP – or alternatively, whether “good (data) is bad (for markets)” – i.e. yesterday’s JOLTS and US Consumer Confidence, along with this morning’s “hot” Euro Area inflation beat.

Right now, Nomura Strategist Charlie McElligott says in his latest note that it feels like it might be an “all of the above,” at least until we get a number more months of data evidencing fatigue in the inflation impulse State-side, and ultimately, until we begin seeing outright Job LOSSES as the perverse “bullish” signal for Equities, as markets will look to “anticipate the anticipators,” where the Fed may well be forced into “moving the goalposts” back towards a more “balanced” dual-mandate at some point in mid- to late- ’23.

In fact just this morning Cleveland Fed President Loretta Mester made it vry clear that The Fed’s hands are somewhat tied due to inflation and employment data (and even if the latter worsens)…

“My current view is that it will be necessary to move the fed funds rate up to somewhat above 4% by early next year and hold it there,” Cleveland Fed President Loretta Mester said in remarks this morning prepared for an event organized by the Dayton Area Chamber of Commerce. “I do not anticipate the Fed cutting the fed funds rate target next year.”

She went on note that talk of ‘peak inflation’ was premature…

“It is far too soon to say that inflation has peaked, let alone on a downward path to 2%,” Mester said.

But the most important comment came during the Q&A…

“Even if the economy were to go into a recession, we have to get inflation down,” Mester said.

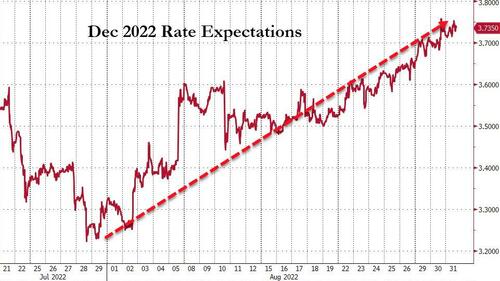

As such, expectations for both Fed and ECB are again re-accelerating (September mtgs are tilting towards 75bps for each: 68.2bps priced for FOMC Sep mtg, 66.7bps priced for ECB Sep mtg), while Fed’s “terminal rate” is now pushed into Apr / May 2023 at ~3.90%, up from the preposterously low 3.20% which had been priced in late July during the “hard landing = dovish pivot” meme narrative.

And the resumption of the prior “tight FCI / hawkish” 1H22 trend trades is driving a move back into the prior “Short Delta, Short Vol” regime, as “the Fed / ECB is selling Calls” theme returns to the forefront over these coming months, with CB’s trapped and unable to ease FCI, due to persistent inflation and labor strength.

Further in Options space, McElligott notes that while positioning and hedging flows are again proving to be so critical here, the trade looks to be a move back into that “Short Delta, Short Vol” stance of a few months back:

Finally, we note that McElligott notes that the “glass half full” view for bulls here with regard to these critical systematic flows is that said CTA “Shorts” are now essentially established (i.e. no more “levels to sell” in the high-profile Eq futs positions).

Yes, they can still grow notionally larger on account of further price and / or vol input, within the leverage and position caps – but from here, market rallies of magnitude could then risk “Short Squeezes” in said systematic positions, which will continue to be a risk in light of such EXTREME “Short Gamma / Short Delta” dynamics within the Options market detailed above.

Tyler Durden

Wed, 08/31/2022 – 11:25