Mike Wilson: J-Hole Was A Shock To Stock Investors, But It’s Just The Start Of The Next Leg Lower

The annual central bank meeting in Jackson Hole has come and gone, and bears such as BofA’s Michael Hartnett and Morgan Stanley’s Michael Wilson are delighted with the very clear message sent by Powell – the Fed’s fight against inflation is far from over.

Indeed, as Wilson writes in his Weekly Warm-Up Note (available to pro subscribers in the usual place), “Chair Powell’s messaging on Friday was crystal clear, and the equity markets did not take it well”, even though no other asset class had a notable reaction to Powell’s comments. As Wilson discussed in his last weekly warm-up 2 weeks ago, stocks had gotten too excited and even pre-traded a Fed pivot that isn’t coming (yet).

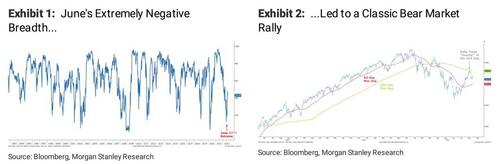

In short, Wilson notes, “the robust rally since June is likely over for now. Technically speaking, this move looks pretty textbook. In June, we reached extreme oversold conditions with breadth collapsing to some of the lowest readings on record (Exhibit 1). However, the rally stalled out exactly at the 200-day moving average for the S&P and many key stocks (Exhibit 2). On that basis alone, the sharp reversal looks quite ominous to even the most basic technical analysts, like us.”

It’s not just technicals, however, and Wilson cautions that from a fundamental standpoint, having a bullish view on US stocks is also challenging for several reasons:

First, there is valuation. As he has discussed many times in his research, the P/E ratio is a function of two inputs – 10 year US Treasury yields and the Equity Risk Premium (ERP). Simplistically, the UST yield is the cost of capital component while the ERP is primarily a function of growth. Generally speaking, the ERP is negatively correlated to growth. In other words, when growth is accelerating or expected to accelerate, the ERP tends to be lower than normal and vice versa. The problem with the conclusion that June was THE low for the Index in this bear market is that the ERP never went above average. Instead, the fall in the P/E from December to June was entirely a function of the Fed’s tightening of financial conditions and the higher cost of capital.

Worse, the ERP plummeted over the past few months and reached near records lows vs. the post GFC period prior to Friday’s sell off. In fact, Wilson notes, the only time the ERP has been lower in the past 14 years was at the end of the bear market rally in March earlier this year, and we know how that ended. Morgan Stanley’s model, which is based primarily on the y/y change in PMIs, suggests the S&P 500 ERP should be closer to 400bps today instead of the 280bps we closed at Friday. That would imply a much lower multiple than the 17.1x we currently trade at. Specifically, assuming a 3% 10-year UST yield implies a fair value P/E of ~14x, or roughly 600 points lower (assuming a conservative 200 in S&P earnings).

Regardless of any rate assumptions, however, Wilson still believes that the real issue remains earnings, not the Fed. He explains why:

While most investors remain preoccupied with the Fed and their next move, we have been more focused on earnings and the risk to forward estimates. In June, many investors began to share our concern, which is why stocks sold off so sharply, in our view. Companies began managing the quarter lower and by the time 2Q earnings season rolled around, positioning was quite bearish and valuations were more reasonable at 15.4x. This led to the “bad news is good news” rally or as many people claimed “better than feared” results. Call us old school, but better than feared is not a good reason to invest in something if the price is high and the results are soft. In other words, it’s a fine reason for stocks to see some relief from an oversold condition but we wouldn’t commit any real capital to such a strategy.

Most importantly, Wilson concludes, recent earnings results showed clear deterioration in incremental operating margins, a trend which is just starting as input costs continue to soar around the globe. In short, Wilson believes that fwd earnings forecasts remain significantly too high.

In the report (available to pro subs), Wilson also lays out his case for further earnings revisions to the downside with much larger cuts than what we have experienced to date. As he noted already, “earnings revision breadth reached very low levels during 2Q results. While revision breadth is a good leading indicator, it tells us nothing about the magnitude of the cuts. As usual, the cuts to NTM EPS forecasts have been de minimis to start this down cycle. Companies and analysts lowered the bar for 2Q into the quarter, but chose to maintain the out year forecasts.

As a result, the NTM EPS forecast for the S&P 500 has fallen by just 1.5% since the top in June (if we back out energy, the NTM EPS estimates have fallen by closer to 5% but this is still just the beginning of the eventual decline we foresee). Again, the full discussion of declining fwd EPS is in the MS note available to pro subs.

Wilson’s bottom line is that “last week’s highly anticipated Fed meeting turned out to be a non event for bonds (flat on Thursday and Friday) while it appeared to be a shock to stock investors. Ironically, given the lack of any material move in yields, all of the decline in P/Es was due to a rising Equity Risk Premium that still remains well below fair market levels, in Morgan Stanley’s view.

Importantly, Wilson thinks Friday’s action could be the beginning of what he says is “likely to be an elongated adjustment period to growth expectations. In our experience, such adjustments to earnings always take longer than they should.” Throw on top of that the fact that operating leverage is now more extreme than it was prior to COVID, and Morgan Stanley concludes that “the negative revision cycle could turn out to be worse than usual.”

Tyler Durden

Mon, 08/29/2022 – 16:44