Airline Ticket Sales Unexpectedly Tumble

One of the big drivers of inflation during the late spring and early summer was – in addition to the relentless meltup in energy and commodities – the surge in airplane ticket prices amid seemingly endless demand, as millions of Americans were willing to pay anything after two years of quarantine, just to go travel anywhere and feel normal again.

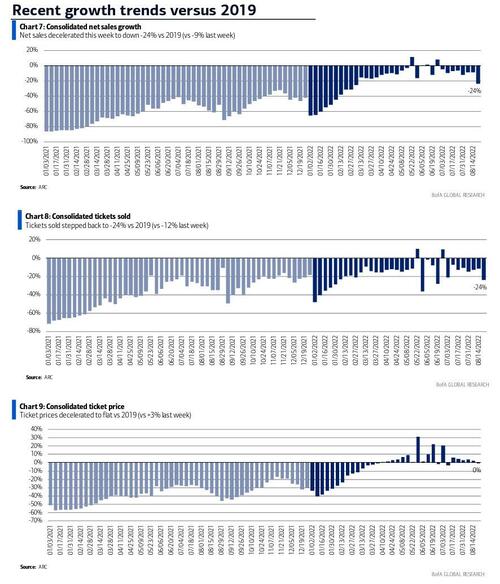

But now that prices have more than caught up with travel enthusiasm, demand is tumbling, and as BofA airline analyst Andrew Didora writes today, system net sales (i.e., total bookings) took a sizable step back this week to -23.6% vs 2019 for the week ending 8/21 (compared to last week’s down -9.3%) the biggest drop since February. System volumes and pricing decelerated to -23.5% vs 2019 (vs -11.5% last week) and -0.1% vs 2019 (vs +2.5% last week).

As Didora explains, “we typically only see this type of weekly change around holidays, so the change is surprising. The only comp issue we have found is that in 2019 Hurricane Dorian was approaching the US at the end of August, which could have pulled forward some bookings.”

Some more details on the recent plunge in bookings:

Domestic/int’l volumes decline with international pricing still > 2019

Overall international net sales (-21.1% vs 2019) remain ahead of domestic net sales (26.0%) relative to 2019.

However, international volumes declined to down -24.0% vs 2019 (vs -9.8% last week) and are now slightly behind domestic volumes for the first time since mid-May (excluding choppy comps), which were down -23.3% vs 2019 (vs -12.4% last week).

Both channels saw pricing step back with domestic and international pricing now down -3.5% vs 2019 (vs -1.9% last week) and +3.8% vs 2019 (vs +6.3% last week), respectively.

Finally, in a peculiar divergence, while leisure tickets slumped a notable 22%, it was corporate travel that really cratered, tumbling 37% Y/Y.

Looking ahead, the BofA strategists caution that if this softness is not reversed in the next 1-2 weeks, “that would indicate more of an underlying demand problem and create risk to 3Q22 outlooks, which call for 100-200bps of sequential total revenue improvement.”

Tyler Durden

Mon, 08/29/2022 – 18:40