What Will The I-Bond Interest Rate Be In November 2022?

Authored by Mike Shedlock via MishTalk.com,

Let’s go over how you can project I-bond rates based on semi-annual CPI estimates.

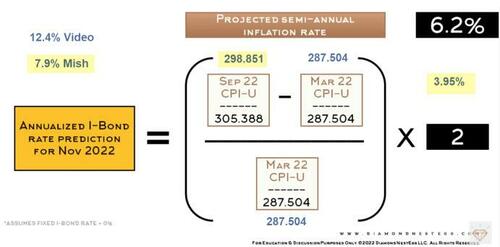

Image from Diamond NestEgg (DNE) video with Mish alternate calculations

I Bond Interest Rate November 2022 Prediction

Assuming a base fixed rate of 0%, the formula for the next I-bond rate is ((September CPI-U Minus March CPI-U) Divided by March CPI-U) * 2.

The CPI numbers are unadjusted.

DNE estimates a whopping 12.4% annualized yield. I arrive at 7.9%.

The difference is in CPI projections. DNE assumed 1.0% inflation for July, August, and September.

We already know July was 0.0% (technically slightly negative).

The Cleveland Fed projects 0.09% month-over-month inflation for August. My assumption based on utilities and rent, with gasoline mostly flat is 0.40%.

For lack of a better number, I used 0.40% for September as well.

Mish vs DNE CPI Projections

July (subject to revision) is a known value. Tacking on 0.40 percent to July and then again for August yields a CPI-U of 298.851.

Plugging that into the lead chart formula gets an annualized yield of 7.9%. That’s far under DNE’s calculation but a very nice yield that everyone should take advantage of.

I-Bond Details

The limit for purchasing I-bonds is per person, so a married couple can each put up to $10,000 in the investment annually, or up to $15,000 each if they both also elect to get tax refunds in paper I-bonds.

Also, you can purchase I bonds for each child and if you have a trust, the trust can buy them.

An investor must hold the bonds for 12 months, and if they sell the bonds before five years, they lose three months of interest.

You must hold the bonds for 5 years to collect all of the interest and the rates will change semi-annually.

Treasury Direct has more details on Buying Series I Savings Bonds

In a calendar year, you can acquire:

up to $10,000 in electronic I bonds in TreasuryDirect

up to $5,000 in paper I bonds using your federal income tax refund

Is it worth the hassle given the above limits?

They make great gifts. But hassle is in the eyes of the beholder.

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

Tyler Durden

Sun, 08/28/2022 – 18:30