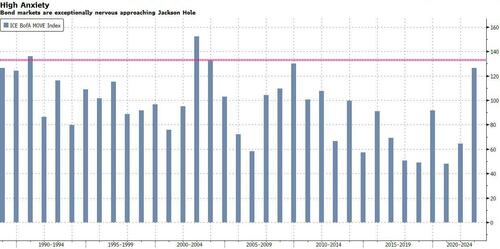

Bonds Have Rarely Been This Anxious About Jackson Hole

By Garfield Reynolds, Bloomberg markets live commentator and reporter

If you were thinking that this week’s Jackson Hole meeting may be one of the most pivotal the Federal Reserve has ever had, then the bond market looks to be agreeing with you.

That makes it more likely that the reactions from all assets after the event will be violent, and that the impact of the speeches from Powell and others will be large and sustained.

The MOVE index of implied bond volatility — at times seen as the Treasuries fear gauge — has rarely been this high in late August. In fact, the only other times it was around or above current levels at this time of the year was in 1990, 2002-03 and 2009. In 2008, it would later move a lot higher, of course, as the global financial crisis struck.

It is noticeable that those prior occasions came either during or just after the Fed cut rates rapidly, rather than in the middle of steep hikes as is now the case.

With the strongest inflation in 40 years and central banks’ policy response threatening to tip the world into recession, investors are right to be nervous. But that doesn’t mean that potential outcomes from Jackson Hole have been fully priced in.

Tyler Durden

Thu, 08/25/2022 – 21:03