U Of Texas Endowment Blows Past Yale, Challenges Harvard As Richest In Nation, Thanks To Oil Investments

While ivy league universities like Harvard are busy virtue signaling about how they won’t be including fossil fuel investments in their endowments, one university has been ignoring the ESG pressure – and has seen its endowment rise to the second largest in the nation as a result.

In fact, not only is the University of Texas ignoring ESG guidelines in their investments, they actually “make about $6 million off a mineral-rich swath of land [they] manage in the US’s largest oil field,” Bloomberg wrote this week. It leases the land to drillers, including ConocoPhillips, Continental Resources, and about 250 other oil companies, the report says.

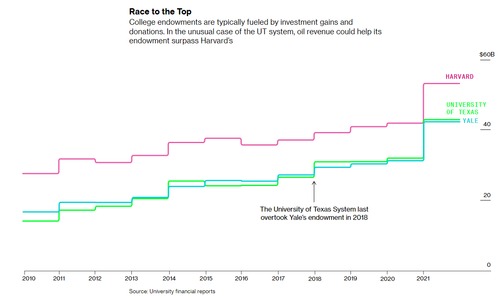

That land is set to post its best-ever annual revenue numbers this year as oil production soars. The incoming revenue is going to push the University of Texas’ monster $42.9 billion endowment closer to Harvard’s country-leading $53.2 billion.

William Goetzmann, a professor of finance and management studies at Yale University’s School of Management, told Bloomberg: “The University of Texas has a cash windfall when everyone is looking at a potential cash crunch. Adjusting your portfolio for social concerns is not costless.”

Harvard’s endowment is expected to show losses this year, the report says, and its annualized 10 year returns as of June 2021 are “among the lowest of its peers” in the Ivy League.

Yale used to be the second largest endowment, but it was passed last year by the University of Texas as oil prices rose.

And what would any money made off of fossil fuels be without the opinion of an activist? Bloomberg found Luke Metzger, the executive director of advocacy group Environment Texas, who said: “We recognize this is a huge source of revenue for UT and higher education that is sorely needed, but at what cost? We’re right here in Texas, experiencing some of the worst impacts of global warming with record high temperatures, wildfires and drought.”

But the University has a hedge: the lands it owns can also be used for solar and wind projects. William R. Murphy, Jr., the chief executive officer of University Lands, who manages the land, said: “These lands host extensive wind and solar power generation.” He said the University “expects considerable growth in these areas and other emerging energies.”

“We’re in the energy business. We’ve been in wind for a long time. We’re on track to be as smart with wind and solar and geothermal and hydrogen as we are with oil and gas,” Murphy concluded.

You can read Bloomberg’s full writeup about the University here.

Tyler Durden

Wed, 08/24/2022 – 13:09