Stocks & Bond Yields Jump As Hawknado Holds Ahead Of J-Hole

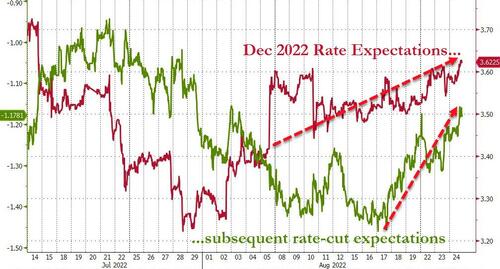

More dismal data today (pending home sales and durable goods orders) sparked some ‘dovish’ moves in stocks BUT the hawkish un-pivot in STIRs was very evident again with both rate-hikes and the subsequent rate-cuts both shifting notably hawkish…

Source: Bloomberg

But stocks didn’t care as the algos bought the bad news (and gave it all back) before stabilizing and clinging to the green. The last hour saw the usual algo chaos with a quick buying-panic lifting The Dow green. Small Caps outperformed followed by Nasdaq and S&P…

Bonds saw more monkey-hammering with yields up 5-7bps across most of the curve but the 2Y underperforming (+10bps)…

Source: Bloomberg

10Y Yields are up 4 days in a row, pushing well above 3.00% to 2-month highs…

Source: Bloomberg

The 2Y yield rallied up to 3.40% – its highest since the FOMC meeting on June 15th…

Source: Bloomberg

The dollar rallied today, retracing around half of yesterday’s weakness…

Source: Bloomberg

Cryptos ended higher on the day with Bitcoin bouncing back up to $21,800…

Source: Bloomberg

Gold was relatively volatile today but ended higher…

EU NatGas topped EUR300/mWh for the first time in history. For context that is equivalent to a $510 barrel of crude oil…

Source: Bloomberg

Oil was very choppy today amid various Iran deal headlines and the DOE Inventory/Demand data, but ended higher with WTI near $95…

Retail pump prices continue to slide but it is due to turn higher soon (Diesel prices ended their near record losing streak today)…

Source: Bloomberg

Finally, we note that the US equity market’s term structure shows no signs of any expectations for excess volatility surrounding the Midterm elections…

Source: Goldman Sachs

We suspect that will change soon…

Tyler Durden

Wed, 08/24/2022 – 16:00