China Launches 200 Billion Yuan Bailout Of Reeling Housing Sector

Lately not a day passes without some China stimulus headline (with a lot of zeroes but not enough to reverse the sharp slowdown in the world’s 2nd biggest economy) and today was no exception.

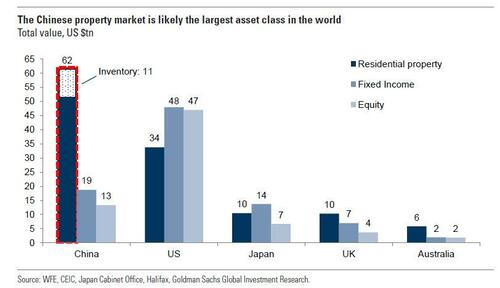

With China’s property sector shrinking with every passing day, following not just last year’s developer defaults of giants such as Evergrande, but this summer’s historic grassroots mortgage boycott which has sent shockwaves across China’s property developers and threatened to crash the world’s largest asset class…

… in its latest show of (not-a-bailout) support for its beleaguered property sector, Beijing will offer 200 billion yuan ($29.3 billion) in “special loans” to ensure stalled housing projects are delivered to buyers, Bloomberg reported citing people familiar with the matter said.

The previously unreported size of the lending program – which was announced with scant details by China’s housing ministry, finance ministry and the central bank late Friday – would make it the biggest financial commitment yet from Beijing to contain a property crisis that’s seen home prices slump and real estate sales plummet, Bloomberg reported, pointing out that housing market instability is a growing threat to political stability during the sensitive run-up to the Communist Party’s leadership transition later this year.

Bloomberg adds that the PBOC and the Ministry of Finance will channel the money through such “policy” banks such as China Development Bank and Agricultural Development Bank of China. And since all banks in China are state-owned, this is effectively the start of the latest housing market bailout. The special loans will only be used on homes that have already been sold but are yet to be finished.

“We view the central government’s introduction of bailout funding as the first meaningfully positive development in the past five to six weeks,” said Jizhou Dong and Stella Guo, analysts at Nomura Holdings Inc. in a note on Sunday. They expected the funding would need to reach at least 200 billion yuan to 300 billion yuan as an initial investment to be effective.

The direct bailout comes just days after the central bank last week unexpectedly lowered its key policy rate to support growth; this in turn led Chinese banks to cut their benchmark lending rates for a second time since May 20, as Beijing urges them to boost overall lending to support the nation’s flagging economy. The five-year loan prime rate, a reference for mortgages, was reduced by a larger than expected 15 basis points to 4.3% after being cut by the same magnitude in May. The one-year loan prime rate was also cut on Monday by a smaller-than-expected 5 basis points to 3.65%, the first decline since January. The drop in the LPRs followed the central bank’s surprise move last week to lower the rate on its one-year policy loans by 10 basis points.

The rate cuts were the latest in a series of actions intended to help the real estate sector as the liquidity crisis is exacerbating a slowdown in the world’s second-largest economy. China is poised to miss its growth target of around 5.5% this year and youth unemployment is at a record 20%.

“We’ve already reached the point where the central government really needs to step in,” said Hyde Chen, head of strategy and asset management for Haitong International, in an interview with Bloomberg TV. With the housing market contributing around 20-30% of gross domestic product, it’s become an “elephant in the room.”

Earlier this year, China allowed banks and bad-debt managers to loosen restrictions on some loans to ease a cash crunch. In April, the central bank held a meeting with about 20 major banks and asset-management firms to help resolve crises at a dozen large real estate firms including China Evergrande Group. Local authorities have offered a variety of housing incentives, including lowering down-payment requirements and even encouraging families with more children to own multiple properties.

However, China’s dogged pursuit of Covid zero, including reoccuring lockdowns, and an increase in bad debt have dimmed confidence and made banks reluctant to lend. Bank loans to the real estate sector have dropped for the first time in 10 years, and the decline could persist, according to Bloomberg Intelligence analyst Kristy Hung.

Tyler Durden

Mon, 08/22/2022 – 17:20