In Sureal Story, 20-Year-Old Student Acquires 6% Of Bed Bath & Beyond, Makes $110 Million In 3 Weeks

We thought that today’s story about Ryan Cohen filing to dump his entire stake in Bed Bath & Beyond after sparking a massive gamma squeeze using deep OTM call options would be the most absurd meme-related story of the day. Boy, were we wrong.

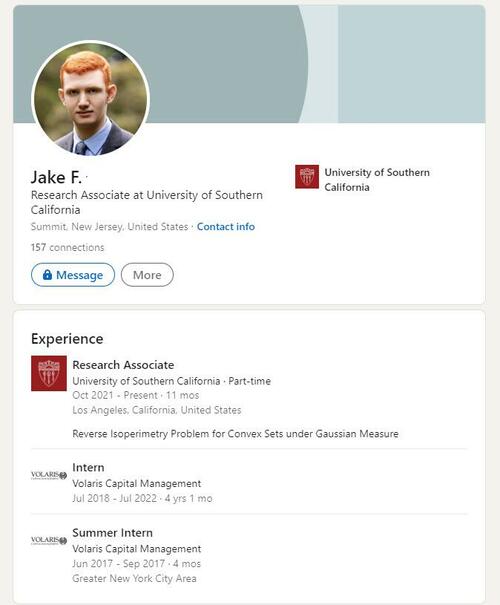

In a late Wednesday article published on the FT which at first (and second, and third) read comes across as a cross between absurdist satire and a PR puff piece, we read the day’s feel-good “riches to riches” story in which a 20-year-old university student, Jake Freeman, who is an applied mathematics and economics major at the University of Southern California, managed to accumulate 6.2% of the entire outstanding stock of Bed Bath & Beyond at under $5.50 share (did we mention he is a 20-year-old university student) amounting to $27 million, which he announced in an activist 13-G letter to BBBY Management on July 21, 2022, and less than a month later sold out of his entire stake – thanks to the insane gamma squeeze in the stock – not through some prime broker but through his TD Ameritrade and Interactive Brokers accounts, making $110 million in the process!

For the sake of simplicity, here is what happened summarized in one chart.

First things first – how the FT got the idea for the story in the first place was rather inspired: they looked at the HDS page of BBBY and found that the 4th largest holder of BBBY is a completely unknown entity called Freeman Capital, which alongside only Ken Griffen’s Citadel and Federated Hermes, were the only three Top 20 holders to build out their entire stakes in the second quarter (as a reminder, shortly before the close we learned that the 2nd largest holder, Ryan Cohen’s RC Ventures, filed a 144 to dump its entire 9.450MM share-equivalent stake). And while we wait for RC Ventures to liquidate its stake, we now know for a fact that the #4 top BBBY holder already sold to unwitting retail investors.

What is remarkable is that at the same time Freeman disclosed its 6.21% (or 4,968,000) stake, the 20-year-old also sent out a 9 page activist letter (hardly the stuff 20-year-old college math majors write) to BBBY management explaining that the company is “facing an existential crisis for its survival” and that the company “needs to cut its cash-burn rates, drastically improve its capital structure and raise cash.” The first page of the letter is below (link to the full letter here). In it…

… Jake Freeman writes that his “plan for the realignment of BBBY consists of two crucial legs: cutting debt and raising capital.” He proceeds to detail his proposal for both legs, which would culminate in reducing the company’s senior debt from $1.2 billion to $500 million (through an exchange offer of the current discounted debt into far less par debt), and the issuance of converts to somehow raise $1 billion in the market (how this would have worked when the stock was trading around $5 with imploding EBITDA is anyone’s guess). But what was most remarkable is what Freeman said in the highlighted section: namely that the “US options market is pricing in high implied volatility for BBBY derivatives which can be leveraged and capitalized on in order to effect a realignment of BBBY’s debt”, in other words a debt reduction using… a gamma squeeze?

Perhaps. We don’t know who on the board (or management team) read Freeman’s letter, or what they did next, but less than ten days after the recent teenager shipped out his “activist letter” to BBBY, the stock doubled, then tripled, quadrupled and so on, from his cost basis… at which point Freeman, quite content with the 6x return he made on his initial investment of $27 million, sold his BBBY stake north of $130 million, making more than $100 million in less than a month!

By this point, readers should have some questions, like for example how did a 20-year-old get $27 million in cash to buy 6.2% of the outstanding shares of Bed Bath & Beyond, and become the 4th largest shareholder? Here, the FT comes to the rescue:

Freeman’s initial stake cost about $25mn, which he said was mostly raised from friends and family. He has invested for years with his uncle, Dr Scott Freeman, a former pharmaceutical executive. The two recently built an activist stake in a publicly traded pharmaceutical company called Mind Medicine.

There’s more:

Freeman also said he had interned for years at a New Jersey hedge fund, Volaris Capital. Just before his 17th birthday, Freeman and its founder, Vivek Kapoor, a former Credit Suisse executive, published a paper titled “Irreducible Risks of Hedging a Bond with a Default Swap”.

But we digress: let’s get this straight: “friends and family” handed a tiny $25 million (really, $27 million) to a 20-year-old math major at USC, whose extensive financial background is co-investing with his uncle “a former pharma executive” and interning at a hedge fund located above a Starbucks office in Milburn, NJ, yet which oddly enough is primarily focused on various options trading strategies.

… $25 million which he invested, through his hedge fund Freeman Capital Managent, LLC, which doesn’t really exist except through a Sheridan, Wyoming-based commercial registered agent at 30 N Gould St. (where more than one registration scam has been discovered recently) and which was “founded” in May 2022 …

…. into just one high-beta, practically bankrupt stock just weeks after the company reported dismal earnings report according to which BBBY sales plunged by 25% in Q2 while its net loss widened to $358mn from $51mn, and its cash position had dwindled to just $107 million from $1 billion at the start of the year, or just a few weeks from insolvency, culminating a catastrophic trend of disappearing EBITDA.

Surely such a concentrated, undiversified investment by a young “hedge fund” guru who doesn’t even have an active Bloomberg account…

… screams “fiduciary duty”, and we can only applaud the “friends and family” who handed their $25 million to this young investing wizard, who were surely expecting a few percent returns here and there, instead of a 5x return in 3 weeks. Surely.

According to the FT, Freeman himself quite shocked by the outcome: “I certainly did not expect such a vicious rally upwards,” Freeman told the Financial Times in an interview on Wednesday. “I thought this was going to be a six months plus play . . . I was really shocked that it went up so fast.”

So young Master Freeman was expecting the 5x return to take place in “six months” but was “really shocked” it took just 24 calendar days. Come to think of it, we would be too (or maybe not, especially since the entire idea was that of Jake’s uncle Scott, M.D…. but more on that in a subsequent post. But here one additional thing is worth noting, between July 13 (when FCM BBBY HOLDINGS, LLC was registered in Wyoming by Jake Spencer Freeman) and July 20 when the 13G was filed disclosing the 5 million share stake, just 41.9 million shares traded, which means that young Master Jake was in quite a rush to build up his stake: as JC Oviedo pointed out, “to amass its stake in this time period, FCM BBBY HOLDINGS, LLC would have had to be over 11% of the average daily volume!”

That’s not only a ton of conviction where to put in every last penny of your “friends and family” money but one hell of a rush too.

Finally, what did Freeman do after making $100 million in what may be the luckiest investment ever made by a 20-year-old?

After selling the shares, Freeman went for dinner with his parents in the suburb of New York City where they live and on Wednesday he flew to Los Angeles to return to campus, he said.

We, for one, can’t wait to see how Freeman Capital Management makes its next 5x return in under a month next (actually we know how, and we will reveal it tomorrow).

Tyler Durden

Wed, 08/17/2022 – 23:01