Will They Roll Or Won’t They? Nomura Warns Of “Lumpy Gamma” Set To Expire This Friday

Decisions have to be made…

As Friday’s OpEx looms, Nomura Strategist Charlie McElligott notes that:

“I am hearing increased confidence from clients around a “soft-landing” scenario, as Jobs then theoretically provide slack to absord the Fed’s signaled path to run policy rates “restrictive- / higher- / tighter- for longer”…”

This all seems very premature according to the strategist:

We know the lesson of the Fed’s 1970s experience was that they backed-off tightening too soon, and then later had to relent and hike again thereafter – with this inconsistent policy uncertainty contributing to what was largely a “lost decade” for Equities; and this is why my largest ongoing medium-term concern is that an increasingly sanguine market “now” does not know how to handle a scenario (say in 1Q23) where inflation remains “stuck” at 4-5%…and the Fed has to continue to “lean in,” with the market getting caught flat-footed against a still-higher Terminal rate being priced

But in the near-term…

…the reality of the Equities price-action is not even about “past peak inflation” and this “cutting of the left-tail”…

…it is no longer about the impulsive FCI easing off a perceived Fed “dovish pivot” on Powell’s horribly messaged communication about policy already being “at neutral,” and / or the hilarious misconception that the Fed is somehow going to be EASING in early 2023 (as my EDZ2EDH3 steepener has seen that prior “cut” totally removed in recent weeks).

Instead, Equities continues to be about “mechanical” flows in the market, particularly:

The magnitude of Options Dealer $Gamma which is stifling Vol, with big “gravity” at the 4300 strike being the largest on the board ($5.33B), and well-pinned btwn 4250 ($3.53B) and 4350 ($3.37B)—while the aggregate implied Net +++$Delta add off of the past month lows is +$744B

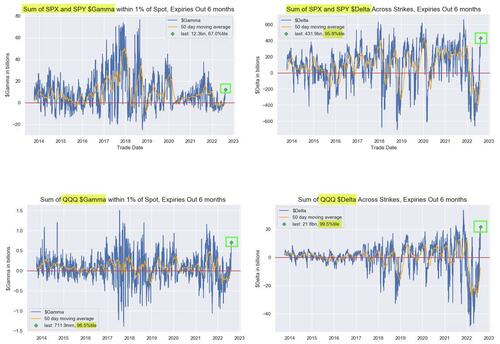

SPX / SPY $Gamma +$12.3B / 67.0%ile with 29.1% of total $Gamma set to expire Friday, Long Gamma vs Spot above 4167 “flip” level; $Delta at $431.9B / 95.8%ile

QQQ $Gamma +$711.9mm / 96.5%ile with 41.4% of total $Gamma set to expire Friday, Long Gamma vs Spot above $322.45 “flip” level; $Delta at $21.8B / 99.5%ile

IWM $Gamma +$70.3mm / 73.4%ile with 31.7% of total $Gamma set to expire Friday, Long Gamma vs Spot above $199.10 “flip” level; $Delta at $2.3B / 86.4%ile

Ongoing Vol Control fund reallocation into Equities exposure (+$27.6B off the lows) via the grinding collapse in trailing SPX realized Vol—1m rVol has been lopped in half since May (36.5) down to current 17.1, while 3m has moved from 30.1 / 100%ile three weeks ago to today’s 24.0—all of which continues to set up for SIGNIFICANT buying over the upcoming month, as more “Vol outlier” days from May continue to drop from the 3m lookback window (1.0% daily SPX change projection = +$32.4B to buy over the next 1m; where a projected 0.5% daily SPX chg = +$40.7B to buy over the next 1m)

Nearing proximity of CTA Trend model triggers to re-leverage currently modest “Long” signals in US Equities futures, with the current “+15% Long” going to 100% Long” in ES1 up at 4329; RTY1 up at 2091; and NQ1 a bit more OTM up at 14,419—all of which would see $sizing grow significantly as a “next wave” of demand overhead, i.e. “buyers are higher”

And so finally, circling back to where we started, McElligott notes that decisions are not only going to need to be made on whether or not funds are going to just let some Delta roll off / monetize some part of those upside Calls which have been put on with abandon into this booming rally since mid-June…

…but also, whether funds are going to capitulate or roll any remaining (and absolutely torched) legacy downside hedges, which are decaying in brutal fashion.

Either way, this Friday’s OpEx is significant to say the least.

Tyler Durden

Tue, 08/16/2022 – 15:00