Walmart Jumps After Beating Lowered Profit, Comp Store Estimates; Boosts EPS Guidance

Three weeks after Walmart stock price tumbled when the retailer spooked Wall Street by preannouncing sharply lower guidance for the second time, and warned the overhang of excess inventory would depress profit margins as the reverse bull whip effect spiked its inventory levels, moments ago the largest US retailer redeemed itself when it reported beats on the top and bottom line as well as comparable store sales as US shoppers sought bargains at the retail giant amid soaring inflation, while nudging its full year guidance slightly higher.

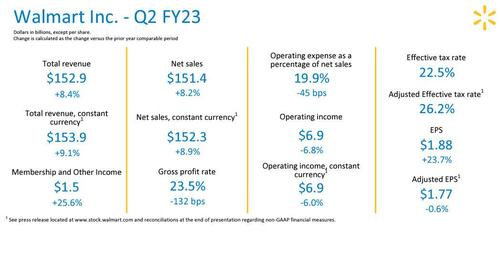

Here are the details:

Revenue $152.86 billion, beating estimate $151.14 billion

Adjusted EPS $1.77, beating the estimate $1.63, which is 10% less than the consensus just before Walmart’s July 25 warning

The company said GAAP and Adjusted EPS include a $0.05 impact from the Walmart Chile insurance settlement, as well as a $0.05 impact from a dividend related to the Company’s equity investment in JD.com

Total US comparable sales ex-gas +7%, beating the estimate +6.48%

Walmart-only US stores comparable sales ex-gas +6.5%, beating estimates of +5.38%

Sam’s Club US comparable sales ex-gas +9.5%, beating estimates of +9.11%

2-year same store sales stack +11.7%, beating estimates of +10.9%

“The actions we’ve taken to improve inventory levels in the US, along with a heavier mix of sales in grocery, put pressure on profit margin for Q2 and our outlook for the year,” Walmart Chief Executive Officer Doug McMillon said in the statement. “We made good progress throughout the quarter operationally to improve costs in our supply chain, and that work is ongoing.”

Walmart is among the countless retailers trying to weather a shift in consumer spending habits as inflation forces shoppers to spend more on essential goods. That’s leaving less money for purchases of general merchandise, which are typically more lucrative for Walmart than groceries, while also forcing the retailer to mark down prices on items such as apparel.

There was some more good news in the company’s inventory level, which after surging in Q1 on the back of the reverse bullwhip effect, declined modestly in Q2 from record highs.

The company also reported a substantial drop in free cash flow which slumped from $7.4BN for H1 2021 to just $1.7BN in H1 2022.

Looking ahead the company maintained its outlook for the second half of FY 2023 while raising its full-year EPS forecast from a decline of 11-13% to 9-11%. Some more detailed from the guidance:

Sees 3Q Adjusted EPS Decline of 9.0% to 11.0%

Sees 3Q Consolidated Net Sales Growth of About 5%

Sees Yr Adj EPS to Decline 9.0% to 11.0%

Sees Yr Adj EPS Ex-Divestitures Decline 8.0% to 10.0%

Says 2Q Top-Line Global Growth Partially From Inflation

Still sees Yr Consolidated Net Sales Growth to Be About 4.5%

Expects FX headwind of about $2.1BN in second half of year

Actions to improve inventory levels and a heavier mix of grocery sales put pressure on 2Q profit margin and FY outlook

In kneejerk response to the stronger than expected earnings, the company stock bounced about 3% premarket, having not only erased all the losses from the previous guidance cut but is now trading at the highest level since early May when it reported dismal Q1 earnings.

The company’s Q2 presentation is below (pdf link):

Tyler Durden

Tue, 08/16/2022 – 07:37