European Assets Risk Being Blindsided By Energy Stew

By Heather Burke, Bloomberg markets live commentator and reporter

European stocks’ recent 10% rally looks overly rosy. The region’s equities, especially Germany’s, and the euro may not be fully pricing in downside risks from the mounting energy crisis.

European 2Q earnings were better than feared. EPS rose 16% y/y, a positive surprise of 3% versus consensus estimates, driven by energy, according to JPMorgan data. Stocks that beat were rewarded more than normal. Many companies from consumer goods to manufacturers were able to pass through higher prices while carmakers shifted production to their most lucrative models.

But there are signs conditions will get tougher, if they’re not already. BMW said new-vehicle orders are retreating as inflation and higher interest rates hit consumers. BASF warned of a “gradual cooling” of the global economy.

Europe faces the worst energy-supply crisis in decades. Energy inflation has soared, up 40% y/y, and last week German and French power futures closed at record highs. Besides curtailed gas supplies from Russia, falling Rhine levels have exacerbated the crisis. On Friday a key waypoint hit a critical mark, further restricting the transport of commodities.

The crunch has pushed up costs for businesses and consumers, thwarting attempts to tame inflation. Already, some countries are preparing for a tough winter — and many economists say a euro-zone recession is increasingly likely.

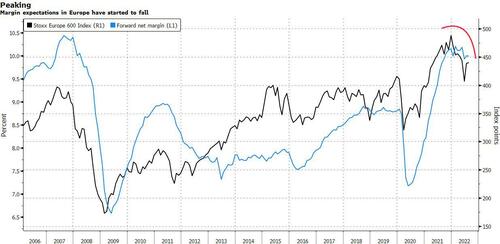

Input costs are rising faster than consumer prices and German CPI is climbing again. European profit-margin expectations are falling.

Cyclical German stocks are particularly at risk from this cocktail of soaring energy, inflation and recession risk, with chemicals, autos and industrials making up about 45% of the DAX. The gauge’s 12-month forward EPS has fallen about 0.5% since July 1, compared to about a 3% gain for the Stoxx 600, and analysts are also more pessimistic on the German benchmark.

If Russia cut all gas deliveries, Euro Stoxx 50 2023 consensus EPS could fall 16%, should energy-intensive companies suspend parts of their European operations, Bloomberg Intelligence estimates. A European recession is likely to result in cuts closer to 20-22%. While this scenario looks extreme, it suggests that estimates need to come down.

The euro, down almost 10% against the dollar this year, could also have further to fall. If the energy crisis drags the euro-area economy into a recession, that will restrict how aggressively the European Central Bank can raise rates. If it decides not to push on with hiking, that would crimp the real yield available on the euro and send it lower, according to colleague Ven Ram. If real rates in the euro area decline by 60 basis points relative to the US, the euro will revisit parity against the dollar, he contends.

The euro also remains a target of short sellers amid concerns about the worsening drought, recession, Italian elections and the energy crisis, as Robert Fullem notes.

To be sure, inflation could start to cool, as seen in the US. Business and consumer sentiment may improve and the doomsday energy scenarios avoided. The weak euro can help lift European earnings. That would sustain the rally in European stocks.

But profit projections are likely too high considering the backdrop, and warnings inevitable. European assets should brace for a tough close to the year.

Tyler Durden

Tue, 08/16/2022 – 05:00