Orwellian Moments Abound

By Peter Tchir of Academy Securities

Orwellian Moments Abound

Today’s T-Report will be more of a hodgepodge of issues that I’m struggling to reconcile. Many of them seem to fit into the perverse sort of logic that we get in 1984.

Doublethink

I won’t harp on Taiwan (or Chinese Taipei) or the “one country, two systems” policy because we touched on those in Things You Will Never See. It is easy to see how ambiguity might have helped as it lets everyone claim what they want, but the reality is that it is a bit absurd. As tensions rise around Taiwan I certainly have trouble fitting many of the statements and policies into a coherent and predictable pattern for what happens next. Maybe these marriages of convenience where we avoid the details (to avoid conflict) tend to end badly? If Taiwan is truly independent and a nation that we have stated we will support military, then why does a senior official visiting spark such a strong reaction from China? Is it because they believe that we accept the one country, two systems policy? It just seems more and more difficult to believe that the positions regarding Taiwan can co-exist. Taiwan has become a major discussion point, so I will summarize the Geopolitical Intelligence Group’s current view:

China does not want conflict with the U.S. so any aggressive behavior on their part would have to be framed as responding to some aggression from Taiwan. They would need (or want) a pretext, which brings back bad memories from discussing Putin and Ukraine late last year.

The timing of any possible invasion or use of force has moved closer. Still unlikely and not the base case for most of the GIG, but a risk that has become more real over the past few weeks.

The economic and political pressure points that China has with Taiwan will be used even more aggressively to shift behavior.

There are parallels and lessons to be learned from Russia’s invasion, but there are also some differences:

Russia’s military system is a barbell (with senior officers and conscripts) and little in the way of non-commissioned officers (NCOs). China has had much more direct exposure to the U.S. (and NATO) style of command (joint exercises, etc.) so it may not face the same issues as Russia. The joint exercises conducted with land, sea, and air power as they intimidated Taiwan showed a level of coordination the Russians haven’t exhibited.

The Chinese military equipment, while untested, may not fail in actual use at the pace that Russian equipment has been failing.

Ukraine was poorly supplied with equipment at the start of the war (not the case with Taiwan), which has a well-equipped and well-trained military. But it is an island, making re-supply much more difficult. In Ukraine, the land route from the West into Ukraine is easy and well controlled. Also, NATO countries adjoin Ukraine, so we are to a large extent operating in our own backyard. Any conflict around Taiwan would be in China’s backyard, giving them logistical advantages.

Even without the prospect of war, I can confirm that more people are revisiting discussions with Academy regarding our supply chain theories. We’ve been highlighting to investors and corporations that supply chain “security” is an issue and we expect a shift in supply chains to become more oriented around North/South transportation lines rather than East/West. Taiwan was effectively blockaded for a few days (many ships apparently wouldn’t go into the area with China and Taiwan conducting live fire exercises).

Oceania Has Always Been at War with Inflation

I’m old enough to remember when we were at war with deflation. That deflation kept central bankers and politicians up at night. It seems crazy, but I could almost be convinced that Japan has been trying to create inflation for 4 decades. Heck, I’d swear that it was less than a year ago that inflation was “transitory,” and many believed that, but I must be misremembering.

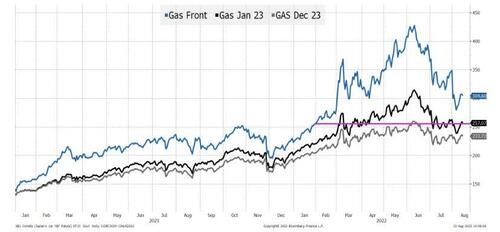

Here we see gasoline futures contracts. In January 2023 we will settle against the January 23 contract as it will be the spot contract at the time. It closed on Friday at 257, versus September which closed at 304. Yes, futures will move around, but for now, it seems that it is “reasonable” or at least partially logical to expect that in January 2023, gasoline prices will have a year-on-year change of 0. The comps get easier from there, and the gas futures curve is downward sloping, also pointing to deflation.

I go back to the Inversion, Inventory, and Incongruity report to highlight my concern about the war on inflation.

While history doesn’t have to repeat, falling energy prices haven’t been great signals for equities.

2 + 2 = 5

Jobs, jobs, and more jobs (or fewer jobs). For some reason the divergence between the two surveys keeps coming to mind. I have no doubt that both surveys follow procedures and are implemented as designed. I just can’t shake the feeling that policy makers, central bankers, companies, and investors are all being forced to work with low quality data. While maybe not as bad as being forced to live in a world where 2+2=5, it does require an extra level of caution regarding making assumptions in either direction.

The Establishment Survey created 528,000 jobs. That seems like a reasonably precise number. But the BLS makes it clear that there is a lot of margin for error around what seems like a precise number. There is a 90% chance that number is right within 120,000. So, last month, the Establishment Survey said that with a 90% chance, between 408,000 jobs and 648,000 jobs were created. To be honest, the fact that there is a 10% chance that we are more off than that is disturbing (at least to me).

The Household Survey is worse, with a 90% chance that the actual number is +/- 300,000 compared to what is reported! So, last month’s reported number of 179,000 jobs (again, seems precise) means that it is 90% likely that the economy lost 121,000 jobs or had created as many as 479,000 jobs.

Maybe we can take some comfort in the fact that job creation in the range of 408,000 to 479,000 is part of both survey’s 90% likelihood range. In this day and age, it seems almost unbelievable that we try and make decisions on data that at best is rough. I’d rather see 87,000 new hires for data collection improvement rather than IRS audits, but that bill gets its own section in today’s T-Report.

The incredible thing about these two surveys is that they balance out well over time.

Going back two decades, the total difference between the two surveys is 74,000 jobs (they periodically do big restatements of the data to ensure that occurs, but it still seemed surprising given the big month to month deviations).

It seems that the deviations are increasing. Differences of 500,000 jobs between the two reports was uncommon, and now it is almost the norm. Those gaps also seemed to close fairly quickly (that could be due to the restatements). Clearly COVID was a shock to the data and one thing about shocks to the data is that it tends to render seasonal adjustments and other smoothing factors somewhat useless. We like “adjusted” data because it smooths for seasonality, but that smoothing process tends to be far less useful after shocks to the system have occurred, because “normal” doesn’t apply and that is a condition for most smoothing functions.

Recently, we aren’t getting this convergence between the Household and the Establishment data:

Last 4 months have seen 1,848,000 more jobs in the Establishment Survey. I’ll pretend there is precision and won’t make fun of the fact that it is reasonable (given the monthly ranges of +/- 120k and +/- 300k) that we would still miss the number 10% of the time.

Year to date, the difference is 981,000 (i.e., almost 1 million jobs that the surveys cannot agree on). Year to date is getting long enough to make me wonder, either we have fewer jobs than the Headline or we have much lower unemployment rates than are being published (or the participation rate is also off).

For the past 12 months, the difference is 563,000. If I cherry picked the data and went for 13 months, I’d get a difference of only 160,000, but going back further makes the difference even larger.

Given the smaller range on the Establishment Survey, it is generally the more trusted of the two reports, so I understand why we are leaning in that direction, but the growing discrepancy is concerning. But as I lament garbage in/garbage out, I can’t help but think that with the +/- 300k jobs range, to get a 90% likelihood on a data series that averages 91k for the past two decades, we deserve better.

We are stuck working with the numbers we have in front of us, but that doesn’t make it right.

Three things seem likely to happen:

The Household jobs data comes in extremely strong to catch up.

If the Labor Force Participation rate ticks up, that would be good and leave fewer of us scratching our heads about why no one wants to work.

If this catch-up drives unemployment rates lower, possibly towards 3%, then the Fed will be forced to remain hawkish for longer.

The Establishment gets some nasty revisions or big losses to catch up (bad).

Ignorance is not bliss and it is frustrating that the quality of our data is so dubious. Maybe it is the best that is achievable, but I think spending government time and money revamping this as much as possible would help policy makers and everyone else make better decisions. Maybe the revised ADP methodology will be helpful when it comes out.

I guess my main message about this is that as we do our analysis, some healthy skepticism about the data (from all directions) is useful. It should help us prepare for “surprises.”

War is Peace

The Inflation Reduction Act bothers me. Not that I have specific objections to the policy (at least none that I want to discuss), but because the title seems to be just pandering to the zeitgeist of the moment. For some reason, I’m having a visceral reaction to the title and the way it is being jammed downed our throats. Yes, politics always has to take advantage of the moment. Yes, all sorts of things are squeezed into legislation to grease the wheels. It is just that somehow, I expected more given how tense the geopolitical climate has become. Much of the bill has little to do with inflation. Some of it seems likely to be inflationary at the beginning, though if the projects bear fruit, it becomes deflationary over time. I think more could have been done in some areas and less in others, but that isn’t the point right now.

What is bothering me is that the bill has become a slogan and D.C. seems to believe that creating a slogan is more beneficial than discussing the details and being open about the trade-offs. I think our best opportunities as a country and for the globe will come from thoughtful, bipartisan discussions where many answers can be found in the middle (if we look for them there). I’m just nervous that sloganizing bills and assuming a lack of demand for more details is the wrong direction. The more we can have serious discussions that can lead to 5-year, 10-year, and even 20-year plans, the better, but we still seem mired in soundbites. I apologize for the rant, but I think that the people of this country can understand issues, make trade-offs, and can make sacrifices for the greater good, but are frustrated that the politicians don’t seem to see it that way. Anyways, I figure that I’m entitled to a good rant given the title of this week’s report.

Bottom Line

Inflation is easing and the “Fed can pivot” story won this week. Thin liquidity and options/volatility managed strategies (including risk parity) all contributed to the market moves. Yield curve inversion eased a little. Rate hike probabilities dropped from almost a certain 75 bps in September to closer to 50 bps. Having made it through the auctions, look for yields to drift tighter.

Credit spreads did extremely well with CDX IG dropping from 81 to 73 and the Bloomberg Corporate Bond OAS dropping from 143 on Tuesday to 132 (there was a robust calendar and Academy had the privilege of not only being on several deals, but acting as Joint Bookrunner on two of them). It was encouraging to see European credit join in the rally (ITRX MAIN went from 102 to 92) and I continue to eye European banks for a possible turnaround story, which could drive a real risk-on trade in Europe (difficult to see with energy problems looming, but that is often the moment of opportunity).

I continue to expect credit to perform well and am encouraged by how many “non-traditional” investors are moving into corporate credit as the combination of all in yields and low dollar prices have made the risk/reward appealing. Stocks finished the week up about 3%, which was impressive as the week started with more fears about semiconductors only to finish the week focused on the potential pivot.

Materials (XME) had a great week, continuing a bounce in those stocks (energy did ok, but materials and commodities were outperforming nicely). I like those sectors as the buildout from the recent legislation should help create demand for raw resources. I still like being overweight Emerging Markets, which also did well. Homebuilders are interesting as construction material costs have dropped and mortgage rates have come down a touch.

The best analogy I heard all week. Last week, Tom Keene at Bloomberg described an analyst saying that the pendulum has swung back and at the moment things look balanced, but that the pendulum won’t stop here and will go too far in the other direction. That sums up my view on where the economic data is headed better than anything I could come up with myself.

It is time for me to go outside and enjoy the weather with a good dystopian novel

Tyler Durden

Mon, 08/15/2022 – 06:30