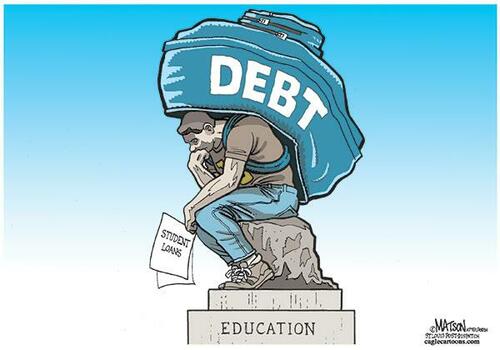

Student Loans Are A $197 Billion Money-Loser For Taxpayers: GAO

Though progressives routinely express horror over that idea that the federal government profits from student loans, a new analysis by the government’s own watchdog finds taxpayers will lose $197 billion on loans made over the past 25 years.

According to the General Accounting Office (GAO) report, that’s a $311 billion swing into the red compared to prior Department of Education estimates that the loans would net taxpayers $114 billion.

The biggest driver of the loss is pandemic relief provided by the CARES Act of 2020. The breaks included suspending all payments, interest accrual, and involuntary collections for loans in default. The pause cost $102 billion through May, but since it’s still in effect, the meter’s still running.

It gets worse: Despite the fact that borrowers aren’t repaying their debt, the pause time still counts toward time-based loan forgiveness plans. The most offensive of those plans forgives the remaining balance after 10 years of working for federal, state or local government.

The government also inaccurately projected how loan payments would be affected by four different income-driven repayment plans. “If your income is low enough, your payment could be as low as $0 per month,” cheerfully proclaims the Department of Education, in a vivid illustration of how the welfare state disincentivizes work and prosperity.

The income-driven plans typically cap payments at 10% of income, and limit them to 20 to 25 years. What if a borrower still has a balance after that? Why, it’s forgiven, of course.

The CARES Act relief provisions are set to expire at the end of the month. The breaks were originally to last just six months, but borrowers are still coasting 29 months later, thanks to five extensions by Presidents Trump and Biden.

Despite the Biden administration’s insistence that the economy is in terrific shape and the fact that most of America now living in a post-Covid world, there are signs that Biden — with his approval ratings in the cellar and his party bracing for a rough midterm election — is going to extend the student loan “pause” once more. The government recently told federal student loan servicers not to send payment reminders to borrowers.

Maybe Biden will pin another extension on The Great Monkey Pox Crisis Of 2022, which is just one of many circumstances overwhelming this NYU adjunct journalism professor:

It’s August. Inflation is at a high. Covid cases are still rampant. Monkey Pox is declared an emergency. Most people have yet to return to the office. Deadly weather events. Everything feels upside down and we’re expected to restart student debt payments? #CancelStudentDebt

— Malak Saleh (@malaknsaleh) August 3, 2022

Of course, on a $1.4 trillion loan portfolio, there’s plenty more opportunity to lose money — and the easiest way is to simply give it away. As a candidate, Biden pledged that he would cancel at least $10,000 of student debt, and progressives like Senator Elizabeth Warren are pushing him to cancel $50,000.

White House officials were slated to meet with student debt cancellation activists on Thursday, and the White House Press Secretary Karine Jean-Pierre earlier said a decision on cancellation will come this month.

As the Cato Institute’s Neal McCluskey explains at The Hill, the federal student loan machine’s harm isn’t limited to its effect on the national debt:

One of the worst effects is higher education’s notorious price inflation. Aid, including loans, is baked into college prices, requiring many people to borrow. A study from the Federal Reserve Bank of New York estimated that for every $1 increase in federal subsidized loan caps, colleges raised their prices 60 cents.

Add it all up, and what was originally thought to be a modest money-maker for the federal government is now yet another means of redistributing wealth — not only to individuals but also to universities and their bloated staffs.

Tyler Durden

Fri, 08/12/2022 – 10:15