Mister Market Handing Out Roses Will Eventually Change His Mind

By Ven Ram, Bloomberg Markets Live commenator and analyst

Just when you thought owning beta isn’t working anymore, out pops Mister Market and serenades you with a bouquet of roses.

If you had taken a deep breath at the start of the second half of the year and kept your faith in the broader market, you would have got one-period price returns of some 11% on the S&P 500 and about 15% on the Nasdaq 100. You would, of course, take that any day. And especially in a milieu where inflation — despite the brouhaha we have seen since the release of US inflation data for July — is running rife and the Fed is nowhere near done with its hiking cycle.

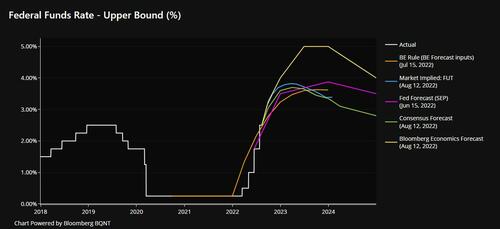

We have already heard from Charles Evans and Neel Kashkari that the Fed will keep going into next year and that the monetary authority has no intention to start slashing rates as the market seems to be thinking. By year-end we will likely be witness to the Fed rate being somewhere between 3.50% and 4% given that the Fed still needs to get into restrictive territory to engineer a soft landing. And lest it should be forgotten, the top end of the rate penciled in by Fed members for next year is 4.40%. Now juxtapose that with what stocks are yielding, and you will know their recent hubris may be tested in the months to come: the S&P promises an earnings yield of 5.4% and the Nasdaq just 4.1%.

If you are going to own equities for the foreseeable future, would you rather not demand a bigger risk premium than a wafer-thin margin over where the Fed rate is likely to be? And don’t forget the rebound in real yields that we have seen this month, which has been nothing short of stunning, which will act as a drag on equities. At the moment, both the major stock benchmarks are sorely in need of a reality check — especially everyone’s favorite technology stocks.

Owning beta has its advantages, but it may be easy to be swept up by a false sense of complacency. Mister Market seems to be thinking that this summer will last all-year long, but when the reality dawns, we know he can turn whimsical before you have time to pare your positions.

Tyler Durden

Fri, 08/12/2022 – 18:05