Yields Hit Session High After Ugly, Tailing 30Y Auction

After two stellar refunding auctions to start the week, moments ago the Treasury concluded the sale of its quarterly refunding week with the sale of $21BN in 30 year paper. Surprisingly – after a solid 3Y and fantastic 10Y sale earlier this week – today’s auction could certainly have gone better.

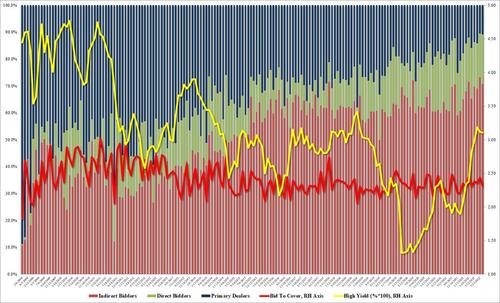

Stopping at 3.106%, the high yield dropped fractionally from last month’s 3.115%, but what is more notable is that after 3 consecutive stropping through auctions, today’s sale tailed the When Issued 3.095% by 1.1bps, which is strange considering the notable selloff into the auction.

The bid to cover of 2.310 dropped from 2.436 in July and was also below the six-auction average of 2.37.

The internals were far more solid, with Indirects awarded 70.65% – one of the highest foreign take downs on record – and with Directs awarded 18.5% meant Dealers were left with just 10.84%, the second lowest Dealers award on record which in a time of not just QE but also QT, it is to be expected that primary dealers will do everything to avoid duration exposure.

In kneejerk response to the results, 10Y yields gaped up to fresh intraday highs, trading around 2.85% at last check.

Tyler Durden

Thu, 08/11/2022 – 13:18