Sorry White House, Gasoline Prices Are About To Surge: Here’s Why

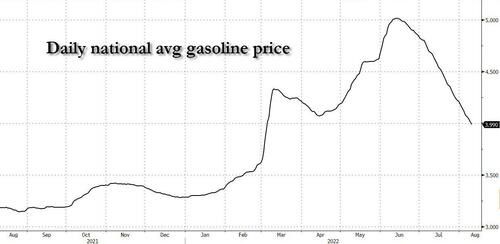

There was celebration in the White House overnight when the AAA reported that the average retail gasoline prices fell below $4 a gallon to the lowest level since early March.

It wasn’t just the Biden admin (which eagerly awaits the plunge in gas prices to translate in sharply higher approval ratings) however, which was enthused by the drop in gasoline: so was the broader market, expecting this drop in gas prices would allow the Fed to ease its tightening pace and accelerate the stock market bounce.

Alas, the recent drop in gas prices is unlikely to last, and not just because after dropping to pre-Ukraine war levels, oil has resumed its move higher, with Brent just shy of $100 and expected to move briskly higher…

… now that fears of collapsing gasoline demand have been shelved.

Implied gasoline demand finally spiked, jumping back over 9 million: was 9.12MM in last week, up from artificially low 8.54MM the week prior

— zerohedge (@zerohedge) August 10, 2022

The more actionable reason why gas prices – especially in the tri-state area – are set to move much higher, is because the wholesale cost of gasoline in New York surged more than 40% against futures after regional supplies sank to the lowest level in a decade, raising the risk of shortages.

Reminding market watchers just how vast the chasm between financial and physical commodities has become, gasoline stockpiles in the central East Coast region are at the lowest absolute level since November 2012, the EIA reported yesterday. Seasonally, supplies are near an all-time low in records going back to 1993…

… and as a result, the premium for New York gasoline on the spot market, jumped by 10 cents Wednesday. Only San Francisco has more expensive wholesale gasoline.

Stockpiles have slumped as a result of tighter supply amid a rebound in demand, a drop in European gasoline imports and continued cargo diversions away from the region. This offset production efforts from East Coast refiners – all of them in the Central Atlantic region – which operated at 100.4% of nameplate capacity last week, the highest on record.

But so what? A New York shortage will hardly crippled the rest of the country? Well, not so fast: as Bloomberg notes, low gasoline supplies in region can have an outsized global impact because New York Harbor is home to physical deliveries of futures contracts that underpin trade flows around the world. A fuel tanker moving from India to Brazil, for example, is likely priced against the New York futures benchmark. So shortages in this key region that cause prices to spike would also impact prices elsewhere.

Meanwhile, gas station fuel sales have been rising over the past few weeks, according to data from price reporting agency Opis and retail tracker Gasbuddy. The implied demand figure from the EIA has been far more volatile than usual in recent weeks (and prompted allegations of manipulation by the Biden DOE), but the latest weekly jump should help further bolster retail volumes.

Commenting on the recent absurd gasoline demand reports, Rabobank’s Michael Every wrote the following:

You could hear the champagne corks fly wherever you were yesterday. After all, there was “zero US inflation” in July, as some put it. And that came after zero US recession, as some also put it, despite two consecutive quarters of negative GDP growth. And after a red-hot labour market report. And EIA energy data showing gasoline usage apparently well below 2020 levels despite all this non-recession and jobs boom, and even as refineries are working at incredibly high capacity levels, diesel stocks are low, and exports are also down. These are all numbers/claims worthy of champagne. Yet they make little sense taken together.

And speaking of diesel, supply there remains dire as well, with seasonal distillates stockpiles languishing at the lowest level ever since March in records going back to 1993. The tightness will start to be felt when the weather turns in two months. The US northeast is the only region in the country where the majority of home and commercial heating comes from burning fuel, and while it won’t be hit as hard as Europe where a monthly electricity bill will hit 4 digits, it will still be hit very hard.

Tyler Durden

Thu, 08/11/2022 – 17:40