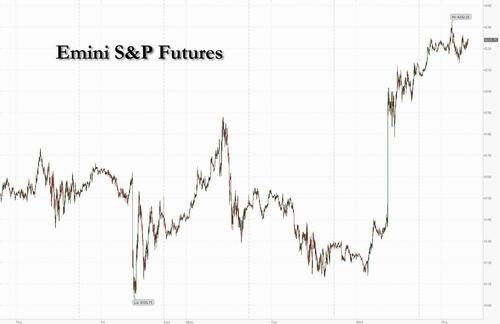

Futures Storm Higher As Nasdaq Bull Markets Sparks FOMO Chase

US equity futures extended their post-CPI miss gains (for reasons laid out last night by Goldman’s trading desk which sees $13 billion in non-fundamental demand every day and a new round of FOMO by lagging hedge funds), rising 0.4% on Thursday morning…

…. while tech stock futures were also higher changed after the Nasdaq 100 advanced 20% from its June lows, entering a new bull market, with Wednesday’s softer-than-expected inflation print bolstering hopes of less aggressive Fed tightening. Contracts on the Nasdaq 100 were 0.4% higher by 7:15 a.m. in New York after the underlying gauge soared 2.8% on Wednesday to the highest level since May 4.

A dollar index slipped, adding to retreat a day earlier that was the biggest since the onset of the pandemic. Short-term Treasury yields held a drop on investors’ scaled-back expectations of how aggressively the Fed will have to tighten monetary policy; bitcoin rose to the mid $24,000s.

In premarket trading, Disney jumped after beating estimates and saying it’s raising the price of its flagship Disney+ streaming service by 38%. Analysts were optimistic about the performance of the company’s Parks business as travel rebounds. Meanwhile, shares in Bumble Inc. fell ~7% after the dating app company lowered its full-year revenue guidance. Given the stock’s recent outperformance, analysts noted that expectations were high going into the firm’s 2Q report and attributed the tepid forecast to a shift in product timing, which increases execution risk in 4Q. Other notable movers include:

Morgan Stanley (MS US) cut its PC shipment estimates for the year after noting that demand for consumer personal computers is weakening and PC channel inventories are moving higher. The brokerage, however, maintained its recommendations on Dell and HPQ.

Matterport (MTTR US) advances ~15% in US premarket trading Thursday after the software company boosted its revenue guidance for the year. Second-half growth outlook is “better-than-feared,” Piper Sandler says.

Traeger (COOK US) analysts reduced their price targets on the stock, with Baird downgrading the grill maker to neutral after it cut its revenue guidance for the full-year. Brokers said that catalysts for the stock in the immediate future were in short supply.

First Solar (FSLR US) raised to overweight at KeyBanc as it refreshes its views on US renewables stocks, including PT raises for Enphase Energy and NextEra.

Marathon Digital (MARA US) and Riot Blockchain lead cryptocurrency-exposed stocks higher in premarket trading with Bitcoin climbing to a near two-month high after softer-than- expected inflation data fueled rallies across digital tokens.

Sonos (SONO US) drops 20% in premarket trading after the audio-products maker cut its full-year guidance for revenue and adjusted Ebitda, citing a challenging macroeconomic backdrop, with the strong dollar and inflation pressuring consumer sentiment. The company also said Chief Financial Officer Brittany Bagley is stepping down to pursue another opportunity.

Stocks surged after the July CPI reading showed US inflation decelerated in July by more than expected, printing at 8.5% in July, down from the 9.1% June print that was the largest in four decades, a development that could take some pressure off the Federal Reserve in deciding on more rate hikes. However, Fed officials were quick to stress more rate increases are coming to counter price pressures and signaled investors should rethink expectations of cuts next year to shore up economic growth. Still, the news was enough to help the duration-heavy and deflation-propelled Nasdaq index reclaim nearly $2.8 trillion from its June 16 low, with Apple, Amazon.com and Microsoft leading the rally. Tech stocks have been rebounding as bond yields pulled back amid expectations that Fed rate hikes may push the US economy into recession. Lower bond yields particularly support growth stocks like tech, which are valued on future profits.

“Despite the Fed’s unwavering rhetoric, this release has given investors hope that the pace of rate rises in the US will slow and that the fabled soft landing may be less elusive than feared,” said Lewis Grant, head of global equities at Federated Hermes.

“From now onwards, the Fed should start worrying about growth risks much more than inflation,” said Ashish Marwah, chief investment officer of ADS Investment Solutions Ltd. While he sees no case for a large rate hike moving forward, Marwah said a smaller increase at the next meeting would give the Fed “time to pause and evaluate what the underlying inflation trend is.”

European stocks trimmed earlier gains as losses in the healthcare sector outweighed optimism that signs of a peak in US inflation would spark a dovish tilt in Federal Reserve policy. The Stoxx 600 Index was less than 0.1% higher by 10:33 a.m. in London after surging yesterday to its highest in two months. Healthcare stocks including Sanofi, GSK Plc and Haleon Plc were major drags on the benchmark amid concern over litigation related to Zantac, a once-popular antacid that has drawn a flurry of US personal-injury lawsuits alleging it causes cancer. Energy as well as travel and leisure stocks were among the sectors moving higher. FTSE MIB outperforms, adding 0.4%, DAX lags, dropping 0.1%. Energy, insurance and banks are the strongest-performing sectors. Here are the biggest European movers:

Coca-Cola HBC shares advance as much as 6%, the most since March 29, after the company reported 1H sales and Ebit that beat estimates and reinstated its guidance for the year.

Kahoot! jumps as much as 22%, the most since August 2021, after the Norwegian game-based learning platform firm reported a rise in 2Q earnings.

Russia’s equity benchmark climbed as the price of natural gas in Europe rose and investors worldwide turned more optimistic after signs of cooling US inflation.

Stroeer surges as much as 17%, the most since November 2020, after the online advertising and billboards company reported 2Q results which Citi says were “strong.”

Zurich Insurance gains as much as 2.4% with analysts saying the Swiss insurer’s quarterly results were strong, as expected.

Network International jumps as much as 19%, the most since November 2020, after the payments firm’s 1H results met expectations and it announced a new buyback.

Sanofi, GSK and Haleon extend their declines amid mounting concerns about litigations around recalled heartburn drug Zantac.

Valneva falls as much as 3.9% after the French biotechnology company lowered its guidance following setbacks for its Covid-19 vaccine.

Earlier in the session, Asian stocks gained as cooler-than-expected US inflation data spurred bets that the Federal Reserve will temper the pace of its interest-rate increases. The MSCI Asia ex-Japan Index rose as much as 1.8%, the most in three weeks, lifted by technology shares amid falling Treasury yields. Tech-heavy markets including Taiwan and South Korea led gains in the region. Benchmarks in China also advanced, while Japan’s market was closed for a holiday on Thursday. US inflation decelerated in July by more than expected, spurring a rally in shares overnight as investors bet on a potential pivot by the Fed on monetary tightening. The positive sentiment carried through to the Asian session, while traders continued to monitor Covid lockdowns in some Chinese cities.

“Inflation has been expected to peak over the summer for some time, so it was reassuring for markets that there are clear signs that this looks to be happening,” said Oliver Blackbourn, multi-asset fund manager at Janus Henderson Investors. “Any dovishness is seen as positive by the stock market, particularly for the highest valued companies.” Still, ongoing US-China tensions have kept some investors on edge, with President Joe Biden being “cautious” about the future of tariffs on more than $300 billion in goods from the US rival. Japan was closed for a holiday.

Indian stocks tracked regional peers higher after softer-than-expected US inflation print raised expectations that the Federal Reserve will raise interest rates at a slower pace. The S&P BSE Sensex climbed 0.9% to 59,332.60 to its highest level in four months in Mumbai. The NSE Nifty 50 Index added 0.7%. Of the 30 member stocks on the Sensex, 20 rose and 10 fell. Housing Development Finance Corp rose 2.4% to its highest level in four months and was among the biggest boosts to the gauge. Fourteen of 19 sectoral sub-indexes compiled by BSE Ltd. advanced, led by a measure of lenders. “The lower than expected US CPI numbers have catalyzed a rally in global markets on the hope that the US Fed may go slow on rate hikes,” Deepak Jasani, head of retail research at HDFC Securities Ltd., wrote in a note. The prospect of faster monetary tightening by the Fed had stoked fears of capital outflows from riskier emerging market assets like India. In earnings, of the 44 Nifty companies that have announced quarterly results so far, an equal number have missed and exceeded analyst estimates. Apollo Hospitals is scheduled to announce results later in the day.

In FX, the dollar slipped while NOK and GBP are the weakest performers in G-10 FX, EUR and DKK outperform.

In rates, treasuries advanced despite better risk appetite with the yield curve extending Wednesday’s CPI-inspired bull-steepening, following gains led by front-end during London session; 2-year yields richer by ~3.5bp, off session low. 10- to 30-year yields (also off lows) are little changed, steepening 2s10s and 5s30s spreads by ~2bp and ~3bp on the day; US 10-year sector outperforms bunds by ~3bp, gilts by ~5bp. The Treasury auction cycle concludes with $21b 30-year bond sale at 1pm ET; Wednesday’s 10-year note auction stopped 0.6bp below the WI yield at the bidding deadline. WI 30-year yield around 3.03% is ~9bp richer than last month’s result, which stopped 1.8bp through. Bunds and gilts erase post-CPI gains, catching up to USTs reversal on Wednesday as hawkish comments from Fed policy makers stymied prospects of a pivot. Peripheral spreads tighten to Germany.

In commodities, WTI crude climbs 0.5% to around $92; gold down about $2 to below $1,790. Most base metals trade in the green; LME nickel rises 2.7%, outperforming peers. LME zinc lags, dropping 0.6%.

It’s a fairly quiet day ahead on the calendar now, but data releases include the US PPI reading for July, as well as the weekly initial jobless claims.

Market Snapshot

S&P 500 futures up 0.1% to 4,216.25

STOXX Europe 600 little changed at 440.16

MXAP up 1.1% to 162.09

MXAPJ up 1.7% to 529.79

Nikkei down 0.6% to 27,819.33

Topix down 0.2% to 1,933.65

Hang Seng Index up 2.4% to 20,082.43

Shanghai Composite up 1.6% to 3,281.67

Sensex up 0.9% to 59,317.34

Australia S&P/ASX 200 up 1.1% to 7,070.95

Kospi up 1.7% to 2,523.78

German 10Y yield little changed at 0.91%

Euro up 0.2% to $1.0323

Brent Futures little changed at $97.39/bbl

Gold spot down 0.3% to $1,786.27

U.S. Dollar Index down 0.15% to 105.03

Top Overnight News from Bloomberg

‘Worst Likely Over’ for EM Asia Currencies as Fed Hike Bets Ease

Oil Steadies as Traders Count Down to OPEC, IEA Market Outlooks

Fed Leaders, Unswayed by Softer CPI, See Rate Hikes Into 2023

Kim Jong Un Was ‘Seriously Ill’ in North Korea Covid Surge

Market Surge After CPI Data Has Skeptics Issuing a Warning

Football Fanatic Builds $1 Billion Bet Against Game’s Mega Rich

Pelosi Says US Can’t Let China Establish ‘New Normal’ on Taiwan

Hedge Funds Face SEC Push to Share More on Their Strategies

JPMorgan Gold Traders Found Guilty After Long Spoofing Trial

Trump Deposition Day: Invoking the Fifth in Showdown With AG

Driller W&T Opens Internal Probe After Whistle-Blower Letter

Chicago Mayor Says City Revenue Unhurt by Corporate Exits

Trump 2016 Staff Can Talk About What They Saw on Campaign

Snowballing US Rent Crisis Spares No City or Income Bracket

CVS Is Said to Have Been Mystery Bidder for One Medical

‘Crying CEO’ Says He Loves His Employees, Even Those He Laid Off

Bolton Was Target of Murder Plot in US Iranian Guard Case

Disney Tops Profit Views, Raises Ad-Free Streaming Price 38%

Ping An Sees HSBC Overstating the Challenges of a Spinoff

Blackstone to Buy Bulk Purchaser CoreTrust From HCA Subsidiary

Apple Ramps Up Its In-House Podcasting Efforts With Studio Deal

Cut-to-Bone Positioning Set the Stage for Stocks’ Big Bounce

More detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks took impetus from their global counterparts after softer-than-expected US CPI data spurred a dovish reaction across asset classes and unwound some of the hawkish Fed market pricing. ASX 200 reclaimed the 7,000 level with the tech and mining-related sectors leading the gains in the index, while financials are also positive as participants digest earnings results and updates from AMP and QBE Insurance. KOSPI strengthened despite the increase in COVID cases to a 4-month high and the recent devastating floods in Seoul, with strength in index heavyweight Samsung Electronics after it introduced its latest line-up of foldable smartphones and other key products. Hang Seng and Shanghai Comp were higher with Hong Kong lifted by tech and property stocks, although advances in the mainland were initially contained following a jump in COVID infections and with the Biden administration said to have currently set aside the option of scrapping some China tariffs or investigating adding more.

Top Asian News

China Pledges to Cut Mining Deaths After Spate of Accidents

LNG WRAP: Asia Price Rally Prompts Chinese Buyer to Sell Cargo

‘Worst Likely Over’ for EM Asia Currencies as Fed Hike Bets Ease

Hang Seng Index Rises 2.4%; Alibaba Leads Advance

Ether at Two-Month Peak on Signs of Success in Key Software Test

Philippine Stocks Surge 3.2% as Central Bank Seen Less Hawkish

European bourses are little changed overall after a modestly firmer open failed to gain much traction with newsflow limited, Euro Stoxx 50 +0.1%. Stateside, performance is very similar though futures are faring incrementally better, ES +0.2% and the NQ +0.4% remains the relative outperformer. China vehicle sales (Jan-Jul): -2% YY (prev. +19.3%), via Industry Association. New energy vehicles sales (Jan-Jul): +120% YY.

Top European News

UK Real Estate Firms Warn of Price Falls as Borrowing Costs Rise

Russia Aircraft Destroyed, Ukraine Says: Photo

Ceconomy Drops; Fighting ‘Perfect Storm,’ Baader Helvea Says

Ether at Two- Month Peak on Signs of Success in Key Software Test

IEA Sees Russian Oil Output Down 20% When EU Ban Takes Effect

Deutsche Telekom Raises 2022 Outlook on US Customer Growth

FX

DXY is back on a softer footing following an overnight session of consolidation from yesterday’s CPI-induced losses.

G10s are firmer vs the USD to varying degrees, with the EUR, AUD, and NZD leading the gains.

GBP and CAD are the relative laggards while haven FX reside towards the middle of the G10 table.

Fixed Income

Core benchmarks under modest pressure but remain above the post-CPI trough with action quiet amid a limited schedule and Japanese holiday.

USTs essentially unchanged, initial incremental upward bias dissipated and we now look to PPI, Fed’s Daly & 30yr supply.

Yield curve continues to re-steepen, though lies in yesterday’s pronounced ranged while BTP-Bund remains steady at 210bp.

Commodities

WTI and Brent front-month futures are extending yesterday’s climb Brent Oct’ extending gains above USD 98/bbl.

Spot gold trades flat around USD 1,789/oz after briefly topping USD 1,800/oz yesterday post-CPI.

LME copper has gained a firmer footing above USD 8,000/t amid the softer Dollar, with LME nickel the current outperformer.

IEA OMR: Raises 2022 estimate for oil demand growth by 380k BPD to 2.21mln BPD due to more gas-to-oil switching; demand growth is expected to slow to 40k BPD in Q4 2022; declines in Russian supply is more limited than previously forecast.

Czech pipeline operator Mero exports oil flows to the nation to resume “soon”; expects flows via Druzhba to restart “tomorrow or the day after”, via Reuters.

US Event Calendar

08:30: Aug. Initial Jobless Claims, est. 264,000, prior 260,000

July Continuing Claims, est. 1.42m, prior 1.42m

08:30: July PPI Final Demand MoM, est. 0.2%, prior 1.1%; PPI Final Demand YoY, est. 10.4%, prior 11.3%

July PPI Ex Food, Energy, Trade MoM, est. 0.4%, prior 0.3%; YoY, est. 5.9%, prior 6.4%

July PPI Ex Food and Energy MoM, est. 0.4%, prior 0.4%; YoY, est. 7.7%, prior 8.2%

DB’s Jim Reid concludes the overnight wrap

After much build-up and anticipation, I am now a married man. It was without a doubt the best day of my life being surrounded by family and friends, and thank you for the many kind words I received. Married life so far has been blissful, but I appreciate when you’re not at work and eating out on a daily basis then the usual pressures of life may not apply. Let’s hope this honeymoon spirit and the benefit of the doubt is still around in a few months’ time.

Markets were also in a buoyant mood while I was away, and that trend has continued over the last 24 hours thanks to a much lower-than-expected US CPI print. That helped to bolster hopes that the Fed wouldn’t need to tighten policy as aggressively as many had feared, though Fed officials threw some cold water on the optimism later in the session which tempered the rally in yields, at least. And whilst some of the CPI details weren’t as flattering as the headline stats (more on which below), this positive reaction was evident across multiple asset classes as investors received a downside inflation surprise of the sort we haven’t seen in a long time, with monthly headline CPI actually seeing -0.02% deflation on the month. That’s the first time that prices have fallen on a monthly basis since May 2020, and the reading also came in two-tenths beneath the +0.2% expected by the economists’ consensus on Bloomberg, which is the first time in more than five years that inflation has come in beneath the consensus by that big an amount.

That unexpected drop in prices was largely driven by a sharp monthly fall in energy prices (-4.6%), which experienced their largest decline since April 2020. Indeed, gasoline specifically was down by -7.7% over the month against the backdrop of a serious decline in oil prices since their recent peaks. In turn, that sent the year-on-year CPI reading down to +8.5%, having been at a four-decade high of +9.1% in June. Furthermore, sentiment was bolstered by the fact that core inflation also surprised to the downside, at +0.3% on the month (vs. +0.5% expected), which meant the year-on-year figure remained at +5.9%.

The market reaction to this was incredibly favourable, as the release led investors to reduce the chances that the Fed would hike by 75bps again at their next meeting in September. Indeed, the hike that futures are pricing in for September came down from +68.2bps to +62.5bps, exactly halfway between a +50bp and a +75bp hike, as live as a meeting as you’ll get. That’s still slightly above where it’d been prior to last week’s much stronger-than-expected jobs report that raised expectations of another 75bps move. In turn that sent Treasury yields lower, with the 2yr yield down more than -20bps following the print, but gave back some of that rally after subsequent Fedspeak (more below). 10yr yields also initially moved lower, falling more than -13bps from immediately before the print, only to end the day +2.0bps higher at 2.78%, so we had a decent amount of curve steepening on the day as well as the last batch of data pointed away from stagflationary fears.

But even as markets have been celebrating the prospect of a less aggressive Fed, it’s worth remembering that we’re still nowhere near out of the woods yet, and annual inflation of +8.5% is still way above what we’ve been used to experiencing over recent decades. In addition, some of the more granular details from the CPI release were much less positive than the immediate headlines. For instance, the Cleveland Fed’s trimmed-mean CPI measure that removes the biggest outliers in either direction was still running at +0.45% on a monthly basis, and on a year-on-year basis it actually ticked up slightly to +7.0%. So it’s clear there are still broad-based price pressures across the economy, in spite of the decline in energy last month. Elsewhere, the Atlanta Fed produce a “flexible” and “sticky” CPI, which separates the CPI components into ones that change prices regularly and ones that don’t. That showed the flexible CPI reading down by -1.0% on the month, but the sticky CPI reading was up by +0.4%, which means that sticky CPI is now running at +5.8% on an annual basis, or in other words its fastest pace since 1991. So there’s still a long way to go here, and remember that Chair Powell himself said in June that the Fed wanted “compelling evidence” that inflation was heading downwards consistent with returning to target, which is going to take a lot more than just one reading.

For markets however, the narrative that we might have seen “peak inflation” was nevertheless dominant, and equities had a buoyant reaction yesterday, with the S&P 500 surging +2.13% to close at a 3-month high for the first time since early January. The more cyclical sectors led the way whilst the megacap tech stocks were a particular beneficiary, with the FANG+ index gaining +3.67% on the day. The VIX index of volatility even closed beneath 20 points for the first time since early April. It was much the same story in Europe too, even if it was a bit more subdued, and the STOXX 600 (+0.89%) closed at its highest level in just over two months as well.

When it came to the Fed themselves, we did actually hear from a few speakers yesterday. Chicago Fed President Evans, who is an FOMC voter in 2023, said that inflation was still “unacceptably high” and said that he expected “we will be increasing rates the rest of this year and into next year to make sure inflation gets back to our 2% objective”. Furthermore, his forecast for core CPI is at 2.5%, which is some way beneath our own economists’ projections, and even then he saw the Fed funds rate range at 3.75%-4% by end-2023. Later in the session, President Kashkari took it a step further, saying he expected a 4.4% fed funds rate by the end of next year, and was resolute that the Fed would not waver in bringing inflation back to its 2% target. So both are projecting rates some way above the 3.11% that Fed funds futures are pricing in for December 2023, which just speaks to the divergence between the Fed’s stated intentions in their most recent dot plot and the cuts that markets are pricing in for the latter part of next year. Then overnight, we heard from San Francisco Fed President Daly, who warned in an FT interview that it was too early to “declare victory” over inflation.

Away from the Fed, we had a mixed bag of news on the European energy situation yesterday. On the one hand, we heard that Slovakia was now receiving Russian oil via the Druzhba pipeline, which had been suspended previously. At the same time though, European natural gas futures rose by +6.86% to €205 per megawatt-hour, which is their highest level since early March, and German power prices for 2023 rose a further +4.84% to €427 per megawatt-hour. European sovereign bonds were more affected by the US inflation news however, with yields on 10yr bunds (-3.2bps), OATs (-2.0bps) and BTPs (-6.0bps) all moving lower.

Overnight in Asia, equity markets are also surging this morning following a strong session on Wall Street overnight. Risk appetite has been evident across the region, with the Hang Seng (+1.74%), the CSI (+1.39%), the Shanghai Composite (+1.18%) and the Kospi (+1.32%) all moving higher, whilst markets in Japan are closed for a holiday. That optimism is also set to extend into the European and US sessions, with futures contracts on the S&P 500 (+0.30%), NASDAQ 100 (+0.43%) and DAX (+0.39%) all pointing towards further gains today as well. Separately, the People’s Bank of China said in its latest quarterly monetary policy report that consumer prices in China will probably remain in a reasonable range and will likely reach its 3% target for full-year inflation . At the same time, the central bank stressed that it will continue to maintain plenty of liquidity in the system so as to provide stronger support to the real economy.

It’s a fairly quiet day ahead on the calendar now, but data releases include the US PPI reading for July, as well as the weekly initial jobless claims.

Tyler Durden

Thu, 08/11/2022 – 07:55