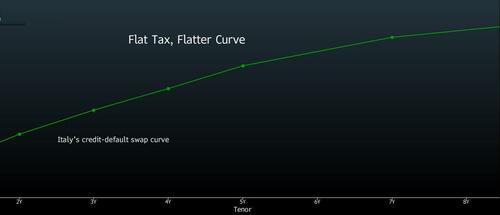

Italy Testing Fiscal Rectitude Will Come To Haunt CDS Curve

By Ven Ram, Bloomberg markets live commentator and reporter

Italy’s CDS curve is likely to flatten and possibly invert if the nation’s right-wing coalition scores the landslide victory that opinion polls predict it will.

Matteo Salvini, leader of the League, has vowed a flat 15% tax on employees, raising eyebrows on what the implications would be for fiscal prudence — or perhaps the lack of it. Moody’s, which last week altered the credit outlook to negative on the nation’s Baa3 rating, has already remarked that “sluggish growth, higher funding costs and potentially weaker fiscal discipline” may have material credit implications down the line.

The European Central Bank’s anti-fragmentation tool — the awkwardly namedTransmission Protection Instrument — may be leading Italy’s right-wing leaders to believe that the backstop affords them the leeway to be profligate. However, the ECB’s smell test before coming to a rescue is that, to be eligible, any economy should in the first place be in compliance with the European Union’s fiscal framework. And it’s worth keeping in mind that a blowout in Italian yields that isn’t accompanied by similar tumult in the rest of the peripheral economies means that such distress will be classified as a single-country issue — meaning the hand of rescue might simply not be available.

Italy’s 10-year bonds currently offer a yield of 3.035%, almost exactly where they are indicated on the modeled curve (3.021%). While further declines are likely given possible fiscal profligacy and further tightening from the ECB, the CDS curve may provide a cleaner read of risk.

Tyler Durden

Wed, 08/10/2022 – 05:00