Much More Demand Destruction Needed: Why Goldman Sees Oil Prices Surging By Year-End

The recent plunge in the price of oil, which has dropped by more than 25% from its post-Ukraine war highs, may be delighting the Biden administration (since presidential approval ratings tend to be inversely correlated to gas prices), but has stumped investors and energy market watchers alike. And not just because the growing chasm between the physical market – which remains extremely tight and allows Aramco to demand Asia pay ever higher prices for its products – and the futures market has been likened to the relationship between Dr Jekyll and Mr Hyde. Market watchers have been further perplexed by the White House eagerness to take credit for the collapse in oil prices even though most attribute the ongoing commodity bear market to the upcoming (or current) recession, for which the Biden administration is responsible. In fact, some have gone so far as to accuse the administration of indirectly (or directly) influencing the EIA to make gasoline demand appear lower than it actually is to further hammer oil prices.

To be sure, it’s not just fears of an economic recession: oil prices have also been driven by low trading liquidity and a mounting wall of worries including China’s zero-Covid policy and real estate sector, the US SPR release, and Russian production recovering well above expectations.

Yet through it all, commodity analysts at the most influential US bank, Goldman Sachs, have remained steadfastly bullish and in a lengthy note published over the weekend titled “Down but not out” (available to professional subscribers), Goldman strategist Damien Courvalin writes that “that the case for higher oil prices remains strong, even assuming all these negative shocks play out, with the market remaining in a larger deficit than we expected in recent months.”

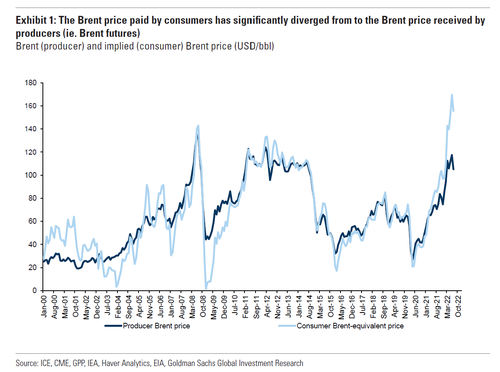

That said, Goldman acknowledges that reiterating the bank’s bullish view requires addressing the divergence between Brent prices, which have averaged $110/bbl in June-July and are trading below $100 in early August, and the $160/bbl Brent-equivalent global retail fuel price.

Courvalin draws three takeaways from this disconnect.

The good: until the recent collapse, retail prices – while not tradable -came in close to Goldman’s forecasts despite all the current macro uncertainties.

The bad: the disconnect between retail and Brent financial prices was much wider than the bank expected, keeping Brent futures well its $130 June-July forecast.

The ugly: Goldman’s retail price forecast did not result in enough demand destruction to end the deficit.

The last point is key and is why as it updates its supply and demand forecasts, Goldman believes that the oil market will remain in unsustainable deficits at current prices, and is why the bank forecasts that the oil market still requires oil demand destruction on top of the ongoing economic slowdown. This, the bank warns, requires a sharp rebound in retail fuel prices – the binding constraint to balancing the oil market – back to $150/bbl Brent equivalent prices, equivalent to US retail gasoline and diesel prices reaching $4.35 and $5.45/gal by 4Q22.

* * *

Before we dig deeper into the Goldman analysis, let’s take a quick detour into the key question of the abovementioned oil price disconnect: what is the right oil price?

As Goldman explains, at the conceptual level two prices matter for modeling the oil market:

(1) the retail price of fuels paid by consumers as it drives demand elasticity and

(2) the crude price received by producers as it drives supply elasticity.

Up until 2021, retail prices followed a stable relationship to Brent prices, leading the bank and its peers to use Brent prices as a common input for both sides of their fundamental modeling. This is however no longer the case, due to significant distortions to each of the steps required to transform crude oil coming out of the ground into fuels consumed by producers.

Understanding this disconnect is all the more important since Goldman’s key tradable forecast is for Brent futures while its current framework is based on the view that retail prices are the key balancing mechanism for the oil market given record low inventories and the lack of supply elasticity. This leaves the bank solving for retail prices in its fundamental modeling, the level at which demand elasticity is achieved, and subsequently deriving its Brent futures price forecast. As such, the bank expresses retail fuel prices as a “consumer” facing Brent price, the Brent price it estimates consumers, and the global economy, actually pay for.

Looking back, Goldman’s Brent price forecasts for June and July were $125 and $140/bbl – this was the bank’s expectation for the average level of the front-month contract on the ICE exchange. Furthermore, Goldman’s mapping into retail prices had it expecting a Brent consumer price of $150-160/bbl. Brent futures have instead averaged $117 and $105/bbl – below Goldman’s forecasts – while the Brent consumer price has been $150-170 – slightly above its forecast. Quite a disconnect.

What’s behind this disconnect?

According to Goldman, the much wider than expected gap between Brent physical prices (i.e. Dated Brent, not ICE Brent futures) and global retail fuel prices in Brent-equivalent terms (c.$45/bbl on average in June-July) can be linked to the Russian energy and EU gas crises, where three of the five moving parts the bank has identified have had an outsized impact: clean freight, EU natural gas prices and the USD, all due to the ongoing Russian energy sanctions. This was only slightly offset by weaker refining margins in July (which we had expected) and continued efforts by governments to suppress retail prices through tax reliefs and subsidies.

The disconnect between retail fuel prices and Brent financial prices (traded on ICE) was even larger, due to a record wide premium of physical over financial barrels. According to Goldman, the growing lack of financial participation in the commodity futures market helps explain this record wide premium as well as the recent new collapse in Brent prices as well as the current extreme level of crude backwardation.

The catalyst for this break was initially fundamental but is now financially self-reinforcing, as we recently discussed. The Covid shock and sanctions on Russia were two unprecedented fundamental disruptions, with initial fears for even greater shocks. This drove price volatility sharply higher, a move quickly exacerbated by extreme inventory levels. Importantly, this volatility forced investors away from commodities, further supporting volatility. A key driver for this self-reinforcing mechanism is the use of value at risk (VaR), the dollar notional measure of at risk capital in a portfolio. When prices and volatility rise, so does the VaR associated with a given volume of commodities, forcing commodity market risk managers to reduce the size of their trades, leaving shrinking positions in barrel terms even if the size of the physical market hasn’t changed. A similar argument holds for banks and dealers, which significantly reduces the ability for producers to hedge, further limiting their ability to invest in future production as reinvestment rates need to be reduced to match higher volatility in oil prices.

Why does this matter, especially since Goldman has previously argued that commodities are real assets, pricing today’s supply and demand imbalances and unable to borrow from future supply? Well, the key is that investors’ trading of commodity futures helps translate expected shifts in supply and demand into immediate price signals. In essence, investors’ participation helps smooth out fundamental shocks, incentivizing supply and demand elasticities to prevent stock-out outcomes. For example, Goldman’s modeling shows that oil forward curves are typically most responsive to three-month forward changes in inventories, with the corn vs. onion price volatility chasm the classic example as only the former – much less volatile – is tradable by investors.

Which is not to say that the formation of physical commodity prices is broken (at least not yet), especially since retail prices still accurately reflect a very tight physical market in recent months. Instead, it is the pass-through to financial commodity futures that is currently distorted due to the conflict in Russia.

First, the significant uncertainty that occurred as sanctions were applied on Russia kickstarted the volatility trap that has pushed investors out of commodities, creating a gap between financial crude and physical crude prices and driving the latest price fall.

Second, the gas shortage in Europe is the primary cause for the unprecedented value gap between physical crude and retail fuel prices as it causes (1)historically elevated refining margins (on higher natural gas input prices and lost Russian refining capacity), and (2) the strength in the USD (which reduces the need for USD crude rally), (3) the unprecedented strength in gas-to-oil substitution for power generation which will exacerbate the tightness in diesel.

***

Having covered the disconnect between retail fuel prices and Brent prices, Goldman next explains why Brent financial oil prices still have to rise due to four key drivers:

(1) the bank’s updated fundamental supply and demand expectations,

(2) the level of retail fuel prices needed to balance the oil market through demand elasticity (the only buffer left in the face of record low inventories and inelastic supply),

(3) the expected gap between these retail fuel prices and Brent physical prices, and finally

(4) how the recent investor exodus from commodity futures markets will evolve, driving the wedge between Brent physical and Brent financial prices.

Goldman’s response to these four key drivers is laid out in the following 6 bullet points:

Goldman’s updated fundamental forecasts point to continued disappointments in supply, with demand instead supported by the still ongoing Covid reopening and gas-to-oil substitution. This will leave markets in open-ended deficits at current spot prices. This is the key to the bank’s still bullish view as commodity markets need to balance and inventories can’t go to zero.

This requires demand destruction on top of the ongoing economic slowdown, requiring high retail fuel prices to end the market deficit. Even cautiously assuming weaker economic growth than our economists, this leaves the bank forecasting that consumer Brent prices will need to average $150/bbl in 4Q22 and in 2023.

Updating the bank’s EU gas, refining margin and USD assumptions, it now expects the differential of Brent-equivalent consumer prices to Brent physical prices to average a more modest $27/bbl in 4Q22 vs. the exceptionally wide $45/bbl seen in June/July and the $15/bbl that the bank had expected previously over 2H22. With refinery runs surprising to the upside this summer – the primary reason for the compression in refinery margins recently – Goldman expects refining margins to average $10 vs. $14/10/bbl previously for 2H22/2023.

Forecasting how the lack of financial participation in Brent futures will evolve is much harder, however, leaving Goldman – which itself is one of the biggest financial mediators – having to assume that the basis between Brent physical and financial prices narrows modestly from historically wide levels to $5/bbl through 2023. This leaves the bank forecasting Brent financial prices of $125/bbl in 4Q22and 2023 vs. $130 and $125 previously, both far higher than the current Brent prices below triple digits.

This lack of investor participation is likely to weigh most on near-term prices, forcing Goldman to make the largest downgrade to its forecast in 3Q22, now at $110/bbl vs.$140/bbl previously. This revision reflects (1) a consumer Brent-price equivalent of$140/bbl vs. $160/bbl previously, reflecting higher Russian supply and a faster than expected rate of SPR release (all offset in 4Q22), (2) a $30/bbl discount of Brent to retail prices vs. $20/bbl previously, reflecting a stronger dollar and sticky high physical premium (i.e. lack of investor participation in the face of still high recession concerns).

Based on the above, Goldman is also introducing – for the first time – a forecast for US retail gasoline and diesel prices, which the bank expects to rebound to $4.35 and$5.50/gal by 4Q22, with average levels of $4.40 and $5.25/gal in 2023. This forecast reflects the bank’s expectations for US refining and marketing margins as well as assumes flat state and federal taxes. In other words, Goldman forecasts that US retail fuel prices will rally into year-end then decline from 2Q 23 onward as refining and marketing margins start to normalize.

Summarizing the above, Goldman’s bullish view is supported by three drivers: (1) oil markets remain undersupplied – with record retail fuel prices unable to stop the market deficit in June and July, and with prices now much lower and helping support demand; (2) higher Brent financial prices are required, even assuming a historical large gap discount to retail fuel prices; (3) oil remains the cheapest source of energy that is logistically substitutable against gas.

In conclusion, Goldman says that its preferred short-term implementation of its bullish view is to be long distillate prices outright to benefit from fall maintenance.

Much more in the full report available to ZH pro subs.

Tyler Durden

Tue, 08/09/2022 – 08:35

Recent Comments