“If Someone Tells You They Predicted This, They’re Lying Through Their Teeth”… Except Everyone DID Predict This

By Michael Every of Rabobank

I am a genius lying through his teeth

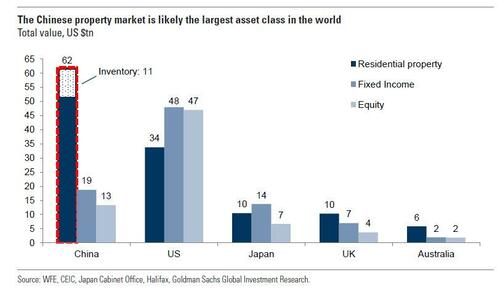

There is a Bloomberg story today that I absolutely have to start with: ‘One of the Decade’s Hottest Bond Markets is Imploding in China’. In a nutshell, the Chinese property market, which was nuts, is now being shelled – and most of the losses are being carried by foreign investors.

This development is apparently a major surprise to some. So much so that: “No one could have predicted this. If someone tells you they predicted this, they’re a genius or lying through their teeth,” says a CIO obviously deeply involved in the failing trade.

I can’t wait to tell my wife I am a genius. (My mother, so proud of my “ologies”, already knew of course.)

Yes, I am lying through my teeth in saying so – just ask my wife. But you had to be the very opposite of a genius, or lying through your teeth, to not see there was no way a property bubble of the scale of China’s scale could avoid ending this way, or that, given a choice, it would be foreign bond holders who would suffer more than local ones when push came to shove.

You also don’t need to be a genius to see that lots of other problems still litter the landscape despite, indeed because of, current market pricing.

The US Treasury yield curve is around 2000’s record levels of inversion over the traditional metric of 2s-10s, a time replete with the idiocies of petfood.com, Enron, and Tony Blair singing Auld Lang Syne in the Millennium Dome. This surely flags a deep recession.

Yet we are being told that isn’t possible by the Fed. We are also being told all is well by the stock market, which is behaving as rationally as a junkie being told there are no more drugs in the house, and instead mixing up sugar, flour, baking soda, and oven cleaner.

Perhaps it tells us inflation is no longer an issue? Hardly!

Yes, US inflation expectations suddenly plunged, says the New York Fed, as US consumers all now see that prices of everything including food(!) and fuel(!) will moderate ahead. Because… Yet the same group also believe unemployment will fall further from here, and their own wages will pick up. Then again, who reads data? Not the people who looked at the Chinese property market anyway.

Yes, this week might see headline US CPI fall back in y-o-y terms, unleashing the latest bout of incorrect “transitory!” calls. Yes, 9% (10%, 13%, etc.) Western inflation might be near its peak.

However, anyone thinking we quickly and effortlessly get back to 2% CPI from here to justify a 2.75% 10-year rate, and higher stocks, is either a genius or lying to themselves through their teeth. The structural problems we now face mean that 4% CPI might be the new 2% CPI ahead for a long time. Or the (“there is no”) recession might be deeper than stocks can imagine. Or both.

Assume 4% CPI ahead and 10-year US yields at 2.75% are a great way to borrow at negative real rates for years: and I’m sure that will ensure waves of productive disinflationary investment, as opposed to fictitious inflationary froth, by the rational capitalists in charge of our capital stock,

Yet don’t take my lying genius word for it. Singapore, a country renowned for its intelligent forward planning and its honesty and probity, just heard its Prime Minister give a pre-National Day televised address in which he stressed “a storm is gathering.”

Partly, this was because “US-China relations are worsening, with intractable issues, deep suspicions, and limited engagement.” As a result, the small country should prepare for a future “less peaceful and stable than now”, and this isn’t seen ending anytime soon, while any miscalculations could make things far worse. Importantly, is that deflationary, as the US yield curve implies? Hardly, if history is any guide.

Indeed, PM Lee also said economic challenges were more immediate and that Singapore’s outlook had “clouded considerably.” Like many other governments –including the US with its new ‘Inflation Reduction Act’, which won’t –Singapore will soon roll out more measures to help people cope. Yet the more states that act fiscally, the more inflationary the backdrop will naturally be. Note that the soon-to-be-signed US fiscal bill includes more, not less, biodiesel, which will of course lift the price of related commodities. (And on food, France is seeing warnings that it may run out of milk. In which case next up would be cheese!)

In fact, just after the Monetary Authority of Singapore made a surprise inter-meeting policy tightening on 14 July, the PM also had a clear a warning for markets: “The world is not likely to return anytime soon to the low inflation levels and interest rates that we have enjoyed in recent decades.”

Lots of geniuses, and others, out there think otherwise.

Tyler Durden

Tue, 08/09/2022 – 10:10