CTA De-Grossing Is Now Complete; Nomura Warns Pain Trades & Stupidity Rule

The last few weeks have seen a dramatic rotation from an “inflation will overshoot forcing central banks to tighten financial conditions aggressively and imminently” narrative to a “fears of growth downsides/recession will bring forward the end of the tightening cycle and herald utopia” dream.

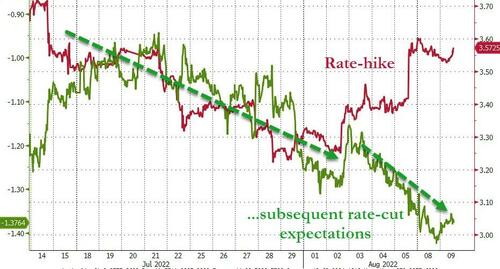

Rate-cut expectations have continued to drift dramatically higher in the last week while the expectations for Fed’s rate-hikes has also rebounded some in the short-term. The recent Fed jawboning has worked in the short-term to remove hopes of an imminent pivot but the higher rates are expected to go, the faster and more aggressive The Fed is expected to cut next year…

As Nomura’s Charlie McElligott details below, that rotation has now reached its peak as CTA-backed Bond- and Equities- legacy ‘Shorts’ in aggregate across net positions are back near ‘flat’, while the Commodities ‘Long’ is de-grossed back to ‘flat’ net as well.

And from a liquidity perspective, gross CTA Estimated Exposure has shrunk from the 90%ile in Feb/Mar to just the 0.1%ile today…

McElligott warns that the current shift into “long gamma versus spot” for US equity index/ETF options a “big deal”, but a spot move lower and shock back into “short game” remains a significant risk, especially with QQQ/NASDAQ very close to its “Zero Gamma”-flip levels…

McElligott notes two themes that are growing in popularity:

The Pain Trade

The popular low-quality ‘short-proxies’ from H1 2022 continues to be rage-de-grossed (or covered) into a brutal quarter-to-date squeeze – even as the major indices are showing signs of stalling…

The Stupidity Trade

US equity ‘meme stock’ options activity is getting dangerously unstable again…

As the Nomura strategist warns though the re-emerging ‘spot up, vol up’ shift tends to pre-empt the potential for stocks to then collapse under the weight of their own ‘extended’ implied expectations.

Tyler Durden

Tue, 08/09/2022 – 11:11