Scaling Ethereum: The Role Of Rollups

Authored by Conor Ryder via Kaiko.com,

The growth of Decentralized Finance and more recently NFTs exposed Ethereum’s lack of scaling solutions for all to see. During the Bored Ape Yacht Club land sale only a few months ago, buyers paid over $10,000 in transaction fees per NFT, which surpassed the $6,000 or so price tag of the NFT itself. These transaction costs rear their ugly head every time the Ethereum network becomes congested – think times of extreme volatility like the Terra collapse or the Celsius crisis recently. Whatever your thoughts on Ether as an investment, the fact that the cost of using the network can exceed the price of the item being bought is a clear sign that the Ethereum blockchain isn’t fit for purpose in its current state.

This Deep Dive will take a look at the data behind Layer 2 rollups, Ethereum’s quickest solution for scaling the network in the short term.

There are two main ways to scale Ethereum:

Improve the transaction capacity of the blockchain itself. The most effective way to upgrade the blockchain but also the most complicated. Sharding and other upgrades may not be seen for another year or more.

Move to Layer 2. Instead of doing all the computational work on Layer 1 (Ethereum blockchain), a solution is to move the bulk of the work to Layer 2 – an off-chain network that reduces the computational strain on the Ethereum mainchain. The Layer 2 protocols responsible for achieving this scalability solution are called rollups. Layer 2 rollups are the fastest way to help Ethereum scale in the short term.

Blockchain Improvements

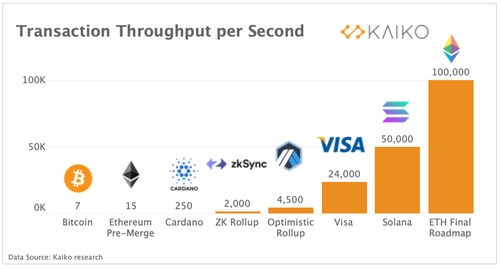

Improvements are being planned to the Ethereum network, most notably the Merge in September, which should see the energy consumption of the Ethereum blockchain reduced by about 99%. However, contrary to what some may think, the Merge itself won’t be a big factor in helping Ethereum solve its scalability issues. These fixes are due to come later in 2023 when the network begins the process of sharding. Sharding is beyond the scope of this deep dive but it essentially entails splitting the network into shards or seperate pieces in order to reduce congestion and improve transaction throughput. Transaction throughput is where Ethereum struggles compared to its ambitions to be the backbone of a new financial system. Currently, Ethereum can only handle about 15 transactions per second, compared to Visa’s 24,000 and Solana’s 50,000.

Only when Ethereum completes its roadmap of sharding and other updates to the blockchain will it reach the elusive 100,000 transactions per second. We can see that optimistic and zK rollups offer respectable throughput improvements and when we factor in that there are, and will be, multiple protocols offering capacity for transactions, that throughput number starts to approach Visa’s level. In the absence of widespread upgrades to the blockchain, rollups definitely serve a purpose for the Ethereum network in the near term – with lower fees comes more adoption.

Ethereum Fees

Transaction fees on the Ethereum network are currently at their lowest levels since December 2020.

A falling transaction fee is exactly what Ethereum needs, however in this instance it’s related to a lack of demand. TVL of DeFi projects has plummeted while NFTs are in their first ever bear market, all combining to bring blockspace demand to recent lows. However, the low fees do offer us a glimpse into how Ethereum users might interact with protocols in the future if the fees weren’t so prohibitive. As decentralized exchange volume decreases year to date, one would assume that this paints a sufficient picture of the activity on these platforms. However, an interesting trend to examine is trade count, which arguably shows the actual usage on an exchange. Trade size is also a useful barometer for whale vs. retail activity and for the purposes of this article, a smaller trade size is indicative of more retail usage.

Take Uniswap and Curve for example, Ethereum’s two largest decentralized exchanges by volume. Have users adjusted their behaviors in light of the lower fees?

The answer is yes. The lowest transaction fees in nearly two years have seen trade sizes on the decentralized exchanges, such as Uniswap above, plummet while trade count actually rises. More trades are being placed by Uniswap users as transaction costs are low. Lower fees make DeFi more accessible to the average user and less geared towards whales, a nuance that is most definitely pivotal for the adoption of DeFi.

One decentralized exchange that is geared towards whales is Curve, an exchange specializing in stablecoin trading. We’ve observed a similar trend there where average trade size has fallen by over 80% while trade count rises.

In contrast, Coinbase volumes are hovering around yearly lows as average trade size and trade count are both moving lower.

In bear markets, volumes plummet on centralized exchanges as general interest among the public wanes. DeFi, however, still has plenty of use cases during a bear market (look at Curve’s role in the Terra collapse) and we can see that one factor of on-chain activity is Ethereum transaction fees, rather than general interest.

Reducing fees is priority number one for the Ethereum community in order to drive underlying adoption of the network. The quickest way to do that is via rollups.

State of Rollups

There are two main types of rollups, Optimistic and zK rollups, and their cost saving benefits have been clear to see already. Below are the fee comparisons between various Layer 2’s and Ethereum, according to l2fees.info.

Optimistic and zK rollups mainly differ on their treatment of transaction veracity – how do we know the block being sent back to the Ethereum network does not contain fake transactions?

Optimistic Rollups

Optimistic rollups (ORs) presume transactions are valid when sending rolled up transactions back to the Ethereum blockchain, hence the name Optimistic. This assumption can be tested with a process called fraud proofs, where an onlooker can claim a transaction is fraudulent. The period for this usually spans 7 days, which is widely accepted as the biggest drawback of optimistic rollups. An exchange might logistically struggle to support immediate withdrawals if it was subject to a 7 day waiting period on transactions.

The two largest ORs are Arbitrum, which has yet to release a token, and Optimism, which launched a token on June 1st this year. There are other Layer 2 protocols with tokens that investors can get exposure to, such as Boba, a governance token for the Boba network, another optimistic rollup. Dydx is also a governance token, this time for the operation of the Layer 2 version of the decentralized exchange, which depends on zK rollups. IMX is a Layer 2 scaling solution for NFTs on Ethereum and differs slightly from the other governance tokens as it also can be used to pay transaction fees on the platform.

The market seemed to start arriving at the conclusion that optimistic rollups were just a band aid over a bigger issue as since the Optimism (OP) token launch, it underperformed not only ETH but also other Layer 2 protocols.

However, with the announcement of a final date for the Merge, the market became more bullish on the Ethereum blockchain as a whole and Optimism started to outperform. This bullish sentiment is also evident in the futures market for OP which has seen a large buildup of open interest while the funding rate has moved positive in the last week.

zK Rollups

While Optimistic rollups presume all transactions are valid and allow onlookers to submit fraud proofs, “Zero knowledge” (zK) rollups do the work of validating each transaction themselves by submitting a validity proof along with each bundle of transactions. This is why they are more computationally intensive and up until recently, not EVM compatible, but it is also why they are far faster at settlements and withdrawals – there is no need for a window for fraud proof. This near-instant settlement is extremely appealing to exchanges who need to be able to satisfy user withdrawals in a timely manner; exactly why dydx has already adopted a zK rollup on Layer 2.

Due to the computational intensity of zK rollups, OR’s were initially rolled out quickest while developers worked on what was deemed the ‘holy grail’ of rollups, a zK rollup that was EVM compatible. In the last couple of weeks we may have witnessed the beginning of the zK rollup era, as three teams, Polygon, Matter Labs and Scroll, all announced breakthroughs with EVM compatible zK rollups.

Layer 2s and DEXs

Looking specifically at Uniswap and Curve’s breakdown of TVL, we can see that only a small portion of their value sit on Layer 2 optimistic rollups (Optimism and Arbitrum): 1.9% on Uniswap and 1.8% on Curve. Uniswap currently has 97% of TVL sitting on the Ethereum mainchain, while Curve has 92%. It’s reasonable to expect that once a zK EVM compatible rollup is rolled out that this number will decrease and move towards Layer 2, allowing more DEX users to avail of the cheaper fees on offer.

Conclusion

Layer 2 rollups are an essential part of Ethereum’s short/mid-term scaling strategy and possibly even in the long term as the rollups will sit on top of the improved Ethereum network.

It looks as if zK rollups are beginning to arbitrage away the competitive advantages of optimistic rollups, and if the teams working on an EVM compatible zK rollup can successfully launch their products, I expect them to gain a large amount of market share, potentially with traffic directed from decentralized exchanges.

Vitalik Buterin: “my advice to teams like Optimism and Arbitrum is that I think they should start zK-ifying themselves fairly soon.”

Tyler Durden

Thu, 08/04/2022 – 22:20