July Payrolls Smash Expectations Soaring To 528K, Wages Come In Red Hot As Unemployment Rate Drops

We are now well and truly in bizarro world.

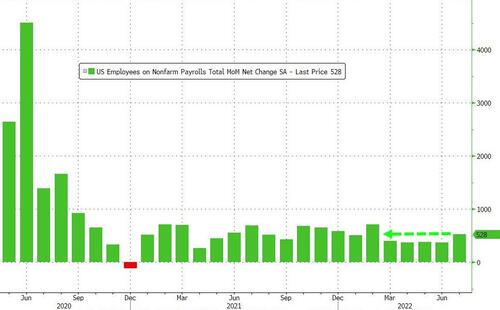

In a time when the US is in a technical recession, and when tech companies are mass laying off thousands of people, moments ago the BLS reported that in July the US added a whopping 528K jobs, more than double the 250K expected, up solidly from last month’s upward revised 398K (up from 372K) and the highest since February’s 714K!

The number means that all the post-covid job losses have now been recovered.

Just how ridiculous was the last monthly cooking of the books by the BLS? So ridiculous that the reported number was a 6 sigma beat to expectations:

One caveat: for the 4th month in a row, the household survey came in far worse than the Establishment survey, and showed a far more modest gain in July employment, at just 179,000 jobs created – notably fewer than the payroll report, but a lot stronger than the 315,000 drop for June.

Reading between the lines, there was 471,000 new private payroll jobs added, more than double the 230k estimates. Not surprisingly, the bulk of new jobs came from the service sector.

But not only did July blow away expectations, but both previous months were revised higher: the change in total nonfarm payroll employment for May was revised up by 2,000, from +384,000 to +386,000, and the change for June was revised up by 26,000, from +372,000 to +398,000. With these revisions, employment in May and June combined is 28,000 higher than previously reported.

The unemployment rate also declined, sliding to 3.5%, from 3.6%, and below the 3.6% estimate as the number of unemployed persons edged down to 5.7 million. These measures have returned to their levels in February 2020, prior to the coronavirus pandemic.

Among the major worker groups, the unemployment rates for adult women (3.1 percent) and Whites (3.1 percent) declined in July. The jobless rates for adult men (3.2 percent), teenagers (11.5 percent), Blacks (6.0 percent), Asians (2.6 percent), and Hispanics (3.9 percent) showed little change over the month.

The participation rate declined again from 62.2% to 62.1%, as the number of people in the job market — either working or looking for work — declined again last month. What the Fed really wants is to see people flocking back in, driving up the unemployment rate and easing pressure on wages. Instead what we are seeing is people leaving the job market and employers fighting to grab those that remain, luring them with higher wages.

It wasn’t just payrolls that smashed expectations however, as wages also came in red hot: July Average Hourly Earnings rose 5.2% Y/Y, smashing expectations of 4.9% and increased 0.5% M/M; also beating estimates of 0.3%.

Additionally, the Average workweek was 34.6 hours the fifth month in a row, beating expectations of a decline to 34.5. In manufacturing, the average workweek for all employees held at 40.4 hours, and overtime increased by 0.1 hour to 3.3 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls remained unchanged at 34.0 hours.

That said, once again there was a stark divergence between the Establishment (+528K) and the Household Survey (+179K). In fact, as shown below, according to the Household survey there has been no jobs growth since March, while according to the Establishment survey the US has added 700K jobs!

Commenting on the report, Bloomberg Intelligence Chief Rates Strategist Ira Jersey, said “It’s hard to see how the yield curve doesn’t invert further as market will have to re-evaluate the Fed’s reaction to a labor market being as strong as it is. Regardless of a 50 vs. 75 in September, we think the market has to increase the terminal rate more than is priced, up to over 4% at least.”

Bloomberg commentator Ven Ram echoed the sentiment, writing that “this is a phenomenally strong jobs report, way stronger than forecast and more than the average payrolls expansion for the year through June. This will increase chatter for a 75-bp move from the Fed, and the reaction should be along those lines.”

Needless to say, and as we previewed, this jobs number which came in well above all sellside expectations, will surely boost expectations for a 75 basis point rate hike at the Fed’s September meeting, because as Bloomberg notes, “this is not at all what the Fed wanted to see. The job market if anything is getting even hotter, not cooling.” The only thing that could reverse the narrative is if next week’s CPI print comes in far below expectations.

Tyler Durden

Fri, 08/05/2022 – 08:35