Blain: “Deeply Concerned” ESG Has Become “Fundamentalist Quasi-Market Religion”

Authored by Bill Blain via MonringPorridge.com,

“You may think I’m a dreamer, but I’m not the only one…”

Biden’s Tax and Climate Bill is the closest thing to a grown-up energy transition plan we’ve seen in the West. There is a significant risk ESG fundamentalism trips up efforts to reach carbon neutrality – but there are signs pragmatism will win out.

It looks like US President Biden will get his long-awaited Tax and Climate Bill though the Senate after cutting a deal with holdout Democrat Senator Kyrsten Sinema. I like the her plans for a !% tax on stock buybacks (see yesterday’s porridge.)

At its core the new Bill looks like a proper long-term transition plan for the US economy to evolve away from fossil fuels towards cleaner technologies – including nuclear. It enables it to happen in a way that should not stifle growth (giving the economy time to adapt) or compromise energy security by cutting out oil and gas too quickly. Sure, the Bill is complex, and Republican naysayers will tear every single paragraph apart as proof positive Biden is a deranged, demented, communist intent on destroying ‘Merica.

I wish we could do something similar over here in Blighty – but I doubt it. Whoever wins the Tory popularity contest will sit in a cabinet of vipers fixated with Brexit and their own chance of advancement. We likely won’t have a functional government till after the next general election (late 2024), and even then…. I have my doubts. After the Bank of England’s 50 bp hike y’day, most of us will have starved by then anyway; crushed by double-digit inflation, higher mortgages, crippling tax hikes, credit bills and exploded brains after trying to figure out what, if anything, Liz Truss actually stands for.

Sure, there is nothing like a good healthy dose of dither and austerity to cure what ails us as the UK slides into Stagflation.

Back to this morning’s topic! I was talking to a US client earlier this week who reckons the only way for Western Economies to effectively decarbonise is to leave it completely to the markets. He wants government completely out the equation. I found myself surprised, and asked: did this mean this Republican, MAGA hat wearing, paragon of Texas State Capitalism, was a fan of ESG? He swore quite imaginatively.

I consider myself an enlightened pragmatist – as a result I have a “challenging” relationship with the ESG Taliban that now de-facto run the financial markets.

The thing is – I do believe in the core tenants of ESG: we can make the world a better place and raising Environmental awareness, that markets should reject “greed is good” morality and address Social inequalities, and how the golden key to a good investment is always good corporate Governance. I call myself a capitalist, but also believe the employees who make firms successful have as much right to the rewards generated by its activities as its owners – some folk dub it “stakeholder capitalism”. Responsible investing should be natural, automatic and simple – firms and investment managers with good corporate governance will do it without prompting.

Despite clearly being a communist for such beliefs …. Me and the Texan get along rather well..

We both agree markets are a function of the ecosystem they operate in.

He ignores ESG – at his peril.

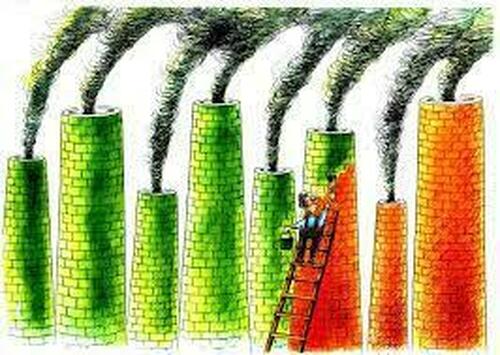

I am deeply concerned ESG has become something of a fundamentalist quasi-market religion; creating massive mis-allocations of capital in its crusade to change the world. It’s becoming a dangerous tickbox regulatory minefield. In short; although a believer, I have become an ESG heretic.

It’s taken the shock of the Ukraine War, and the exposure of the West’s long-term failure to secure Energy Security, that’s brought the key issue to the fore – the way in which ESG has misallocated capital. ESG encouraged a blind assumption we could replace nasty polluting fossil fuels from the economy with lovely clean green electricity overnight. You can’t. It will take decades to shift the global economy into new clean power – and will transform by doing difficult stuff like tide and nuclear alongside the easy wins from Solar and Wind..

But the thing is it can be done – if we had the kind of proper transition strategies the Biden bill is moving towards.

The problem is; closed ESG thinking struggles to get past sensible, planned transition strategies that involve phased replacement and evolution away from fossil fuels. There are good, solid, properly costed plans to move toward Carbon Neutral by 2050, but you hear little about them because they involve Gas as a transition fuel, promote Nuclear, and acknowledge the limitations and inconsistencies that swirl around electric cars, wind farms and solar power.

I spend most of my day job talking to real investors – and most privately say ESG has gone too far. They sincerely believe in markets, and are increasingly sceptical of the time demands ESG reporting is placing up them – I understand the last EU ESG regulatory reporting demands over 500 boxes are completed on the reporting spreadsheet! ESG proponents say ESG compliant investments preform better – but there is zero evidence for this claim. Pragmatic fund managers watch ESG driven decisions put strains on their ability to generate returns.

Whenever we I discuss potential new investments, the first question potential investors are beholden to ask is…. “is this ESG compliant?” They do so because it’s the first thing the groupthink investment committee will ask, and the first thing their marketing departments tell them other investors ask for. Everyone in the financial food chain wants to show off their green credentials, forgetting their decisions hit the bottom line and impact the guys trying to generate returns.

When I started in the City, about the very first thing I learnt is it’s the primary duty of any investment banker to take any unwise regulation, rule or thesis, and arbitrage the dumbf***ery out of it.

We did it with capital rules and it’s happening with ESG.

It’s no wonder the authorities are uncovering multiple cases of greenwashing – where fund managers know they have to show ESG credentials (any will do) to potential investors to attract funds. THe SEC is investigating Goldman Sachs, while the notoriously bumbling German financial authorities (I am not allowed to say incompetent) have spotted Deutsche Bank’s fund arm DWS has been Greenwashing… (Its always Deutsche…)

I’m taking a different route – honesty. I am financing a post oil-age petrochemicals refinery. We are not going to make fuel, but petrochemical products that will remain vitally critical for a growing global economy that can only be manufactured from oil – like adhesives, artificial rubber, plastics, packaging and 1001 other critical products. Our plant will be as green as we can make it. It will create massive multiplier effects and well paid new jobs across the economy in the country we are building it in, and we’re listing it in London to ensure it retains the highest corporate governance standards.

Changing tack slightly, not all Conservatives are climate change deniers.

I make a point of trying to read the obituaries pages. You never know who might pop up. I was catching up and came across the obituary of James Lovelock, the scientist who proposed the Gaia Hypothesis – that the earth acts like a living organism to regulate itself through complex feedback loops. His writings became a key component of my 1980’s studies in early Environmental Economics, alongside Kenneth Boulding’s Spaceship Earth hypothesis – that in a closed system, there will be consequences from an unconstrained production/consumption process.

Lovelock’s great contribution was a machine that could detect tiny parts per million of industrial gases. He quickly understood how these gases revealed the constantly changing composition of the atmosphere, and that climate is essentially chaotic: if it becomes unbalanced, there will be dramatic consequences.

Margaret Thatcher is widely acknowledged to have been among the UK’s more successful politicians. She was also a highly qualified scientist. She grasped the science of climate change immediately when she saw Lovelock’s evidence of how chlorofluorocarbons (“CFCs”) were breaking down the ozone layer and would have consequences on the climate. She banned CFCs in the UK, and the rest of the world soon followed. Funny to think of La Thatcher as a climate change icon…

Lovelock also invented the microwave oven, but never thought it might have commercial possibilities.

Shard Capital Podcast: Inflation, fundamentals, solutions and predictions.

In this week’s Shard Capital Lite-Bite Podcast, Bill Blain, Strategist at Shard Capital hosts Ernst Knacke, Head of Research at Shard Capital and LeifBridge, and Mike Hollings, CIO at LeifBridge, whereby they discuss inflation fundamentals, solutions, and how markets need to adapt to stagflationary pressures and long-term price rises.

Tyler Durden

Fri, 08/05/2022 – 10:05