The Fed “Got The Memo” In A Big Way – Jawboning Hammers Powell-Pivot Hope

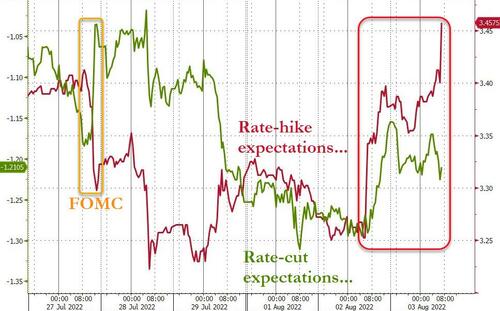

The Fed “got the memo” in a big way it seems, exclaims Nomura’s Charlie McElligott, as Committee speakers yesterday grabbed the Rates market by the scruff of their neck and slapped some “inflation hawk” sense into them yesterday (and Jim Bullard today)…

Again, the realities are that despite slowing activity data (ummm that’s the point!), the labor market’s continued strength as per robust ongoing monthly job adds, record-low U-rate and still growing monthly average hourly earnings / record high wage growth all conspires against their “inflation killing” goal – they need to create “demand destruction”…

Additionally, as McElligott notes, the ridiculous misconception that Powell “dropping” forward guidance was some sort of “dovish signal” is / was ludicrous – they dropped the fwd guidance “game” because they’re horrible at it, as has been seen on repeat time-and-time again, per the total fail on guiding us to June & July 50bps hikes…which was so mis-managed that days before the meeting and in blackout, they had to leak a 75bps hike through the press, and follow with another 75bps hike the following month.

Finally, the Nomura strategist warns that despite “Goods” inflation moving lower, Services and Rent show that inflation is now embedding into the “sticky” components of CPI – so yes, we can move down to 4-5-6% inflation in-due-time, but getting back to a 2% target looks to be a pipe-dream, unless we start printing negative CPI monthlies along with negative jobs- and wage- prints!

Stocks are decoupling from STIRs for the 3rd time in this cycle – despite SF Fed’s Mary Daly strongly reiterating that there will be no pivot.

And with an eye to the market, and how to trade it, as ‘upside’ comes off the boil at same time that Puts are finally firming and hedgers are seeing some “value” return in outright Puts…and mind you, also seeing “vol of vol” with a meaningful 2 day move higher as well, showing signs of life in “tails” for the first time in ages.

Tyler Durden

Wed, 08/03/2022 – 13:50