Futures Jump, Bonds Slump As Taiwan Tensions Ease

If yesterday morning markets were losing their mind over the potential risk of World War 3 ahead of Nancy Pelosi’s arrival in Taiwan, this morning it has been a mirror image, with risk assets rising and fears unclenching as investor anxiety over tense US-China ties eased after Pelosi left Taiwan less than 24 hours after arriving after pledging solidarity and hailing its democracy, leaving a trail of Chinese anger over her brief visit to the self-ruled island that Beijing claims as its own. Meanwhile, despite all the jawboning, China’s response to Pelosi’s Taiwan visit fell short of more aggressive expectations raised by nationalists like Hu Xijin, the former editor-in-chief of the Global Times, giving markets a breather. Among them:

Trade: Beijing added boycotts to fish and fruit imports from Taiwan and banned natural sand exports. It also prohibited dealings with some Taiwanese companies including Hyweb.

Markets: China’s potential to weaponize its almost $1 trillion pile of US bonds became a source of chatter after yesterday’s surge in Treasury yields.

On the ground: Pelosi flew off after vowing the US wouldn’t abandon Taiwan as she met with President Tsai Ing-wen. She was expected to meet with TSMC’s chairman.

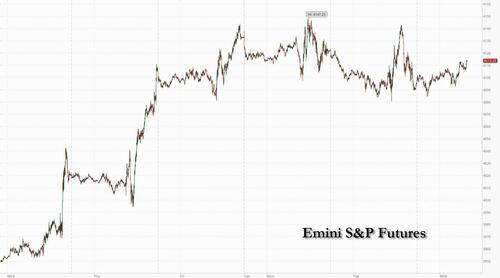

As a result, both S&P 500 and Nasdaq 100 futures rose by about 0.5%. In New York premarket trading, while Treasuries extended a slide sparked by hawkish Federal Reserve comments (and the lack of world war). The dollar fell against most G-10 peers, gold fluctuated and oil was lower ahead of an OPEC+ meeting where some report output may be boosted by a modest 100kb/d (or less jet-fuel than Biden consumed flying on Air Force One to Jedda last month) as Saudis “appease”the president.

In premarket trading, Airbnb fell after the home-rental company missed estimates on bookings. Match Group fell after the parent to dating appsincluding Tinder gave a weak revenue forecast. PayPal Holdings jumped after the payments giant said activist investor Elliott Investment Management is now among its biggest shareholders. Robinhood slumped after saying it’ll cut 23% of its workforce and shut two offices amid a reorganization. MicroStrategy’s Michael Saylor is stepped aside as CEO to focus on Bitcoin after the token’s plunge prompted a $1 billion loss. CVS beat and raised guidance. Under Armour,and Moderna are up next. Lucid and eBay are after hours.

While an immediate concern around US-China tensions may be fading Wednesday, investors still face a host of worries including inflation and how the policy response by central banks to surging prices could hobble global growth. Equities trading doesn’t reflect the headwinds confronting the market, according to Goldman Sachs strategist Sharon Bell. Additionally, it remains to be seen what China’s delayed response to Pelosi’s visit will be. Here is a summary of the key overnight Taiwan/Pelosi linked headlines:

US House Speaker Pelosi has concluded her Taiwan visit, has now departed on SPAR19

US House Speaker Pelosi said there is bilateral support for Taiwan in the US and that her visit is a reminder of the bedrock promise America to always stand with Taiwan, while she added that the delegation came to Taiwan to make it unequivocally clear that they will not abandon Taiwan. Pelosi also said they explored deepening trade ties with Taiwan and a trade agreement may be imminent, according to Bloomberg and Reuters.

Taiwan President Tsai told Pelosi she is one of Taiwan’s most devoted friends and the visit shows firm US support for Taiwan, while she thanked Pelosi for her unwavering support of Taiwan on the international stage. President Tsai also said Taiwan will not back down in facing deliberately heightened military threats and Taiwan will do whatever it takes to strengthen its self-defence.

White House National Security Council Coordinator for Strategic Communications Kirby said the US is monitoring Pelosi’s travel and has taken measures to ensure her safety, while he added that China has positioned itself to take further steps and the White House expects China to react beyond Pelosi’s trip including by scheduling live fire exercises, while other steps by China could include economic coercion, according to Reuters.

Taiwan Defence Ministry said Chinese drills have invaded Taiwan’s territorial space and they will counter any move that violates Taiwan’s territorial sovereignty, while it added that Chinese drills violate UN rules and amount to a blockade of Taiwan’s air and sea space, according to Reuters.

China’s Taiwan Affairs Office said it will take disciplinary actions against two Taiwan foundations which will be banned from financially cooperating with mainland firms and individuals. China also announced a stoppage of certain fruit and fish imports from Taiwan and halted exports of natural sands to Taiwan which is a key component used in chip-making, according to Bloomberg. Furthermore, China will adopt criminal penalties regarding Taiwan separatists and vowed criminal punishments for Taiwan-independence diehards, according to Xinhua.

China’s Vice Foreign Minister Xie lodged representations regarding Pelosi’s Taiwan visit, according to Xinhua.

Taiwan is negotiating alternative aviation routes with Japan and the Philippines, according to Taiwanese press.

Meanwhile, comments from Fed officials including Mary Daly, Loretta Mester and Charles Evans served to highlight a challenging backdrop of rising borrowing costs, price pressures and slowing economic growth. San Francisco Fed President Daly said the Fed has “a long way to go” on reaching price stability around a 2% inflation target. Cleveland counterpart Mester said she wants to see “very compelling evidence” that month-to-month price increases are moderating.

In crypto, Senate Democrats want to expand CFTC oversight to include trading in the largest digital assets. New legislation will be unveiled today amid questions over whether the derivatives regulator or the SEC is best placed to oversee the industry. Also of note: Thousands of Solana wallets were hacked overnight, and at least $8 million appears to have been stolen

Europe’s Stoxx 600 was little changed as traders assessed the latest company earnings. BMW AG sank as the carmaker flagged softening demand, while Societe Generale SA rallied after the French lender outlined new revenue targets. Here are the biggest European movers:

Infineon rises as much as 3.7% after the chipmaker lifts full- year sales and margin guidance, marking the third straight quarter with an outlook boost. Citi says better margins provide some relief to concerns that the company may not be willing or able to price as aggressively as peers.

Just Eat Takeaway’s shares gain as much as 6.1% in Amsterdam after swinging between gains and losses. The food delivery firm’s top-line growth and profit metrics missed consensus estimates but the report reassures investors that the firm is on track to reach positive adjusted Ebitda in FY23, according to analysts.

Avast shares jump as much as 43%, the most on record, after the UK’s Competition and Markets Authority provisionally cleared its acquisition by NortonLifeLock, seen as a welcome surprise by analysts.

Auto1 shares jump as much as 19% with analysts highlighting a strong quarterly revenue performance from the digital auto platform.

JDE Peet’s shares rise as much as 12% after reporting 1H results which Citi called reassuring, noting that both adjusted Ebit and organic sales growth beat consensus expectations.

Taylor Wimpey shares rise as much as 4.9%, second-best performer in FTSE 100 Index, after the UK homebuilder released 1H results and forecast FY operating profit around the top end of current market estimates. Citi called it an “encouraging” performance.

Rolls- Royce shares gain as much as 4.1% in London after the UK company said that the Spanish government has approved the sale of ITP Aero to a consortium of investors led by Bain Capital Private Equity.

Siemens Healthineers shares fell as much as 9.1%, the most ever since 2018 IPO, after the company reported weaker- than-expected earnings as supply chain snarl-ups and pandemic lockdowns in China hurt profits.

BMW drops as much as 6.2% in Frankfurt trading despite a beat on second-quarter results; Citi notes that a downgrade to full-year free cash flow forecast “points to growing pressures” in 2H. Oddo BHF says the FY outlook update is likely to disappoint, highlighting a cut to the FCF outlook.

Bank of Ireland shares drop as much as 5.9%, with Morgan Stanley saying weaker revenue drove a miss on the bottom line for the lender.

Man Group shares fall as much as 5.6% on Wednesday, dropping for a third consecutive day as Barclays cuts its AUM estimate following weaker flow momentum in 2Q.

Earlier in the session, Asian stocks pared losses as investors monitored China’s response to US House Speaker Nancy Pelosi’s Taiwan trip along with the latest corporate results. MSCI Inc.’s Asia-Pacific equity index slipped 0.2% in a mixed day after falling as much as 0.8% earlier. Japanese megabank MUFG was among the biggest drags as it reported a profit decline the previous day. Alibaba was among the biggest gainers and also lifted Hong Kong shares ahead of its earnings report on Thursday. Key equity gauges in Hong Kong and Taiwan fluctuated before closing slightly higher while equities in mainland China declined. Pelosi reaffirmed US support for the democratically elected government in Taipei. Beijing halted some trade with Taiwan and planned military drills around the island.

“Further deterioration of diplomatic relations between the two countries could hurt manufacturing and supply chains, stoking inflationary pressures,” said Manish Bhargava, a fund manager at Straits Investment Holdings in Singapore. Heightened US-China tensions have renewed pressure on Asian stocks, which capped their best month this year in July. The regional benchmark has underperformed US and European peers in 2022 amid worries about inflation, rising interest rates as well as China’s property crisis and Covid curbs.

Japanese stocks climbed as traders looked past an escalation in US-China tensions and a weaker yen boosted the outlook for exporters’ earnings. The Topix Index rose 0.3% to 1,930.77 as of the close in Tokyo, while the Nikkei advanced 0.5% to 27,741.90. Sony Group Corp. contributed the most to the Topix’s gain as it advanced 2%. Out of 2,170 shares in the index, 756 rose and 1,294 fell, while 120 were unchanged. “While NY stocks fell yesterday, Japan factored in tensions over US House Speaker Pelosi’s visit to Taiwan first,” said Hideyuki Suzuki, general manager at SBI Securities.

Australia’s S&P/ASX 200 index fell 0.3% to close at 6,975.90, dragged by weakness in banks as well as consumer discretionary and staples stocks. Nine of the 11 sub-gauges finished lower, with only mining and technology shares advancing. In New Zealand, the S&P/NZX 50 index rose 1.5% to 11,705.03. The nation’s unemployment rate unexpectedly rose from a record low in the second quarter but wages climbed at the fastest pace in 14 years, suggesting the central bank may need to keep raising interest rates aggressively to tame inflation

Key Indian equity gauges also rose, capping a rally that’s brought benchmarks back to levels at the start of the year, as foreign inflows and a drop in crude oil prices supported appetite for riskier assets. The S&P BSE Sensex climbed for a sixth-straight session, rising 0.4% to 58,350.53, its highest level since April 12. The gauge fell as much as 0.6% earlier in the session. The NSE Nifty 50 Index rose 0.3%. Both indexes have gained at least 5.5% over the past six sessions. The rally has been helped by a resumption of inflows from foreign funds, which purchased a net $1.5 billion of local stocks in the quarter through August 1. “A perceived pivot in the US Fed’s tightening cycle and cooling off of crude oil prices have made the macro environment more favorable for India, which has outperformed emerging markets and Asian peers by 6% in the last week,” S. Hariharan, head of sales trading at Emkay Global Financial Services wrote in a note. Price of Brent crude, a major import for India, fell below $100 a barrel as part of a drop by about 9% in the week. All but three of the 19 sector sub-indexes compiled by BSE Ltd. fell Wednesday, led by telecom companies, which were down amid worries over operators’ massive commitment for 5G expansion. A measure of IT companies was the best performer and climbed 1.3%, with heavyweight Infosys giving the Sensex its biggest boost.

European yield curves flatten after PMIs reaffirmed economic weakness in Europe, on the heels of hawkish remarks from Fed speakers. Euro Stoxx 50 rises 0.3%. IBEX outperforms peers, adding 0.4%, FTSE 100 is flat but underperforms peers. Travel, tech and insurance are the strongest performing sectors. S&P futures rise 0.2%. Nasdaq contracts are steady. Treasury curve inversion deepens with 2s10s widening 1.8bps. Bund and gilt curves bear-flatten. Bloomberg dollar spot index is slightly down but has steadied since Thursday’s climb. CHF and NZD are the weakest performers in G-10 FX, AUD and CAD outperform. WTI trades within Tuesday’s range, falling 0.5% to around $94. Spot gold rises roughly $7 to trade near $1,767/oz. Most base metals trade in the red; LME tin falls 1.4%, underperforming peers

In FX, the Bloomberg dollar spot index fell 0.1% erasing a bigger drop earlier. CHF and NZD are the weakest performers in G-10 FX, AUD and CAD outperform. The yen swung between gains and losses as traders assessed rising US yields and China’s sanctions against Taiwan following US Speaker Nancy Pelosi’s visit to the island. USD/JPY is largely unchanged on the day after snapping four days of losses on Tuesday. The dollar’s better performance followed comments by Fed officials that pushed back against the narrative that policy makers will slow down on rate hikes. EUR/USD gained as much as 0.3%; still, with more comments from Fed officials expected on Wednesday, “any fresh hawkishness could easily push EUR/USD back to parity,” ING Groep NV strategists wrote in a note. GBP/USD rose 0.2% to 1.2194; UBS analysts see the pound falling to $1.15 this quarter and staying around that level until the end of the year.

In rates, the two-year Treasury yield added to its advance beyond 3% following a selloff in bonds on Tuesday sparked by Fed officials indicating the central bank has some way to go to curb inflation, leading traders to trim wagers on policy easing in 2023. Treasuries traded near session lows into early US session, following wider selloff across core European rates which underperform with stocks marginally higher. Yields cheaper by up to 4bp across front-end and belly of the curve, flattening 5s30s, 10s30s spreads by 1bp and 1.5bp; 10- year yields around 2.785%, cheaper by 3.5bp on the day and outperforming bunds by ~4bp. Treasury quarterly refunding announcement is due at 8:30am, where dealers forecast more cuts to issuance with particular emphasis on the 20-year sector. The market is awaiting ISM’s gauge of services in the US: “A reading below 50 might administer a strong shock to markets — challenging yesterday’s jump in US Treasury yields and sharp fall in the Japanese yen,” according to Saxo Bank strategists. European yield curves flattened after PMIs reaffirmed economic weakness in Europe, on the heels of hawkish remarks from Fed speakers.

In commodities, WTI trades within Tuesday’s range, falling 0.5% to around $94. Spot gold rises roughly $7 to trade near $1,767/oz. Most base metals trade in the red; LME tin falls 1.4%, underperforming peers.

Bitcoin continues to firm after eclipsing the USD 23k handle from an initial USD 22.6k trough.

Looking at today’s economic data, we get July ISM services index and June factory orders for the US, with the focus on signs of economic weakness. A line-up of Fed speakers includes Bullard, Harker, Barkin and Kashkari. In Europe, trade balance will be due for Germany, along with Italy’s July services PMI and June retail sales, UK’s July official reserves changes, and Eurozone’s June PPI and retail sales. Corporate earnings will feature AXA, Maersk, CVS Health, Just Eat, Regeneron, Nintendo, BMW, Vonovia, Moderna, Booking, Fortinet, eBay, Telecom Italia and Robinhood. All eyes will also be on Taiwan.

Market Snapshot

S&P 500 futures up 0.2% to 4,101.50

MXAP down 0.2% to 159.38

MXAPJ little changed at 517.86

Nikkei up 0.5% to 27,741.90

Topix up 0.3% to 1,930.77

Hang Seng Index up 0.4% to 19,767.09

Shanghai Composite down 0.7% to 3,163.67

Sensex down 0.2% to 58,041.78

Australia S&P/ASX 200 down 0.3% to 6,975.95

Kospi up 0.9% to 2,461.45

STOXX Europe 600 little changed at 435.72

German 10Y yield little changed at 0.85%

Euro up 0.2% to $1.0186

Brent Futures down 1.1% to $99.47/bbl

Brent Futures down 1.1% to $99.48/bbl

Gold spot up 0.4% to $1,766.57

U.S. Dollar Index little changed at 106.15

Top Overnight News from Bloomberg

China Warns Airlines to Avoid ‘Danger Zones’ Around Taiwan

World’s Food Supply Faces Threat as India Rice Crop Falters

Fed Pushes Back Against Pivot Idea, With Inflation Yet to Slow

China Hits Taiwan With Trade Curbs Amid Tensions Over Pelosi

Pelosi Hints Gender Is Real Reason China Is Mad at Taiwan Trip

Pelosi Vows US Won’t Abandon Taiwan in Face of China Threats

Oil Swings as OPEC+ Decision on Production Takes Center Stage

Taiwan Turmoil Prompts Detours, Delays for Global Shipping

Pelosi Knocks Out China’s Weibo as Millions Track Taiwan Trip

Pelosi Visit Highlights TSMC and Taiwan’s Global Tech Import

‘Burn Pit’ Bill Passes Senate After Jon Stewart Assails GOP

China Disappointment Over Taiwan Response Puts Pressure on Xi

Twitter Subpoenas Musk Deal Investors, Digs Into Andreessen, VCs

Apollo Said Nearing $3.2 Billion Takeover of Atlas Air Worldwide

JPMorgan’s China Calls Show Market Timing Is Tough: Tech Watch

Fed Pushes Back Against Pivot Idea, With Inflation Yet to Slow

Microsoft Investor Targets Donations to Anti-Abortion GOP Groups

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks were mostly kept afloat with markets somewhat relieved following US House Speaker Pelosi’s safe arrival in Taiwan but with upside capped given China’s response including the announcement of military drills and bans on trading certain items with Taiwan. ASX 200 was dragged lower by weakness in consumer-related sectors despite better-than-expected Retail Sales. Nikkei 225 gained amid earnings updates and with exporters underpinned after yesterday’s resumption of the currency depreciation. Hang Seng and Shanghai Comp rebounded from recent losses but with the recovery contained by the geopolitical concerns and mixed Chinese Caixin Services and Composite PMI data in which both remained in expansion territory albeit with a slowdown in the latter.

Top Asian News

Chinese city of Yiwu imposed COVID restrictions and locked down some areas, according to Reuters.

Nomura’s 97% Profit Drop Adds Urgency to Shift Away From Trading

Billion-Dollar IPOs Keep Coming to Mainland China: ECM Watch

Blinken Doesn’t Plan to Meet China’s Wang, Lavrov in Cambodia

S. Korea Presidential Office Says Pelosi-Yoon Meeting Unlikely

Nomura to Review Retail Costs as Business Trails Daiwa Again

Turkish Inflation Approached 80% in July and Has Yet to Peak

Stand By Me: The Bloomberg Close, Asia Edition

Nintendo Expects Switch Output to Improve From Late Summer

European bourses are mixed but with a modest positive underlying bias emerging as the session progresses ahead of key risk events, Euro Stoxx 50 +0.4%. Note, the FTSE 100 -0.1% is the morning’s clear laggard owing to its high energy exposure as the broader crude complex comes under pressure. Stateside, futures are firmer across the board, ES +0.4%, moving directionally with their European peers and eyeing US/China/Taiwan, ISM Services and Fed speak.

Top European News

EDF to Curb Nuclear Output as French Energy Crisis Worsens

UK July Composite PMI 52.1 vs Flash Reading 52.8

Ukraine Latest: US Blacklists Former Gymnast Linked to Putin

Avast Jumps on UK Regulator’s NortonLifeLock Deal Clearance

Vonovia Results Show Resilience, Upside Potential: Analysts

Danish Gas Field Delays Restart, Raising Stakes in Energy Crisis

FX

Buck wanes after decent bounce on hawkish Fed vibes and marked rebound in US Treasury yields, DXY nearer 106.000 than 106.550 recovery high.

Aussie pares some post-RBA losses as Kiwi labours in wake of sub-forecast NZ jobs data, AUD/USD back on 0.6900 handle, AUD/NZD just under 1.1100 and NZD/USD hovering around 0.6250.

Yen attempts to stabilise following sharp retreat, USD/JPY circa 133.00 between 132.28-133.90 band and sub-130.50 low on Tuesday.

Euro derives some support from broadly better than expected Eurozone PMIs, but faces hefty option expiries vs Dollar between 1.0195-1.0200 (1.84bln).

Franc lags after fractionally softer anticipated headline YY Swiss CPI, but Lira remains pressured as Turkish inflation metrics rise further, USD/CHF approaching 0.9600 and USD/TRY elevated around 17.9500.

Sterling cautious ahead of BoE on Thursday with analysts and markets split on 25/50bp hike verdict, Cable pivots 1.2150 and EUR/GBP straddles 0.8350.

Fixed Income

Bond reversal extends with Bunds sub-157.00 vs 159.70 at best yesterday, Gilts under 118.00 from almost 120.00 on Tuesday and 10 year T-note just shy of 120-00 compared to 122-02.

2038 German supply lacklustre as demand dips and retention rises.

Debt still feeling the after-effects of hawkish Fed commentary and eyeing further speeches in pm session.

Commodities

Benchmarks have been moving lower as we head into today’s JMMC and OPEC+ events, sources thus far suggest production will be maintained or subject to a small increase – newsquawk preview available here.

US Private Inventory Data (bbls): Crude +2.2mln (exp. -0.6mln), Cushing +0.7, Distillates -0.2mn (exp. +1.0mln) and Gasoline -0.4mln (exp. -1.6mln).

Kazakhstan’s Energy Minister says OPEC+ nations are to discuss the fate of the deal after 2022 at Wednesday’s meeting. Current prices of USD 100/bbl are above the preferred USD 60-80/bbl corridor; OPEC+ needs to look at prices so they become more realistic.

Three OPEC+ sources state that they see “very little chance” for an oil output increase at today’s meeting, according to Reuters.

OPEC Sec Gen says OPEC expects demand to continue to recover albeit at a slower pace than earlier this year and 2021, according to Algerian TV; Challenges to the supply of US shale is impacting global supply and demand.

Three ships may leave Ukrainian ports daily vs one per day following the first ships successful departure, via a Senior Turkish Official.

Spot gold is firmer as the USD pulls-back further, but the yellow metal remains well within yesterdays and recent parameters; base metals are mixed owing to broader uncertainty.

US Event Calendar

07:00: July MBA Mortgage Applications, prior -1.8%

09:45: July S&P Global US Services PMI, est. 47.0, prior 47.0

09:45: July S&P Global US Composite PMI, prior 47.5

10:00: June Durable Goods Orders, est. 1.9%, prior 1.9%; -Less Transportation, est. 0.3%, prior 0.3%

10:00: June Factory Orders, est. 1.2%, prior 1.6%; Factory Orders Ex Trans, prior 1.7%

10:00: June Cap Goods Ship Nondef Ex Air, prior 0.7%

10:00: June Cap Goods Orders Nondef Ex Air, prior 0.5%

10:00: July ISM Services Index, est. 53.5, prior 55.3

Fed Speakers

07:30: St. Louis Fed President James Bullard speaks on CNBC

10:30: Fed’s Harker speaks on fintech at Philadelphia Fed conference

11:15: Fed’s Daly speaks in Reuters Twitter Space event

11:45: Fed’s Barkin gives speech on inflation

14:30: Fed’s Kashkari speaks in fireside chat

DB’s Jim Reid concludes the overnight wrap

I’m trying not to get too distracted by markets during the day for the next couple of weeks until I have to start work on the EMR as I’m trying to write my annual long-term study before holidays in the second half of the month. However, I couldn’t resist engaging in the bizarre spectacle of tracking and then watching a US politician’s plane land yesterday afternoon US time. It seems like the entire market was also watching if you look at the reaction. Yields sold off and US equities moved back into positive territory as US House leader Pelosi’s plane landed in Taiwan without incident at 3:43pm BST yesterday. The last time I watched a plane tracker was when Liverpool tried to sign a player on transfer deadline day.

To be fair yields had already moved a lot higher earlier as hawkish Fed speak cast some doubt on the (dubious) Fed pivot narrative that’s been developing since the FOMC. Anyway, we’ll move onto a big sell-off in yields in a bit but first more on Speaker Pelosi. In response to Pelosi’s visit, China announced a series of military tests and drills from August 4th (tomorrow) to August 7th that will encircle Taiwan. These drills are said to be the most significant since 1995. So things will undoubtedly be tense for a few days. Additionally, China has imposed a series of punitive economic moves, including suspending exports of natural sand to Taiwan and banning various food imports from the Island.

10-year US yields had already climbed 10bps before Speaker Pelosi’s safe landing, mostly in the hour or so before the plane landed on comments from San Fran Fed President Daly who said the Fed’s work was “nowhere near” done on fighting inflation. Chicago Evans’ comments didn’t really move the market but Mester highlighted that “monthly inflation hasn’t even stabilized yet”. 2 and 10yr yields eventually closed up +19.7bps and +18.6bps, respectively, and thus inverted the curve back a bit to around cycle lows of -30.6bps. In fact, this move has wiped out the post FOMC dovish pivot interpretation. Indeed, looking at swaps pricing, last Tuesday (pre-FOMC) the terminal rate peaked at 3.40% for the December meeting, in contrast to yesterday’s close that sees it around 3.44% in February. Both dipped to the low 3.20s after the strange interpretation of the FOMC.

Speaking after the bell, St. Louis Federal Reserve President James Bullard also gave a hawkish message by expressing confidence in the US economy stating that the economy can avoid a recession, even though he expects the Fed will need to keep hiking rates to control inflation.

In fact, the 10yr US move yesterday was the 4th biggest in the last 5 years behind 2 Covid days and the WSJ leaked 75bps story just before the June FOMC last month. The 2yr move was the 4th biggest in the last decade with 9 of the top 10 happening so far in 2022 with one just after the Covid lows. So we’re still seeing big volatility in markets. As we go to print, yields on the 10yr USTs are -4.18bps lower, currently at 2.71%. We did highlight that one of the reasons that August is usually bullish for bonds is that corporate issuance is light and thus leaving investors having to park money in government bonds. However, the surprise of the first two days of August is how much US corporate supply there has been. Bloomberg reported that we’re already seeing supply estimates for the entire month surpassed already. So maybe some money rolled out of Treasuries yesterday that was loosely parked there.

US stocks were originally chiefly preoccupied by geopolitics before the spike in yields gathered momentum, with major benchmarks recouping earlier losses as Speaker Pelosi landed in Taiwan only to dive back into the red again after headlines of China’s missile tests came through shortly after. Dragged lower by the risk sentiment and then ever higher yields, the Nasdaq (-0.16%) outpaced the S&P 500 (-0.67%), although both ended the day way off the intraday highs. As the risk-off mood took over by the close, 76% of the index constituents ended the day lower, with no sector in the green for the day. Most pain came from real estate (-1.30%), financials (-1.07%) and industrials (-1.05%). On the other end of the performance spectrum were communications (-0.18%), energy (-0.21%) and utilities (-0.22%) stocks as investors looked for more stable names.

Some dispersion in price action also came from earnings, which provided a boost to sentiment earlier in the day after solid results from Uber and Lyft. Yet, Caterpillar’s results and earnings call sent a gloomy message for capital-intensive stocks by pointing to sticky costs and supply-chain issues. Speaking of the latter, it was a tailwind for Maersk that raised its guidance by expecting full-year EBIT of $31bn (up from $24bn) and the company will report its earnings this morning. It was a more cheerful day for oil firms as well, with BP rounding up oil majors’ reporting season yesterday by raising dividend and boosting buybacks. The five firms have squirreled $62bn in income in the last quarter amid elevated oil prices that helped trading firm Vitol report record profits as well. But with crude prices struggling in recent weeks, the meeting of OPEC+ today will be in focus. Oil prices were up by +0.31% for WTI and +0.08% for Brent yesterday but WTI is around -0.48% lower this morning.

European yields were also lifted by the hawkish tone in the US, especially in the front end. Yields on bunds rose +3.9bps, ahead of the +0.9bps rise in breakevens. The 2y (+7.8bps) raced ahead in a bear flattening. A similar picture but with larger magnitudes in moves was seen in France (OATS +5.9bps and front end +17.5bps) and Italy’s (BTPs +6.8bps and front end +8.0bps) markets. Higher yields weighed on stock markets in the region as the STOXX 600 declined by -0.32%. IT (-1.45%) and discretionary (-1.10%) stocks were the main drivers, and only four sectors managed to cling to gains on the day, led by energy (+0.57%) and utilities (+0.51%). So Spain’s IBEX (+0.15%) and the FTSE 100 (-0.06%) were the relative outperformers in the region.

Back to yesterday and markets got a brief reprieve from geopolitical headlines when the JOLTS data dropped early in the US session. Going through the numbers, the headline figure fell by more than the median estimate on Bloomberg (10.7m vs 11m) from May’s 11.25m in a sign of some easing in the labour market. In fact, it was the first miss since January. However, this is still relative to 7.2m job openings in January 2020 so it’s all relative. Metrics like private quits (unchanged at 3.1%) and the vacancy yield at 0.56 continued to point to historical tightness despite the miss in openings. In line with warnings we received from US retailers in the recent weeks, retail (-343k) and wholesale trade (-82k) saw the largest decreases in openings. Overall the data is consistent with a historically very tight labour market, albeit one where some of this pressure is loosening.

Asian equity markets are mostly trading higher this morning after stumbling earlier following China stepping up the rhetoric with Speaker Pelosi’s Taiwan visit. As I type, the Hang Seng (+0.60%) is trading higher led by a rebound in Chinese listed technology stocks whilst the Nikkei (+0.53%) and the Kospi (+0.50%) are also up. Over in Mainland China, markets are mixed with the Shanghai Composite (+0.40%) in the green while the CSI (-0.04%) has been oscillating between gains and losses in early trade. Further, US stock futures are fluctuating in Asia with contracts on the S&P 500 (+0.13%) higher while NASDAQ 100 futures (-0.04%) are just below the flat line.

Early morning data showed that Japan’s service sector activity nearly stagnated in July as the final au Jibun Bank Japan Services dropped to a seasonally adjusted 50.3, marking the lowest reading since March.

Today’s economic data releases will include July ISM services index and June factory orders for the US, with the focus on signs of economic weakness. A line-up of Fed speakers includes Bullard, Harker, Barkin and Kashkari. In Europe, trade balance will be due for Germany, along with Italy’s July services PMI and June retail sales, UK’s July official reserves changes, and Eurozone’s June PPI and retail sales. Corporate earnings will feature AXA, Maersk, CVS Health, Just Eat, Regeneron, Nintendo, BMW, Vonovia, Moderna, Booking, Fortinet, eBay, Telecom Italia and Robinhood. All eyes will also be on Taiwan.

Tyler Durden

Wed, 08/03/2022 – 08:05