If Volcker Were Alive Today, He Would Be Appalled

Authored by Bruce Wilds via Advancing Time blog,

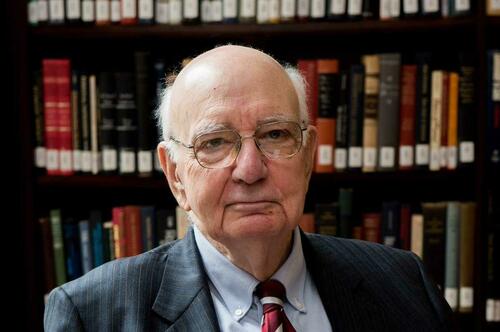

For many people, former Fed Chairman Paul Volcker’s relevance today is rooted in how he broke the back of surging inflation in 1980. He is widely credited with employing the harsh policies that ended the high levels of inflation seen in the United States during the 1970s and early 1980s. back then few people realized his brave and bold move would shape the economic system for decades.

Paul Volcker served two terms as the 12th Chair of the Federal Reserve from 1979 to 1987. He was nominated to the position by President Jimmy Carter and renominated by President Ronald Reagan. Paul Volcker died on December 8, 2019. Before his death, Volcker participated in an interview with Ray Dalio. I recently stumbled upon this video from February 2019 on YouTube.

Paul Volcker was a firm believer in good governance and felt it is a key factor in keeping the nation healthy. Even back in early 2019, Volcker was unhappy with the efficiency of government management. Since then it could be argued the government has performed even more poorly. He voiced concern over how it seems today that working in government has become a revolving door where people go into a job just long enough to make contacts they can exploit when they return to the private sector.

If Volcker were alive today, it is likely he would be appalled at the current state of affairs considering the role he felt government should play in our lives. One similarity the late 70s and early 80s have in common with today is that many special situations exist that scream huge risk ahead. When we look closely at current trends, it is difficult to ignore the numbers simply do not work going forward.

In the intro to the video, Dalio wrote; I sat down with one of my greatest heroes, Paul Volcker, to talk about the state of the economy and U.S. government as well as learn about the principles that guided his incredible career. We also discuss the decline of civil service and how Paul hopes to revitalize the field with The Volcker Alliance by working with universities and the government to train people effectively and efficiently and minimize the bureaucratic hurdles that deter people from pursuing government jobs.

While I don’t hold much hope for The Volcker Alliance to have a significant impact, I do applaud its noble goal. I’m fond of the insight that some of the older more conservative economists express and their basic appreciation of numbers. The financialization of America and globalization have made many of the comparisons with the past obsolete. The big question remains will we revert to many of the old standards and whether the current trend is sustainable?

I remain in the group that feels things are not different this time and we will soon pay a massive price for thinking we can outwit the natural laws of economics. Today’s financial world is nothing like it was in 2008. Since then the top has been blown away due to massive money creation. The financial system has entered uncharted waters and it would be wise to take nothing for granted.

While Paul Volcker was one of Ray Dalio’s greatest heroes, another man that stands tall in my mind is Professor Allan Meltzer. He specialized in studying monetary policy and the US Federal Reserve System, Meltzer also authored several academic papers and books on the development and applications of monetary policy, and about the history of central banking in the US. Together with Karl Brunner, Meltzer created the Shadow Open Market Committee: a monetarist council that deeply criticized the Federal Open Market Committee.

Meltzer died in 2017, he was an “old school” economist that knew numbers mattered. Way back in 2013 he saw we were on the wrong path, “We’re in the biggest mess we’ve been in since the 1930s,” he has been quoted as saying “We’ve never had a more problematic future.” In a Wall Street Journal opinion piece on June 30, 2010, titled “Why Obamanomics Has Failed” Meltzer wrote about how uncertainty about future taxes and regulations was the biggest enemy facing future economic growth. Most economic watchers will agree that little has changed since then.

In the article he went on to say that the administration’s stimulus program has failed. Growth is slow and unemployment remains high. The president, his friends, and advisers talk endlessly about the circumstances they inherited as a way of avoiding responsibility. Two overreaching reasons explain the failure of Obamanomics. First, administration economists and their outside supporters neglected the longer-term costs and consequences of their actions. Second, the administration and Congress have through their deeds and words heightened uncertainty about the economic future.

Meltzer went on to say that most of the earlier spending was a very short-term response to long-term problems. Part of the money financed temporary tax cuts and these seldom work because they ignore the role of expectations in the economy. Meltzer’s thoughts on the direction of recent economic policy dovetails with those expressed in the prior article appearing on this blog and noted in the footnote below. Simply put, more attention must be given to the fact all economic growth is created equal. If you spend money but afterward have little to show for it, you have wasted it.

Tyler Durden

Mon, 08/01/2022 – 07:20

Recent Comments