Here Are The Best And Worst Performing Assets In July And YTD

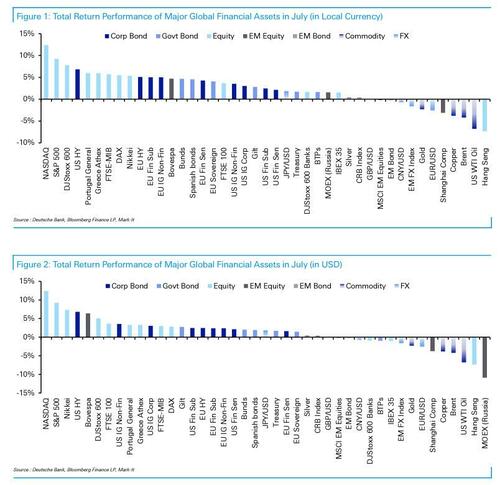

After a historically poor first half of the year, July saw asset price performance turn on its head as a majority of the non-currency assets in the main Deutsche Bank asset sample were in positive territory. As DB strategist Karthik Nagalingam writes, 29 of the 38 major assets tracked by the bank started the second half of the year with a monthly gain in July – the highest percentage since November 2020 when Covid vaccines were first approved.

July’s gains were led by a combination of factors, including the prospect of the Federal Reserve pivoting due to softening economic conditions and potential peaking in inflationary factors. Still, despite the July rush, only 5 assets of the 38 in the sample are currently enjoying a YTD gain, which if trends continued will make this year even worse than we saw in 2008.

Concerns about growth slowing and some signs that inflation might be peaking meant that investors began to price in a less aggressive pace of monetary tightening from the Fed over the coming months. In fact, markets are pricing rate cuts now within the next six months.

The Federal Reserve Chair this past week acknowledged softening economic changes, but also reiterated that getting prices under control was the priority. Chair Powell left open the possibility of another 75bp or more hike in September, but avoided providing forward guidance, saying that the Committee would be making policy decisions on a meeting-per-meeting basis. Up into the FOMC and then thereafter the prospect of a less aggressive Fed proved supportive for US fixed income.

At the ECB meeting in mid-July, the central bank began their hiking cycle with a 50bp hike for all three of their main interest rates, which leaves the deposit facility rate at 0%, and the main refinancing rate at 0.5%. Just a week before the Fed meeting, the ECB also discontinued forward guidance, saying that the Governing Council would “make a transition to a meeting-by-meeting approach to interest rate decisions.” The 50bp hike from the ECB came alongside their new mythical antifragmentation tool, the Transmission Protection Instrument (TPI), which helped some peripherals. And while Europe is crashing into a recession, most economists paradoxically still see another 100bps of hikes in the near term amid calls for a 2% terminal rate (even if it is delayed until 2024 over a two-stage hiking cycle that pauses because of a recession, which is hilarious since rates will be cut far deeper than before in the “middle” of the recession).

One reason that markets have started to reprice inflation expectations is the pullback in commodity prices. The prospect of slower global growth and an impending recession in both Europe and the US impacted oil prices with Brent crude futures dropping -4.2% and WTI futures trading off -6.8%. The pullback in commodities such as copper (-3.8%), wheat (-7.0%), and iron (-5.8%) also are projected to reduce pricing pressures.

Not every commodity was lower, however: European natural gas soared, and was a major theme last month due to the economic ramifications of the geopolitical maneuverings surrounding the maintenance of Nord Stream 1. Gas flow did turn back on after a roughly 2 week break mid-month, however gas flow has been slowed to 20% of capacity after initially returning to the 40% of capacity seen prior to maintenance. EU countries reached a deal on emergency gas cuts for this winter, with member states due to prepare emergency plans by the end of September to show how they will curb demand. European natural gas futures climbed +28.5% this month after spiking 50.6% in June.

Adding to the case for a Fed pivot, the last week of July saw US GDP come in at -0.9% in 2Q, which is the second consecutive print in contractionary territory and thus a technical recession. As such, markets are currently pricing a Fed response to the slowing activity and that the economic slowdown will help reduce pricing pressures.

Finally, Q2 earnings season kicked off, with many major US financials disappointing as major money center banks signaled that they would likely need to optimize their balance sheets to increase capital ratios over the near-term. And while many large technology firms announced plans to cut or slow hiring, though shares advanced as earnings outperformed lesser expectations. Analysts have lowered earnings estimates for Q3 by 2.5% already, which is more than average, though the forward P/E ratios for the S&P 500 rose over the course of the month.

With all that in mind…

Here are the assets which saw the biggest gains in July:

Equities: Risk assets rallied in response to expectations that slowing economic conditions would mean a dovish pivot by the Federal Reserve in the medium term. DM equities were the best performing asset this month with the Nasdaq (+12.4%) topping our monthly leaderboard for the first time since April 2020. The S&P 500 (+9.2%) and Stoxx 600 (+7.8%) were second and third respectively.

Fixed Income: The prospect of a slowing hiking cycle by the Fed and less dire European economic forecasts proved supportive for DM fixed income with the turn in risk sentiment leading Credit to gain in July. US HY (+6.8%) saw its biggest monthly gain since July 2009, while EUR IG (+5.0%), EUR HY (+5.1%) and US IG non-fin (+3.5%) all produced strong months in an otherwise historically bad year. European government bonds rallied as concerns over an economic slowdown mounted as the energy crisis fears deepen. The announcement of the ECB‘s new anti-fragmentation tool, the Transmission Protection Instrument (TPI), seems to have helped Spanish (+4.6%) bonds keep up with bunds (+4.6%), though BTPs underperformed as they were not able to overcome Prime Minister Draghi’s resignation (+1.6%).

Which assets saw the biggest losses in July?

Chinese Equities: The Hang Seng (-7.3%) and the Shanghai Composite (-3.1%) were among the worst equity indices this past month as fresh covid flare-ups in Shanghai and the surrounding areas meant that risk sentiment remains weak. Furthermore there was renewed scrutiny on tech shares as China imposed fines on several companies including Tencent and Alibaba for not adhering to anti-monopoly rules on disclosures of transactions.

Oil: WTI (-6.8%) and Brent (-4.2%) were at the second and third from the bottom of our monthly rankings. The prospect of slower global growth and an impending recession in Europe and the US impacted oil prices.

Metals (both precious and industrial): Commodities across the board struggled, as both precious and industrial metals followed oil prices lower on the backdrop of slower global growth. Copper (-3.8%) was just behind oil for worst performing commodity, with gold (-2.3%) somewhat better but still down on the month.

Tyler Durden

Mon, 08/01/2022 – 15:45

Recent Comments