Biden Nemesis Exxon Reports Record Earnings As Company Prints $20 Billion In Cash

The Biden administration will be terribly vexed to learn that the one company it hates the most, Exxon (we are confident the sentiment is mutual) reported record Q2 earnings (largely thanks to Biden’s SPR release which has proven to be a risk-free arb black gold mine for the company) which smashed expectations and also reiterated guidance while maintaining its generous $30 billion buyback program. The biggest North American oil explorer followed European giants Shell Plc and TotalEnergies, as well as US peer Chevron in disclosing unprecedented results.

Here are the Q2 details for the company which is reaping the rewards from surging commodity prices and the Biden admin’s destructive “green energy” policies that have sent gas prices to record highs.

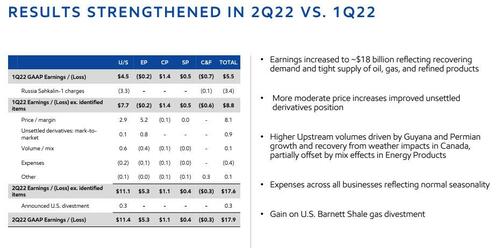

Net income reached $17.9 billion, surpassing the previous record set in 2008.

Adjusted EPS $4.14, beating the estimate $3.98 and about 4x more than the $1.10 year ago

Operating cash flow in Q2 was a record $20 billion; on a YTD basis, Free Cash Flow in H1 has more than doubled Y/Y to $27.7 bilion.

Going down the list:

Refinery throughput 3,988 KBD

Total revenues & other income $115.68 billion, estimate $119.4 billion

Upstream production 3,732 koebd, estimate 3,720 koebd

Refinery throughput 3,988 KBD, estimate 4,068 KBD

Crude oil, NGL, bitumen and synthetic oil production 2,298 KBD, estimate 2,358 KBD

Some more financial highlights:

Generated earnings of $17.9 billion (vs $5.5 billion in the first quarter of 2022) and cash flow from operating activities of $20 billion in second-quarter 2022 as a result of increased production, higher realizations and margins, and aggressive cost control

Cash increased by $7.8 billion in the second quarter, as strong cash flow from operating activities more than covered capital investments and shareholder distributions. Free cash flow in the quarter totaled $16.9 billion. Shareholder distributions were $7.6 billion for the quarter, including $3.7 billion of dividends.

Net-debt-to-capital ratio improved to 13% reflecting a period-end cash balance of $18.9 billion. The debt-to-capital ratio was 20%, at the low-end of the company’s target range.

Capital investments totaled $9.5 billion for first half of 2022; on track with full-year guidance

And some further details on production:

Oil-equivalent production in the second quarter was 3.7 million barrels per day.

Excluding entitlement effects, divestments, and government mandates, including the impact of curtailed production in Russia, oil-equivalent production increased 4% versus the first quarter.

Liquids volumes increased nearly 35,000 barrels per day and natural gas volumes grew by more than 150 million cubic feet per day.

XOM said it is helping meet increased demand by expanding its refining capacity by about 250,000 barrels per day in the first quarter of 2023 – representing the industry’s largest single capacity addition in the U.S. since 2012.

Exxon also maintained its stock buyback program, which it tripled to $30 billion in April, as well as its CapEx program at $21 billion to $24 billion, above the estimate of $18.27 billion. That said, Exxon’s capital spending in Q2 was surprisingly low at just $4.6 billion. In order to meet its $21B-$24B guidance, Exxon likely will have to pick up the pace on spending aggressively in the second half of the year.

“Earnings and cash flow benefited from increased production, higher realizations, and tight cost control,” said Darren Woods, chairman and chief executive officer. “Strong second-quarter results reflect our focus on the fundamentals and the investments we put in motion several years ago and sustained through the depths of the pandemic.

And speaking of CapEx, one of Exxon CEO Darren Woods’ favorite slides is back in the presentation after a notable absence: The oil industry is not investing enough to keep up with future demand:

Here’s something else that’s interesting from Exxon’s slide presentation (see below): They expect America’s tight oil industry to produce record high volumes this year of 8.5m b/d. That’s in spite all the complaints and warnings about inflationary pressures across the nation. On top of that, the entire sector is warning of a lack of labor, while equipment for use in the projects are getting snapped up so rapidly it’s making availability through next year already tight.

While Exxon’s sky-high profits come at a sensitive political time for the oil industry, which has been accused by idiot politicians and democrats in general of profiteering from the fallout from Russia’s invasion of Ukraine and failing to invest enough in new drilling (largely because of democrat policies), the recent retreat in crude and gasoline prices may provide executives with some cover from the political backlash they faced in June, when President Joe Biden accused Exxon of making “more money than God.”

To be sure, the bears are warning that with recession fears gathering pace, the second quarter may end up marking the high point for Big Oil this year; on the other hand Exxon’s money printing machine may be just getting started if politicians indeed follow through with their abjectly retarded Russian price cap idea which will send oil above $200/bbl. For now however, somewhat lower oil prices simply mean that the bonanza may be a little more muted but will last longer. Additionallly, US refining margins also have deflated somewhat since touching all-time highs, though natural gas prices remain elevated around the world.

As Bloomberg notes, Exxon CEO Darren Woods has made a series of public appearances and statements in recent weeks defending the industry’s profit surge. Woods has also repeatedly pointed out that Exxon incurred a record loss of more than $20 billion in 2020 which did not lead to a White House bailout, and took on vast amounts of debt to finance major projects like deepwater oil production in Guyana and refinery expansions that will increase fuel supplies in the coming years.

As an aside, the Manchin-Schumer climate and energy pact did include several things that are likely on Exxon’s wish list, such as locking in lease sales, and even pairing renewable rights to oil and gas lease sales. While Exxon didn’t directly comment on the Manchin-Schumer deal earlier this week, CEO Woods says the US needs “clear and consistent” policy that promotes US resource development. “This policy could include regular and predictable lease sales, as well as streamlined regulatory approvals and support for infrastructure such as pipelines.”

Wall Street was unified in its praise of the company’s record earnings:

“The key drivers of the beat were the upstream, as well as lower corporate costs relative to our estimates,” RBC’s Co-Head of European Energy Research Biraj Borkhataria says in a note.

Jefferies (hold): “Strong set of numbers beating consensus in both upstream and downstream,” analyst Giacomo Romeo wrote in a note. Notes wide earnings per share beat “primarily driven by international downstream”

Vital Knowledge: “Keep in mind that Exxon provides analysts with a first look at their quarterly results in an 8K filing, so they tend to not beat by as much as CVX,” Adam Crisafulli wrote. Downstream saw “explosive growth thanks to record refining margins”

Exxon stock, which we have been recommending since late 2020, has climbed more than 50% this year, has blown away all of its peer majors and remains the third-best performer in the S&P 500 Index.

The company’s Q2 slideshow is below:

Tyler Durden

Fri, 07/29/2022 – 07:38