With US In Recession, Buyers Scramble For Duration In Blistering 7Y Treasury Auction

After remarkably solid 2 and 5 year auctions earlier this week, moments ago the Treasury sold $38 billion in seven year paper in the week’s final coupon auction, which saw demand just as blistering as the previous two.

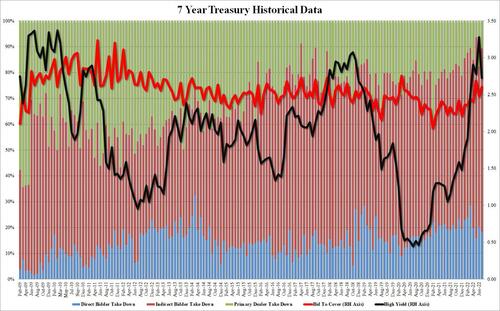

The high yield of 2.730% was a huge drop from the 3.280% in June, one of the biggest monthly drops on record, but in a testament to just how much duration is in demand today, the auction stopped through the When Issued 2.735% by 0.5bps despite the massive rally across the curve earlier, now the the US is in a recession.

The bid to cover of 2.604 was also a major jump from the 2.481 last month and well above the 2.46 six-auction average.

Internals were even more impressive with Indirects surging from last month’s 61.9% to 70.9% in July, one of the highest prints on record. And with Directs awarded 18.4%, Dealers were left holding just 10.6% of the final allotment, the third lowest on record.

In summary, and just as one would expect during a recession, demand for duration is raging and it was obvious in today’s 7Y auction which saw one of the highest ever bidside-demands on record. Expect even more demand for 10Y, 20Y and 30Y paper in August and subsequent months.

Tyler Durden

Thu, 07/28/2022 – 13:22