Goldman Explains Why It Is Not Buying This “Most Hated Rally”

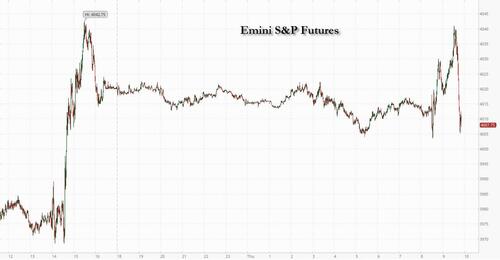

With stocks surging, first on the Fed’s dovish pivot and then on the US entering a recession, and then dumping because- well – the US just entered a recession, there has been ample confusion among traders who are paralyzed and unsure whether they should buy or sell here.

Which brings us to the latest market comments from Goldman trader John Flood who overnight explains why he – and many Goldman clients – remain skeptic of this “most hated rally“:

Only 10.4b shares traded today vs 12.5b share ytd avg. Especially noteworthy in sense it is peak earnings + FOMC session. The last 3 Fed decision days mkt traded 13.6B shares, 13.7B shares, and 15.9B shares. Last 2 Fed meetings (June and May) market rallied on Wednesday post decisions and melted lower on Thursday: Jun/15: +1.46%, Jun/16 -3.25%, May/4: +2.99%, May/5: -3.56%. Dejavu? My gut is Thursday follows suit.

Skeptics of this recent market clearly getting frustrated (myself included). My trading colleague Benny Adler put it very well this AM: “In this tape it currently takes a whole lot more bad news to make the market go down than it takes good news to make the market go up.” My take is depressed sentiment/positioning/liquidity currently (yet temporarily) winning the tug of war vs depressed fundamentals/macro.

Speaking of depressed sentiment, here is a fascinating chart showing just how underweight positioning in tech has become: as Flood writes, “speaking of light positioning it is worth noting that Info Tech sector weighting vs. SPX on the Prime book ended just at fresh 10-year low….”

Judging by the insane yo-yo move in stocks this morning, depressed sentiment may have indeed won the early morning post-recession battle as shorts were brutally stopped out, but fundamentals will eventually win the war as a new wave of shorts takes their place… at least until the buyback and CTA buying rampage hits later in the day.

(The full Goldman note is available to pro subscribers in the usual place).

Tyler Durden

Thu, 07/28/2022 – 09:56