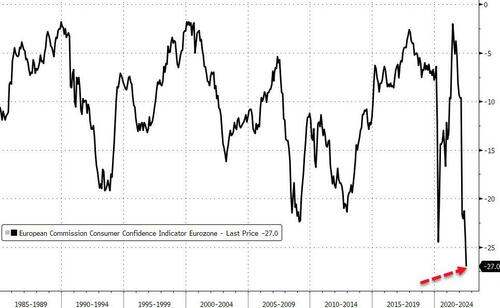

EU Consumer Confidence Crashes To Record Lows As German CPI Unexpectedly Re-Accelerates

Economic Sentiment in the euro-area economy tumbled to the weakest in almost 1 1/2 years as fears of energy shortages haunt consumers and businesses, and the European Central Bank’s first interest-rate increase in a more than decade feeds concerns that a recession is nearing.

The drop was led by a collapse in consumer confidence to a new record low – worse than at the peak of the COVID lockdown crisis…

Source: Bloomberg

Specifically, Bloomberg notes that worries that an economic contraction is on the horizon grew in 11 of the euro zone’s 19 countries – also the highest level since COVID…

Source: Bloomberg

Adding to that, it appears Goldman Sachs is not afraid to use the ‘r-word’ when talking about the European economy as they warn this morning that a European “Recession is Coming”

The growth outlook has continued to deteriorate and we now look for a Euro area recession in H2.

First, the incoming activity data has weakened significantly further in recent days. The area-wide composite flash PMI fell below 50 in July, driven primarily by a sharp weakening of growth in Germany. While the softening in industrial activity has been in train for some time, the marked slowing in services growth was a surprise, suggesting that the post-Omicron bounce in services is now mostly behind us. Moreover, global growth momentum has continued to weaken—reinforcing our below-consensus forecasts for the US and China—consistent with a further sharp drop in Euro area PMI new export orders. Our current activity indicator (CAI) now stands at 0.6% for the Euro area as a whole—and at -1.6% in Germany—with the forward-looking surveys pointing to more slowing ahead.

Second, reduced supply of Russian gas and high gas prices are set to weigh markedly on activity in coming quarters…

Finally, piling on all the pain for The ECB, German inflation unexpectedly re-accelerated in July with EU-Harmonized CPI rising 8.5% YoY (considerably worse than the expected deceleration from +8.2% to +8.1%)…

Source: Bloomberg

A big jump in food and energy costs drove the surprise, more than offsetting temporary fuel-tax rebates and subsidized public-transport tickets.

“Even the drop in the national measure is not the start of the end but rather just government-induced temporary relief,” ING’s global head of macro Carsten Brzeski said in an emailed report to clients.

Beyond Germany, Italy and Spain are expected to report fresh inflation records on Friday. For the euro area as a whole, economists reckon price growth accelerated to 8.7% in July.

So Christine is hiking rates into stagflation… and promising to buy Italian bonds no matter what happens in some magical ‘save the EU’ strategy.

This won’t end well.

Tyler Durden

Thu, 07/28/2022 – 09:05